Get the free Bond Placement Report

Show details

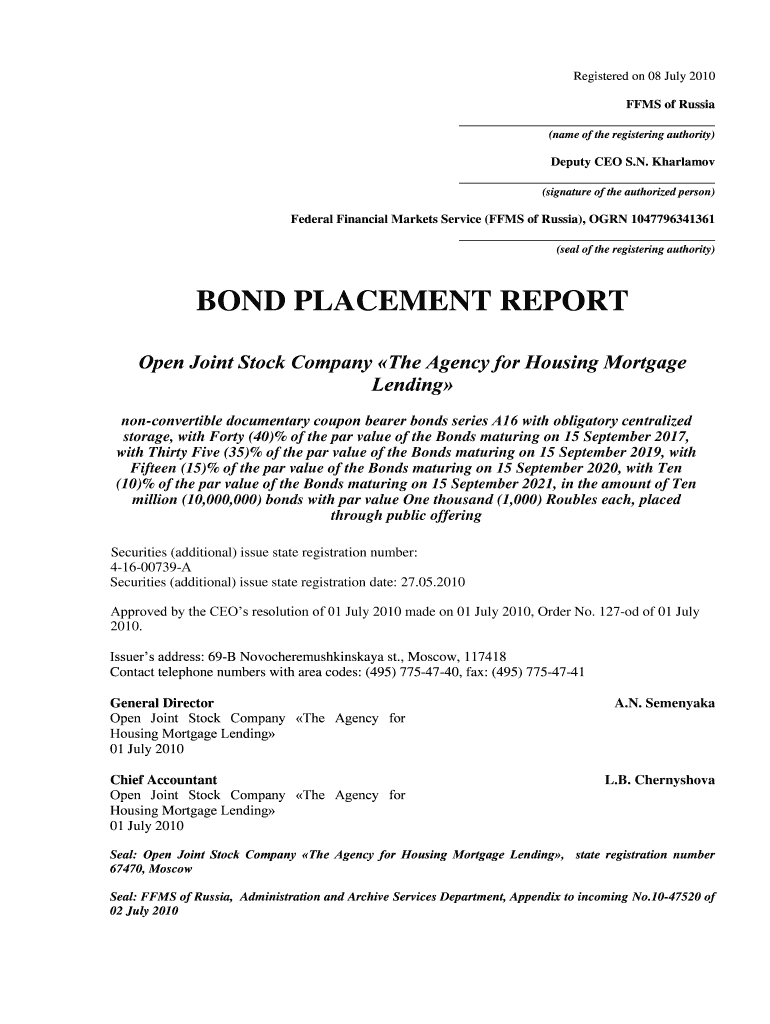

The document provides detailed information about the bond placement of Open Joint Stock Company «The Agency for Housing Mortgage Lending», including details on the securities issued, terms, pricing,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bond placement report

Edit your bond placement report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bond placement report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bond placement report online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bond placement report. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

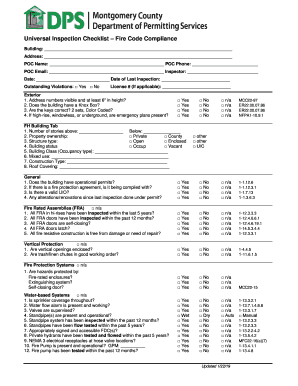

How to fill out bond placement report

How to fill out Bond Placement Report

01

Begin by entering your company name at the top of the report.

02

Fill in the date of the report.

03

Provide details of the bond issuer, including the name and contact information.

04

Specify the bond details such as type, maturity date, and interest rate.

05

Include the total amount of bonds being placed.

06

List any underwriters involved in the bond placement.

07

Document the use of proceeds, explaining how the funds will be used.

08

Include any pertinent financial statements or data that support the bond issue.

09

Review the report for accuracy and completeness.

10

Submit the report to the appropriate regulatory agency and stakeholders.

Who needs Bond Placement Report?

01

Corporations looking to issue bonds.

02

Investment banks facilitating bond placements.

03

Regulatory agencies overseeing bond issues.

04

Investors interested in bond offerings.

05

Financial institutions involved in underwriting.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between IPO and placement?

The term “private placement” describes the sale of securities to a select group of investors, such as rich individuals, private equity firms, or institutional investors. In contrast, an IPO entails the initial public offering of securities through a stock exchange.

Is bond face value 100 or 1000?

Most bonds are issued in $1,000 denominations, so typically the face value of a bond will be just that – $1,000. You might also see bonds with face values of $100, $5,000 and $10,000.

What is a bond placement?

Since bonds are securities by definition, private placement refers to any unregistered bond issuance under federal law: “Under the federal securities laws, a company may not offer or sell securities unless the offering has been registered with the SEC or an exemption from registration is available.

How to report bonds payable?

The principal portion of the bond is recognized as a bond payable in the liabilities section of the balance sheet. The entry to record the bond payable is a debit to cash for the amount of the funds received and a credit to the bond payable, to be remitted to the purchaser of the bond upon maturity.

How to read a bond report?

How to Read Bond Information Ask: The ask price is the price at which the seller is attempting to sell the bond. Bid: The bid is the price at which the buyer is attempting to buy a particular bond. Coupon/Rate: The terms coupon and rate refer to the interest rate generated on a bond.

What are placements in finance?

Key Takeaways. Placement refers to the sale of securities to a group of investors, either on a public or private level. A public offering would typically involve registering with the Securities and Exchange Commission, while a private placement is exempt from registering.

What does placing a bond mean?

A bond, which is offered by most brokerage platforms, is a fixed-income investment product where individuals lend money to a government or company at a specified interest rate for a predetermined period. The entity repays individuals with interest in addition to the original face value of the bond.

What is bond placement?

What does this mean? Simply put, when a company chooses a private placement of bonds it means it will offer its bonds to a select group of investors/institutions instead of offering it publicly, in an open market for anyone to invest.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Bond Placement Report?

The Bond Placement Report is a document that provides detailed information about the distribution and sale of bonds issued by an entity. It typically includes data about the bonds' placement, the investors involved, and the financial terms of the bonds.

Who is required to file Bond Placement Report?

Entities that issue bonds, such as municipalities, corporations, or governmental bodies, are required to file a Bond Placement Report to provide transparency and accountability regarding the placement of the bonds.

How to fill out Bond Placement Report?

To fill out a Bond Placement Report, issuers must gather required information such as bond details, placement details including the investors or financial institutions involved, terms of the bonds, and any relevant financial information, and then input this data into the designated format or form provided by the regulatory body.

What is the purpose of Bond Placement Report?

The purpose of the Bond Placement Report is to ensure transparency in the bond issuance process, allowing regulators and the public to review how bonds are placed and the investors involved, ultimately ensuring compliance with financial regulations.

What information must be reported on Bond Placement Report?

The Bond Placement Report must include information such as the type of bonds issued, the total amount of bonds sold, details of the placements including names of investors, pricing and underwriting information, and any commissions or fees involved in the placement.

Fill out your bond placement report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bond Placement Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.