Get the free WellsTrade® account commissions and fees schedule

Show details

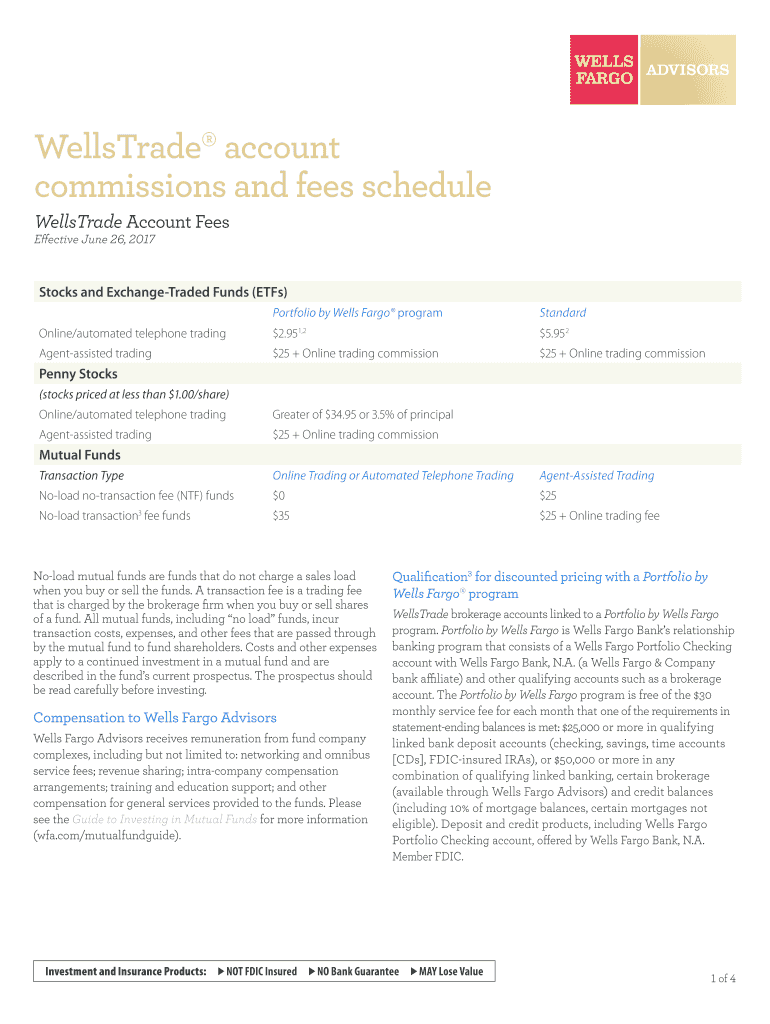

This document outlines the fees and commissions associated with WellsTrade accounts for various types of trading and investment activities, effective June 26, 2017.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wellstrade account commissions and

Edit your wellstrade account commissions and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wellstrade account commissions and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wellstrade account commissions and online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit wellstrade account commissions and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wellstrade account commissions and

How to fill out WellsTrade® account commissions and fees schedule

01

Log in to your WellsTrade account.

02

Navigate to the 'Commissions and Fees' section of your account settings.

03

Review the list of commissions and fees applicable to your account type.

04

Fill in the required fields regarding your trading activity.

05

Ensure you include all relevant information about the types of trades you plan to make.

06

Double-check the accuracy of your entries.

07

Submit the completed schedule for review.

Who needs WellsTrade® account commissions and fees schedule?

01

Investors actively trading stocks, ETFs, and options.

02

Individuals who want to understand the cost structure of their trading activities.

03

Clients opening a new WellsTrade account to establish their expected trading expenses.

04

Financial advisors managing accounts for clients who need to assess trading costs.

Fill

form

: Try Risk Free

People Also Ask about

Is a 1% financial advisor fee worth it?

Key takeaways Financial advisor fees are often around 1%, but whether this is worth it depends on the services provided. If you're only getting investment management, a 1% fee might be too high. But it could be worth it if you're also getting in-depth financial planning.

How much commission does trading take?

Most commissions typically range between $5 and $15 per trade, and they can be flat or calculated as a percentage of your trade volume (or a combination of both). $9.5 per trade, regardless of trade volume. $4.9 per trade or 0.3% of trade volume, whichever is greater.

What is the average commission fee for trading?

Some firms may charge a flat fee for their services, while others may charge a percentage of the overall value of the transaction. The average fee charged by brokerage firms is typically between 1% and 2% of the total transaction value.

What fees do brokerage accounts charge?

Brokerage fee Brokerage feeTypical cost Inactivity fees May be assessed on a monthly, quarterly or yearly basis, totaling $50 to $200 a year or more Research and data subscriptions $1 to $30 per month Trading platform fees $50 to more than $200 per month Paper statement fees $1 to $2 per statement2 more rows • Jun 6, 2025

What is the transaction fee for WellsTrade?

$0 per trade is applicable to commissions for online and automated telephone trading of stocks and exchange-traded funds (ETFs). For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is charged. Each trade will be treated as a separate transaction, subject to commission.

How much does WellsTrade charge for trades?

$0 per trade is applicable to commissions for online and automated telephone trading of stocks and exchange-traded funds (ETFs). For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is charged.

Is WellsTrade worth it?

WellsTrade offers some convenient features for existing Wells Fargo customers, but for the average trader, this brokerage account delivers a rather basic investing experience. You'll get the industry standard of commission-free stock and ETF trades, and access to nearly 1,500 no-transaction-fee mutual funds.

How much charge per trade?

Trade Charges ChargesRate(excluding GST) Brokerage 2.5% of turnover or upto Rs. 20/- per Executed Order, whichever is lower Exchange Turnover Charges 0.00297% of Traded Value for NSE and 0.00375% of Traded Value for BSE Security Transaction Tax (STT) 0.1% of turnover on buy and sell orders SEBI Turnover Fees 0.0001% of turnover4 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WellsTrade® account commissions and fees schedule?

The WellsTrade® account commissions and fees schedule outlines the various fees associated with trading, such as commissions for stock trades and other account-related charges.

Who is required to file WellsTrade® account commissions and fees schedule?

Any customers holding a WellsTrade® account who engage in trading activities are required to be aware of and adhere to the commissions and fees schedule.

How to fill out WellsTrade® account commissions and fees schedule?

To fill out the WellsTrade® account commissions and fees schedule, users need to review the fee structure provided, calculate their expected trading costs, and provide any required account information as specified by the form.

What is the purpose of WellsTrade® account commissions and fees schedule?

The purpose of the WellsTrade® account commissions and fees schedule is to inform clients about the costs associated with trading and managing their accounts, ensuring transparency in fees.

What information must be reported on WellsTrade® account commissions and fees schedule?

The information that must be reported includes the types of trades, the applicable commission rates, any additional fees for transactions, and relevant account details.

Fill out your wellstrade account commissions and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wellstrade Account Commissions And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.