Get the free alb commercial capital

Show details

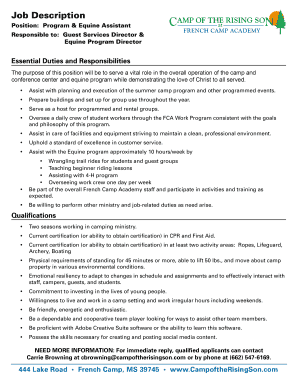

SA M PL E BPO PRO Broker Price Opinion 30 Unit Multifamily Apartment Building 6021 Carlton Way, Los Angeles, CA. 90017 Loan # 00012345-A2 Debtor: Carlton Way, LLC. BPO completed by: BPO # APN # Map

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alb commercial capital form

Edit your alb commercial capital form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alb commercial capital form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alb commercial capital form online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit alb commercial capital form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alb commercial capital form

How to fill out ALB Commercial Capital:

01

Start by gathering all the necessary information and documents required to complete the ALB Commercial Capital application. This may include financial statements, tax returns, personal identification, and business details.

02

Carefully review the application form and ensure that you understand all the questions and instructions. It's essential to provide accurate and complete information to avoid any delays or complications in the approval process.

03

Begin filling out the application form by entering your personal and business details. This may include your name, contact information, business name, address, and industry type. Double-check for any spelling errors or incorrect information.

04

Provide detailed information about your business, such as the years in operation, revenue figures, and industry-specific details. Be as precise as possible to demonstrate your business's stability and potential for success.

05

Fill out the financial section of the application. This typically includes providing information about your current debts, outstanding loans, and available assets. It's crucial to provide truthful and accurate financial information to facilitate the evaluation process.

06

Carefully review the terms and conditions of the ALB Commercial Capital application. Understand the repayment terms, interest rates, and any other associated fees. If you have any questions, it's advisable to seek clarification from ALB Commercial Capital representatives.

07

Finally, sign and date the application form. Ensure that you have reviewed all the information filled out, and there are no errors or missing sections. Submit the completed application along with any additional supporting documents as instructed.

Who needs ALB Commercial Capital:

01

Small business owners who require financing options to expand their business or cover operational expenses may benefit from ALB Commercial Capital. This could include funding for inventory purchases, equipment upgrades, or hiring additional staff.

02

Start-ups or entrepreneurs looking for capital to launch a new business venture may find ALB Commercial Capital to be a valuable resource. Securing initial funding can be challenging, but ALB Commercial Capital may provide the necessary financial support.

03

Established businesses experiencing cash flow gaps may also seek ALB Commercial Capital's assistance. This could help cover expenses during slow seasons, provide working capital, or bridge the gap between accounts receivable and payable.

04

Business owners needing to refinance existing loans or consolidate debt may consider ALB Commercial Capital. By streamlining their payments and potentially reducing interest rates, this can help improve financial stability and enhance cash flow management.

05

Individuals or companies seeking flexible financing options may find ALB Commercial Capital appealing. With various loan products available, they can tailor a financing solution that fits their specific needs and repayment capabilities.

Remember, it is essential to carefully assess your business's financial situation, goals, and needs before applying for ALB Commercial Capital or any financial product. It may be advisable to consult with financial advisors or experts to ensure the best decision for your business's future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is alb commercial capital?

Alb commercial capital refers to the amount of funding or capital that a commercial entity has available for its operations and investments.

Who is required to file alb commercial capital?

Commercial businesses and entities are required to file alb commercial capital as part of their financial reporting obligations.

How to fill out alb commercial capital?

To fill out alb commercial capital, businesses need to analyze their financial statements, including assets, liabilities, and equity, to calculate their available capital.

What is the purpose of alb commercial capital?

The purpose of alb commercial capital is to provide an overview of a business's financial strength and capacity to fund its operations, investments, and growth.

What information must be reported on alb commercial capital?

The information reported on alb commercial capital includes the value of assets, liabilities, equity, and any additional funding sources available to the business.

Can I create an electronic signature for the alb commercial capital form in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your alb commercial capital form in minutes.

Can I create an eSignature for the alb commercial capital form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your alb commercial capital form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the alb commercial capital form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign alb commercial capital form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your alb commercial capital form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alb Commercial Capital Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.