Get the free ,, Utah Retirement Systems 401(k), 457, and IRAs - urs

Show details

3rd Quarter 2013, Utah Retirement Systems 401(k), 457, and IRAs

An informational bulletin published quarterly for members of the Utah Retirement SystemsIncrease Your Savings

for a Better RetirementPreparing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign utah retirement systems 401k

Edit your utah retirement systems 401k form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your utah retirement systems 401k form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing utah retirement systems 401k online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit utah retirement systems 401k. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

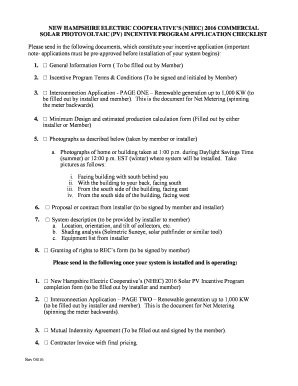

How to fill out utah retirement systems 401k

How to fill out Utah Retirement Systems 401k:

01

Begin by gathering the necessary documentation. You will need your personal identification information, such as your Social Security Number, date of birth, and contact information. You may also need to provide details about your employment, including your job title and the date of hire.

02

Log in to the Utah Retirement Systems website or create an account if you haven't already done so. This will allow you to access and manage your 401k account.

03

Once logged in, navigate to the section specifically dedicated to managing your 401k. Look for options like "Manage 401k" or "My Retirement Account."

04

Provide the requested information, such as your employment details and contribution preferences. You may be asked to select a contribution percentage or a specific dollar amount to contribute from each paycheck. Consider consulting a financial advisor or reviewing your budget before making these decisions.

05

Review and confirm the information you have entered. Take the time to double-check that all the provided details are accurate and up to date.

06

Set up your investment options. When filling out your 401k, you will typically have a range of investment options to choose from. These can include various mutual funds, stocks, or bonds. You can select the investment mix that aligns with your preferred risk tolerance and long-term goals.

07

Decide if you want to take advantage of any employer matching contributions. Some employers offer to match a percentage of their employees' 401k contributions, typically up to a certain limit. If this option is available to you, consider contributing enough to maximize this employer match, as it effectively boosts your retirement savings.

Who needs Utah Retirement Systems 401k:

01

Employees working for public institutions in Utah, such as state agencies, public school districts, or public universities, may need to enroll in the Utah Retirement Systems 401k. This retirement plan is specifically designed for Utah public employees.

02

Individuals who wish to save for retirement and have the option to contribute to a 401k plan may find the Utah Retirement Systems 401k beneficial. It offers tax advantages, provides a way to save for the future, and allows for potential growth through investment options.

03

Anyone who wants to take advantage of the employer match should consider enrolling in the Utah Retirement Systems 401k if their employer offers this benefit. The matching contributions can significantly increase the overall retirement savings.

Remember, it is advisable to consult a financial advisor or the Utah Retirement Systems' resources for personalized guidance and specific information on filling out the Utah Retirement Systems 401k.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my utah retirement systems 401k in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your utah retirement systems 401k and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send utah retirement systems 401k for eSignature?

Once your utah retirement systems 401k is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete utah retirement systems 401k online?

Easy online utah retirement systems 401k completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is utah retirement systems 401k?

The Utah Retirement Systems 401k is a retirement savings plan offered by the state of Utah to its employees. It allows employees to contribute a portion of their salary to a tax-advantaged account and invest that money for retirement purposes.

Who is required to file utah retirement systems 401k?

All employees of the state of Utah who are eligible for retirement benefits are required to participate in the Utah Retirement Systems 401k plan. This includes full-time and part-time employees.

How to fill out utah retirement systems 401k?

To fill out the Utah Retirement Systems 401k, employees must complete the necessary enrollment forms provided by the Utah Retirement Systems. These forms require individuals to provide personal information, choose their contribution amount, select investment options, and designate their beneficiaries.

What is the purpose of utah retirement systems 401k?

The purpose of the Utah Retirement Systems 401k is to provide state employees with a retirement savings vehicle that offers tax advantages and allows them to accumulate funds for their future retirement needs. It aims to help employees achieve financial security in retirement.

What information must be reported on utah retirement systems 401k?

Employees must report their personal information, such as their full name, social security number, and contact details, on the Utah Retirement Systems 401k enrollment forms. They also need to specify their contribution amounts, investment allocations, and beneficiaries.

Fill out your utah retirement systems 401k online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Utah Retirement Systems 401k is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.