Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement 2008-2026 free printable template

Show details

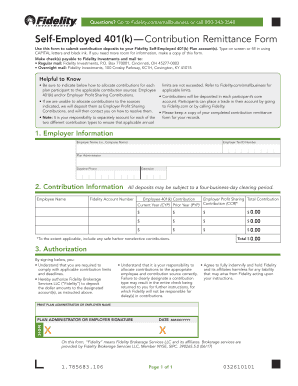

The Fidelity Retirement Plan Profit Sharing/Standardized 401(k) Plan Adoption Agreement No. 003 A Prototype Plan for use with the Fidelity Retirement Plan, Basic Plan Document No. 03 1 2 PLAN INFORMATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fidelity adoption agreement form

Edit your retirement plan document form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Fidelity Profit SharingStandardized 401k Plan Adoption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Fidelity Profit SharingStandardized 401k Plan Adoption online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Fidelity Profit SharingStandardized 401k Plan Adoption. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Fidelity Profit SharingStandardized 401k Plan Adoption

How to fill out Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement

01

Begin by gathering all necessary information about your business, including legal structure and tax identification numbers.

02

Choose the type of plan you want to adopt (Profit Sharing, Standardized 401(k), etc.).

03

Fill in the Plan Name and Plan Year in the designated sections.

04

Specify the eligibility requirements for employees (e.g., age, length of service).

05

Decide on the contribution formula and input it in the appropriate section.

06

Indicate whether you want to allow loans or hardship withdrawals in your plan.

07

Review the designated custodian or trustee for the plan assets and complete their details.

08

Include any vesting schedules for employer contributions.

09

Provide the necessary signatures from plan sponsors or authorized representatives.

10

Submit the completed agreement to Fidelity for processing.

Who needs Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement?

01

Businesses looking to establish a retirement saving plan for their employees.

02

Employers wanting to provide a competitive benefits package.

03

Self-employed individuals seeking tax advantages and retirement savings.

04

Companies that want to attract and retain talent through 401(k) plans.

Fill

form

: Try Risk Free

People Also Ask about

What is a volume submitter document?

What is a Volume Submitter Plan (VSP)? A VSP is a type of plan that, once approved by the IRS, gives assurance that the plan document meets the legal and regulatory requirements of a 403(b). Employers who have adopted a VSP that has been approved by the IRS know they can rely on the plan document being compliant.

What is a 401k adoption agreement?

401k adoption agreement is a section of a retirement plan document that allows the employer to choose the provisions that apply to its (employer sponsored) retirement plan.

What is a pre approved plan document?

A pre-approved retirement plan is a plan sold to employers by a document provider such as a financial institution or benefits practitioner.

What is a basic plan document for a 401k plan?

The basic plan document contains all the non-elective provisions and can't include any options or blanks for the employer to complete. The adoption agreement contains the options (and blanks) for the employer to complete and is also where the employer signs the plan.

What is a 401k basic plan document?

The basic plan document contains all the non-elective provisions and can't include any options or blanks for the employer to complete. The adoption agreement contains the options (and blanks) for the employer to complete and is also where the employer signs the plan.

What is 401k basic information?

A 401(k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. Elective salary deferrals are excluded from the employee's taxable income (except for designated Roth deferrals). Employers can contribute to employees' accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Fidelity Profit SharingStandardized 401k Plan Adoption directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your Fidelity Profit SharingStandardized 401k Plan Adoption and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit Fidelity Profit SharingStandardized 401k Plan Adoption online?

The editing procedure is simple with pdfFiller. Open your Fidelity Profit SharingStandardized 401k Plan Adoption in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the Fidelity Profit SharingStandardized 401k Plan Adoption electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your Fidelity Profit SharingStandardized 401k Plan Adoption.

What is Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement?

The Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement is a legal document that allows employers to establish a profit-sharing and 401(k) retirement plan for their employees. It outlines the terms and conditions of the plan and serves as an agreement between the employer and the plan participants.

Who is required to file Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement?

Employers who wish to set up a Fidelity Profit Sharing/Standardized 401(k) retirement plan for their employees are required to file the Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement.

How to fill out Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement?

To fill out the Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement, employers need to provide accurate information related to their business, such as the company's name, address, tax identification number, and details about the plan features, including eligibility, contributions, and distribution options.

What is the purpose of Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement?

The purpose of the Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement is to formally adopt a retirement plan for employees, ensuring compliance with regulations while providing a structured way for employees to save for retirement.

What information must be reported on Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement?

The information that must be reported on the Fidelity Profit Sharing/Standardized 401(k) Plan Adoption Agreement includes the employer's identification details, the specific plan features chosen, employee eligibility criteria, contribution methods, and other relevant plan administration details.

Fill out your Fidelity Profit SharingStandardized 401k Plan Adoption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Profit SharingStandardized 401k Plan Adoption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.