Get the free Request for Issuance of Revised Good Faith Estimate

Show details

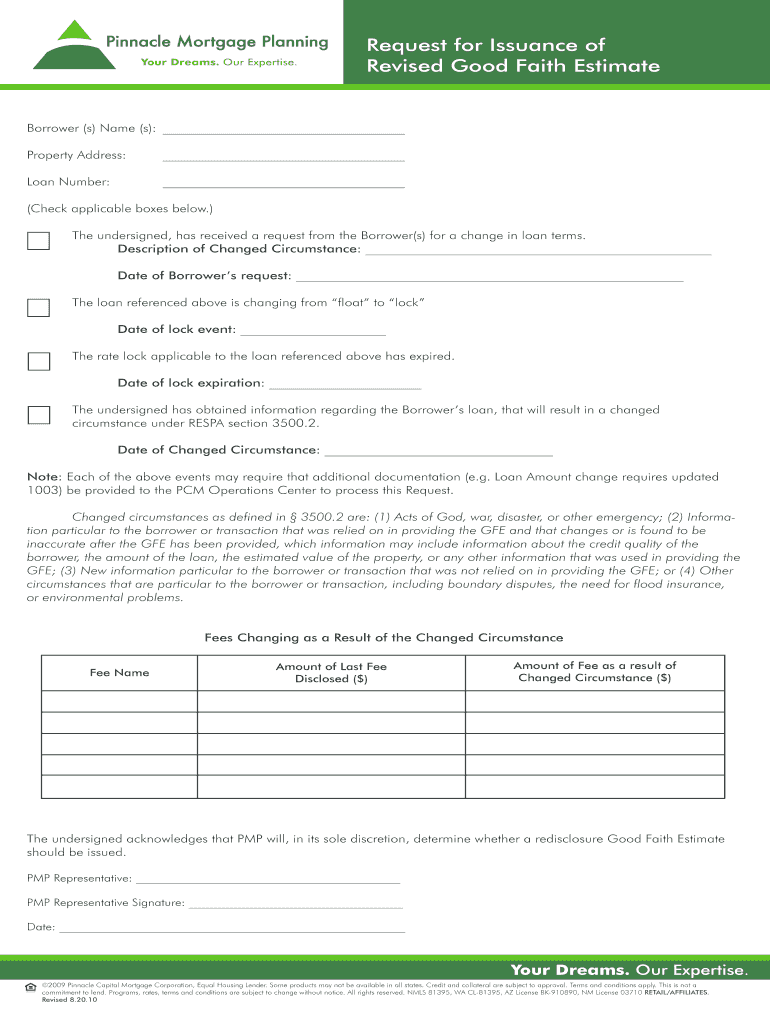

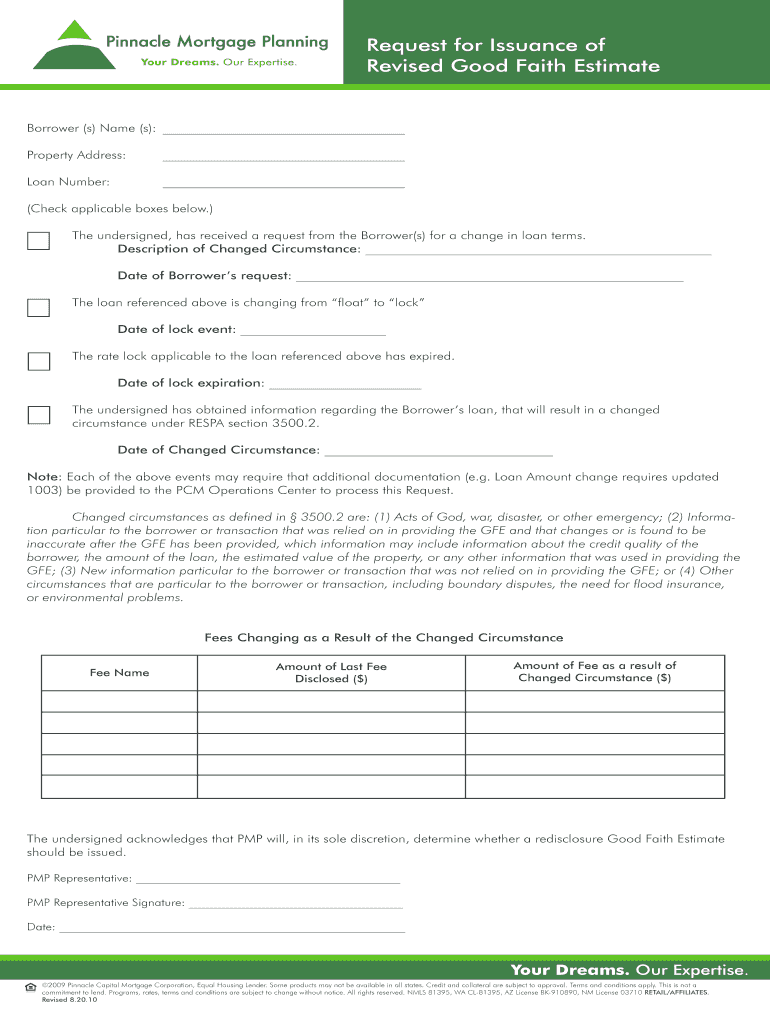

This document is a request form for the issuance of a revised Good Faith Estimate due to changed loan circumstances for a borrower.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for issuance of

Edit your request for issuance of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for issuance of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for issuance of online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request for issuance of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for issuance of

How to fill out Request for Issuance of Revised Good Faith Estimate

01

Obtain the Request for Issuance of Revised Good Faith Estimate form.

02

Fill in your personal information, including name, address, and contact details.

03

Provide information about the loan in question, including loan amount, property address, and type of loan.

04

Indicate the reason for requesting a revised Good Faith Estimate, such as changes in loan terms or estimated costs.

05

Review all entered information for accuracy and completeness.

06

Sign and date the form to affirm the request.

07

Submit the completed form to your lender or mortgage broker as per their instructions.

Who needs Request for Issuance of Revised Good Faith Estimate?

01

Homebuyers or borrowers who are seeking updated loan estimates due to changes in their mortgage scenario.

02

Individuals who have experienced changes in loan terms or fees and require an updated Good Faith Estimate for transparency.

Fill

form

: Try Risk Free

People Also Ask about

What is a good faith estimate statement?

A Good Faith Estimate, also called a GFE, is a document that a lender must provide when you apply for a reverse mortgage. The GFE lists basic information about the terms of the loan offer. The GFE includes the estimated costs for the reverse mortgage.

How to write a good faith estimate?

The good faith estimate must include a number of disclaimers. For example, it must state that the estimate is based on information known at the time it was created. Therefore, it won't include any costs for unanticipated items or services that are not reasonably expected and that could occur due to unforeseen events.

What triggers a revised loan estimate?

Common reasons you may receive a revised Loan Estimate include: The home was appraised at less than the sales price. Your lender could not document your overtime, bonus, or other irregular income. You decided to get a different kind of loan or change your down payment amount.

What is the time frame for a loan estimate?

Once you've submitted your six key pieces of information, each lender is required to send you a Loan Estimate within three business days. Allow a few extra days for mail delivery if the lender is using postal mail. If you haven't received a Loan Estimate within that timeframe, call the lender and ask why.

Which of the following may cause the loan estimate to be revised in Quizlet?

[CORRECT] Explain: A creditor may provide and use a revised Loan Estimate if a changed circumstance affected the consumer's creditworthiness or the value of the security for the loan, and resulted in the consumer being ineligible for an estimated loan term previously disclosed.

Under which of the following circumstances is a creditor prohibited from issuing a revised loan estimate?

A creditor may not provide a revised Loan Estimate after it issues a Closing Disclosure even if the interest rate is locked on or after the date the Closing Disclosure is provided to the consumer.

What are the rules of a GFE?

Good faith estimates only list expected charges for a single provider or facility. You may get an estimate from both your provider and facility, or from multiple providers. The estimate must: Include an itemized list with specific details and expected charges for items and services related to your care.

When can a lender issue a revised loan estimate?

Common reasons you may receive a revised Loan Estimate include: The home was appraised at less than the sales price. Your lender could not document your overtime, bonus, or other irregular income. You decided to get a different kind of loan or change your down payment amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for Issuance of Revised Good Faith Estimate?

The Request for Issuance of Revised Good Faith Estimate is a formal request made by a borrower to a lender, asking for a new Good Faith Estimate (GFE) reflecting updated terms or conditions for a mortgage loan.

Who is required to file Request for Issuance of Revised Good Faith Estimate?

Homebuyers or borrowers who have experienced changes in their loan terms, or who have received a new loan estimate that differs from the original, are required to file the Request for Issuance of Revised Good Faith Estimate.

How to fill out Request for Issuance of Revised Good Faith Estimate?

To fill out the Request for Issuance of Revised Good Faith Estimate, the borrower needs to provide personal information, details about the original GFE, the reasons for requesting a revision, and any changes in loan terms or estimates required by the lender.

What is the purpose of Request for Issuance of Revised Good Faith Estimate?

The purpose of the Request for Issuance of Revised Good Faith Estimate is to ensure that borrowers receive an updated and accurate estimate of the loan terms and costs, reflecting any recent changes, providing transparency in the lending process.

What information must be reported on Request for Issuance of Revised Good Faith Estimate?

The information that must be reported includes the borrower's personal details, original GFE details, specific changes being requested, reasons for the revision, and any new terms or costs associated with the loan.

Fill out your request for issuance of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Issuance Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.