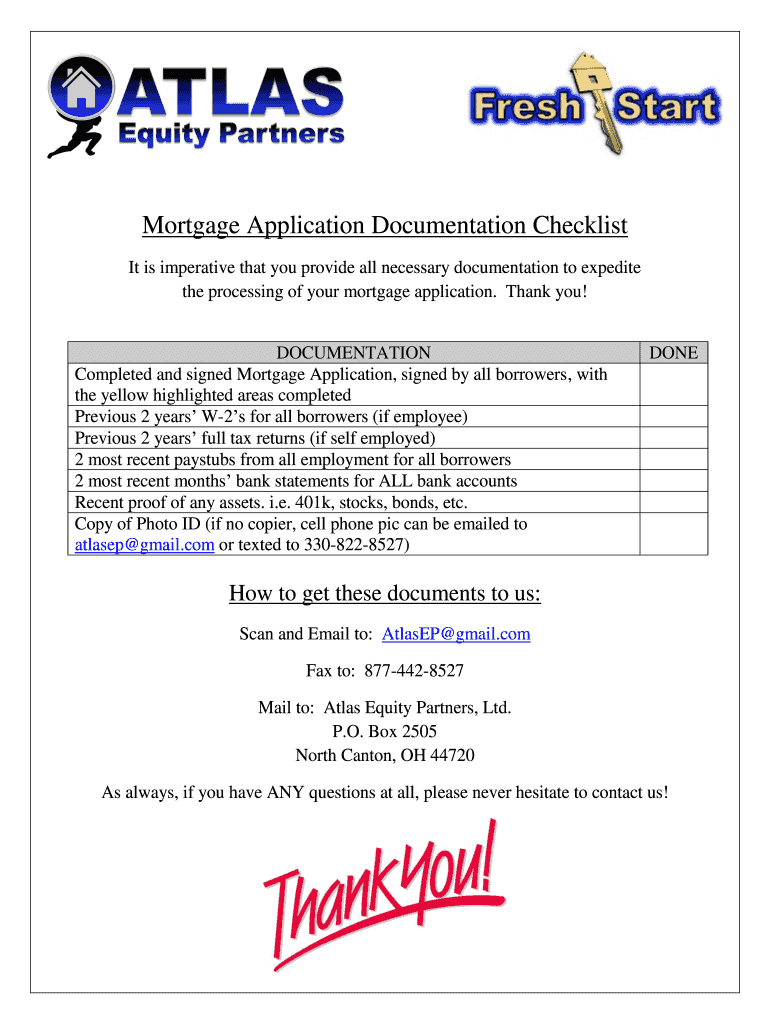

Get the free Mortgage Application Documentation Checklist

Show details

This document outlines the necessary documentation required for expediting the processing of a mortgage application.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage application documentation checklist

Edit your mortgage application documentation checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage application documentation checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage application documentation checklist online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage application documentation checklist. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage application documentation checklist

How to fill out Mortgage Application Documentation Checklist

01

Gather personal identification documents such as a government-issued ID or passport.

02

Collect your social security number and any relevant proof of income, such as pay stubs or tax returns.

03

Prepare documentation of your employment history including job title, employer details, and length of employment.

04

List your assets, including bank statements, retirement accounts, and other investments.

05

Compile information regarding your debts, such as credit card statements and other loans.

06

Fill out the Mortgage Application Documentation Checklist by inputting your details in the specified fields.

07

Review all information for accuracy before submitting the checklist.

08

Consult your lender for any additional documentation they may require.

Who needs Mortgage Application Documentation Checklist?

01

Anyone applying for a mortgage loan.

02

First-time homebuyers looking for financing options.

03

Individuals refinancing an existing mortgage.

04

Real estate agents assisting clients with mortgage applications.

05

Financial advisors helping clients navigate mortgage options.

Fill

form

: Try Risk Free

People Also Ask about

What documents to provide for a mortgage?

Basic identity and proof of address checks. Checking your income and employment details. Looking at recent bank statements for any irresponsible spending patterns including evidence of regular gambling. Checking repayments and balances on existing credit accounts.

What documents to provide for a mortgage?

Home loan documents Pay stubs from the most recent 2 months. W2 forms for the last 2 years. Tax returns for the last 2 years (for self-employment, rental income, and commission income) 1099 forms (for contract employees) Social Security award letter (if receiving Social Security benefits)

What two documents make up most mortgages?

A mortgage involves two important legal documents: a promissory note and either a mortgage document or deed of trust.

What information is needed for a mortgage application?

Getting prepared for when you apply for a mortgage Check your credit report. Proof of ID. Proof of address documents. Evidence of where your deposit is coming from. Proof of income. Proof of expenses.

Which document is very necessary for a mortgage?

A filled application form. Credit information. KYC documents of the applicant and co-applicant/guarantor (if any), including identity proof (such as PAN card, Voter ID, Passport, Aadhaar, etc.), address proof (such as Driving license, Passport, Aadhaar, etc.), and two latest passport size photographs.

What is checked in a mortgage application?

The documents required for a mortgage application can be categorized by type: Proof of Income/Employment, Proof of Assets, Credit History, and Residential History. These give potential lenders a glimpse into your situation so they see whether you're a worthy borrower or not.

What documents do I need for my mortgage application?

Home loan documents Pay stubs from the most recent 2 months. W2 forms for the last 2 years. Tax returns for the last 2 years (for self-employment, rental income, and commission income) 1099 forms (for contract employees) Social Security award letter (if receiving Social Security benefits)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Application Documentation Checklist?

The Mortgage Application Documentation Checklist is a document that outlines the necessary paperwork and information required by lenders to process a mortgage application.

Who is required to file Mortgage Application Documentation Checklist?

Individuals applying for a mortgage loan are required to file the Mortgage Application Documentation Checklist, including homebuyers and homeowners refinancing their existing loans.

How to fill out Mortgage Application Documentation Checklist?

To fill out the Mortgage Application Documentation Checklist, gather the required documents, check each item off the list as you provide them, and ensure accuracy in the information submitted.

What is the purpose of Mortgage Application Documentation Checklist?

The purpose of the Mortgage Application Documentation Checklist is to ensure that applicants provide all necessary documentation for lenders to assess their financial situations and make informed lending decisions.

What information must be reported on Mortgage Application Documentation Checklist?

The Mortgage Application Documentation Checklist typically requires information such as proof of income, employment verification, credit history, debt information, and property details.

Fill out your mortgage application documentation checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Application Documentation Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.