Get the free REGISTERED INVESTMENT ADVISOR (RIA) PROFESSIONAL LIABILITY INSURANCE APPLICATION (NO...

Show details

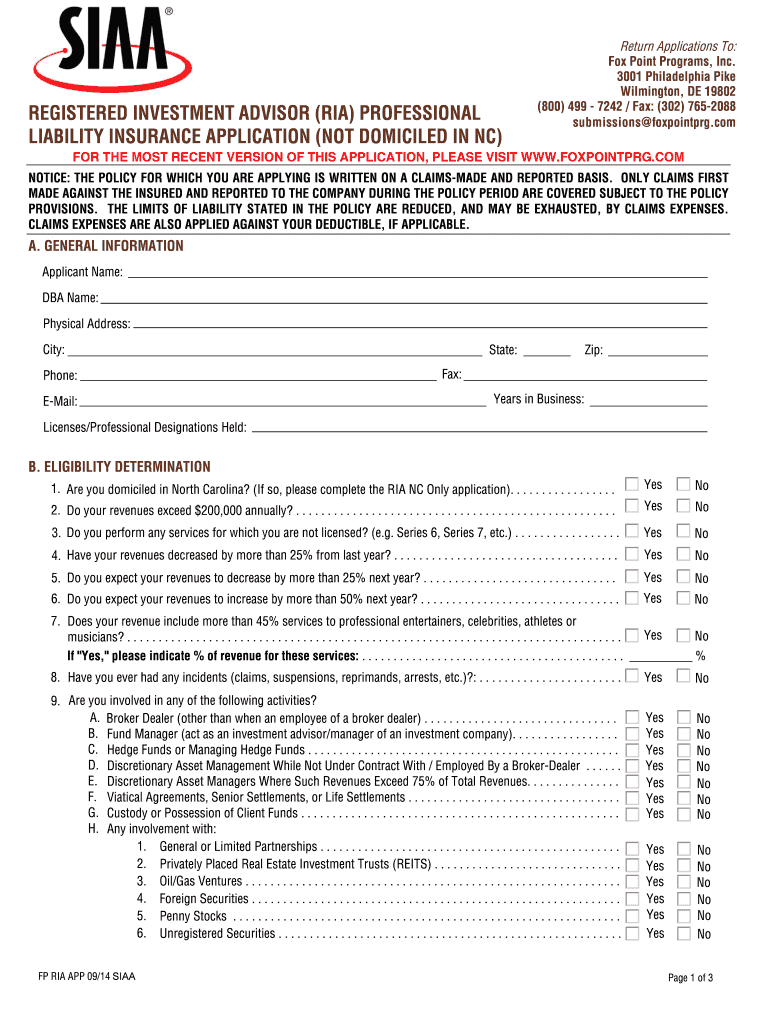

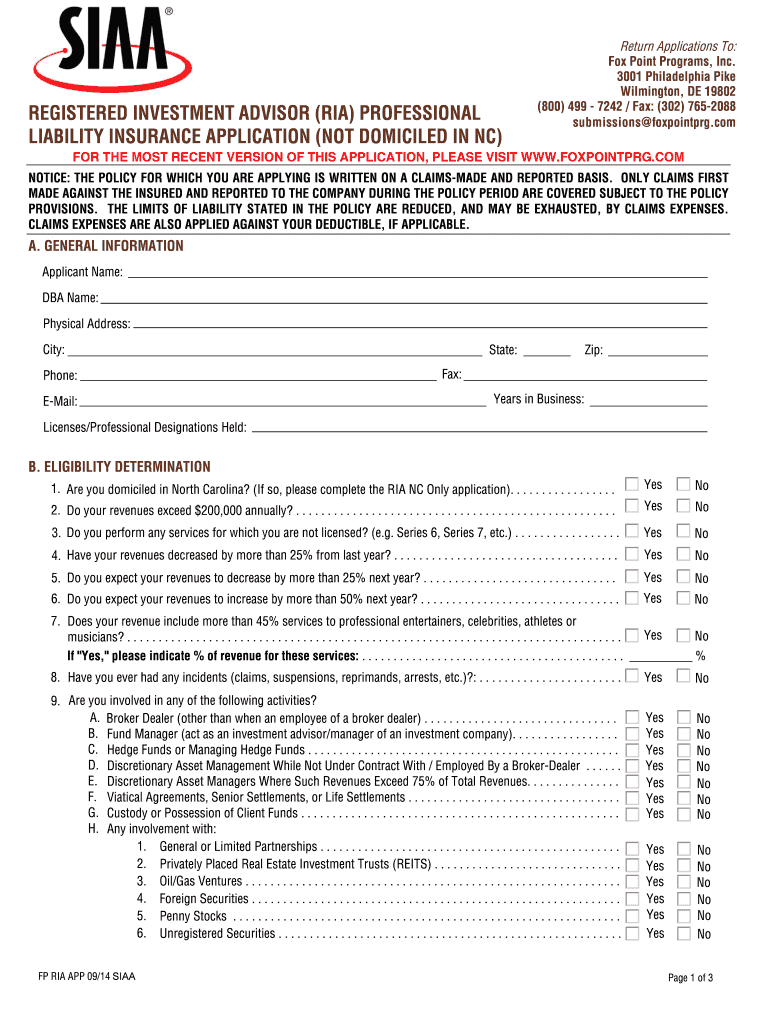

REGISTERED INVESTMENT ADVISOR (RIA) PROFESSIONAL LIABILITY INSURANCE APPLICATION (NOT DOMICILED IN NC) Return Applications To: Fox Point Programs, Inc.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registered investment advisor ria

Edit your registered investment advisor ria form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registered investment advisor ria form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit registered investment advisor ria online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit registered investment advisor ria. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registered investment advisor ria

How to fill out registered investment advisor (RIA):

01

Gather required information: Begin by collecting all necessary documents and information, such as personal identification details, financial statements, balance sheets, and other relevant records.

02

Understand compliance regulations: Familiarize yourself with the regulatory requirements for becoming a registered investment advisor. This may include studying the rules and regulations outlined by the Securities and Exchange Commission (SEC) or other regulatory authorities.

03

Develop a business plan: Create a comprehensive business plan that outlines your investment strategies, target market, client acquisition strategies, and projected financials. This plan will serve as a roadmap for your RIA business.

04

Complete Form ADV: The Form ADV is a crucial document that needs to be filled out accurately. It requires information about your firm's structure, ownership, key employees, services offered, fee structure, and any potential conflicts of interest. Ensure that you complete all sections carefully and truthfully.

05

Meet registration requirements: Apart from filing Form ADV, you may need to fulfill additional registration requirements based on your jurisdiction. This might include obtaining certain licenses or completing specific exams, such as the Series 65 or Series 66.

06

Establish compliance procedures: Develop and implement robust compliance procedures to ensure that you adhere to regulatory guidelines. This might involve maintaining proper record-keeping practices, establishing a code of ethics, and implementing adequate cybersecurity measures.

Who needs a registered investment advisor (RIA):

01

High-net-worth individuals: Wealthy individuals who require personalized investment strategies and financial planning services may benefit from the expertise of a registered investment advisor. RIAs can provide tailored advice and help clients maximize their investment returns.

02

Businesses and institutions: Many businesses, including pension funds, endowments, and foundations, often seek the services of an RIA to help manage their investment portfolios. RIAs can assist in optimizing asset allocation, minimizing risk, and achieving financial goals.

03

Individuals seeking unbiased advice: Unlike traditional brokerages or commission-based financial advisors, RIAs have a fiduciary duty to act in their clients' best interests. Individuals who value unbiased advice and objective recommendations may prefer working with an RIA.

04

Retirement plan sponsors: Employers responsible for managing retirement plans, such as 401(k)s, may utilize the services of an RIA to ensure compliance with ERISA (Employee Retirement Income Security Act) regulations and offer appropriate investment options to their employees.

05

Those in need of comprehensive financial planning: RIAs can help clients with a wide range of financial planning needs, including retirement planning, tax planning, estate planning, and education funding. Those requiring holistic financial guidance often turn to registered investment advisors.

It is important to consult with legal and financial professionals to ensure you follow all applicable laws and regulations and to tailor the process to your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find registered investment advisor ria?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific registered investment advisor ria and other forms. Find the template you need and change it using powerful tools.

How can I edit registered investment advisor ria on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing registered investment advisor ria, you can start right away.

How do I fill out registered investment advisor ria using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign registered investment advisor ria and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is registered investment advisor ria?

A registered investment advisor (RIA) is a firm that advises high-net-worth individuals on investments and manages their portfolios in accordance with their investment objectives and risk tolerance.

Who is required to file registered investment advisor ria?

Any firm or individual that provides investment advice for a fee is required to register as an RIA with the Securities and Exchange Commission (SEC) or state securities regulators.

How to fill out registered investment advisor ria?

To fill out the RIA registration form, the firm or individual must provide information about their business model, fee structure, investment strategies, and disclosure of any conflicts of interest.

What is the purpose of registered investment advisor ria?

The purpose of an RIA is to provide personalized investment advice to clients based on their individual financial goals and risk tolerance.

What information must be reported on registered investment advisor ria?

Information reported on the RIA includes details about the firm's assets under management, client base, investment strategies, fees charged, and any disciplinary history.

Fill out your registered investment advisor ria online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registered Investment Advisor Ria is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.