Get the free FHA Back to Work – Economic Event Initiative

Show details

This document outlines the FHA's Back to Work initiative designed for borrowers facing economic hardships such as bankruptcy or foreclosure. It provides criteria for eligibility, application process,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha back to work

Edit your fha back to work form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha back to work form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha back to work online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fha back to work. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha back to work

How to fill out FHA Back to Work – Economic Event Initiative

01

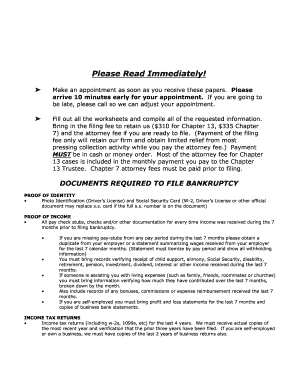

Gather necessary documentation: Collect all relevant financial documents, such as income statements and credit reports.

02

Verify eligibility: Ensure that you meet the criteria for the FHA Back to Work program, including experiencing an economic event.

03

Complete the FHA application: Fill out the required application forms accurately.

04

Obtain a copy of your economic event documentation: Document your financial hardships due to the economic event.

05

Submit your application: Send the completed application and all supporting documents to your lender or the FHA.

06

Wait for approval: Monitor the status of your application and provide any additional information if requested.

Who needs FHA Back to Work – Economic Event Initiative?

01

Individuals who have experienced a financial hardship due to economic events such as job loss, reduction in income, or a major medical expense.

02

First-time homebuyers seeking assistance to qualify for an FHA loan after recovering from economic hardships.

03

Those who need to demonstrate their ability to repay a mortgage despite past financial challenges.

Fill

form

: Try Risk Free

People Also Ask about

Is there a way around the FHA 100 mile rule?

And if you want to buy a house with an FHA loan. Live there for a year or two. And then buy anotherMoreAnd if you want to buy a house with an FHA loan. Live there for a year or two. And then buy another house with an FHA loan a new primary residence.

What is the 3 year rule for FHA loans?

The FHA mortgage three-year rule is one of the guidelines that the Federal Housing Administration requires those seeking a new mortgage to follow. The rule states that individuals who have experienced foreclosure or bankruptcy in the past need to wait at least three years before applying for a new mortgage with FHA.

What are the exceptions to the FHA 90 day flip rule?

FHA Flipping Rule Exceptions: Exceptions to the FHA flipping rule include newly built homes, properties owned by nonprofit organizations or the government, inherited properties, homes sold due to relocation, and homes in Presidentially Declared Major Disaster Areas (PDMDA).

Is there a way around the 90 day flip rule?

While the 90 day rule can be a headache, there are some exceptions that give us a bit more flexibility as house flippers. One key exception is the second appraisal rule. If the sales price exceeds the seller's acquisition cost by 100% or more, a second appraisal is required to support the increased value.

What is the FHA 3 job rule?

“If the Borrower has changed jobs more than three times in the previous 12-month period, or has changed lines of work, the Mortgagee must take additional steps to verify and document the stability of the Borrower's Employment Income.

How to get around the FHA 90 day rule?

FHA Flip Rule Exceptions Non-profit resales: Homes sold by approved non-profit organizations for affordable housing purposes are not subject to the 90-day or 91-to-181-day rules. Inherited properties: If a property is being sold as part of an inheritance, the FHA flip rule does not apply.

What is the 90 day rule for FHA loans?

The FHA 90-day flip rule is a safeguard designed to prevent FHA financing for properties resold within 90 days of the seller's acquisition. In simple terms, if a property has been bought, renovated, and re-listed within 90 days, buyers using FHA loans cannot purchase it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FHA Back to Work – Economic Event Initiative?

The FHA Back to Work – Economic Event Initiative is a program designed to assist borrowers who have experienced a loss of employment or significant income due to economic events, allowing them to qualify for an FHA loan sooner than traditional waiting periods.

Who is required to file FHA Back to Work – Economic Event Initiative?

Borrowers who have faced financial hardship due to economic events, such as job loss, foreclosure, or bankruptcy, and wish to qualify for an FHA mortgage must file under the FHA Back to Work – Economic Event Initiative.

How to fill out FHA Back to Work – Economic Event Initiative?

To fill out the FHA Back to Work – Economic Event Initiative, borrowers should complete the required forms, provide documentation of their economic event, and submit it through an approved lender who can facilitate the process.

What is the purpose of FHA Back to Work – Economic Event Initiative?

The purpose of the FHA Back to Work – Economic Event Initiative is to help individuals and families affected by economic hardships regain access to home financing, thereby promoting stability and recovery in housing markets.

What information must be reported on FHA Back to Work – Economic Event Initiative?

The information that must be reported includes details about the economic event, the impact it had on employment or income, the borrower's current financial situation, and any relevant supporting documentation to justify the request.

Fill out your fha back to work online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Back To Work is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.