Get the free IRA Recharacterization Request - Fidelity Investments

Show details

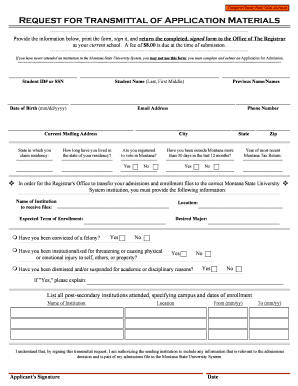

Print Reset Save Questions? Go to Fidelity.com or call 1-800-544-6666. IRA Re characterization Request Use this form to recharacterize: NY annual contributions you made to a traditional IRA as annual

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira recharacterization request

Edit your ira recharacterization request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira recharacterization request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira recharacterization request online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ira recharacterization request. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira recharacterization request

How to Fill Out IRA Recharacterization Request:

01

Obtain the necessary forms: Start by obtaining the IRA recharacterization request form from your financial institution or online platform. This form may also be referred to as Form 8606.

02

Provide personal information: In the designated sections of the form, provide your personal information such as your name, address, social security number, and the year for which you are requesting the recharacterization.

03

Specify the IRA accounts: Indicate the specific IRA accounts involved in the recharacterization. Provide the names of the custodians and the account numbers of the original and receiving IRA accounts.

04

Describe the contribution: Clearly state the type of contribution being recharacterized, whether it is a traditional IRA contribution, a Roth IRA contribution, or a conversion contribution.

05

Provide contribution details: Specify the amount or percentage of the contribution that you wish to recharacterize. This information should include both the original contribution amount and any earnings or losses associated with it.

06

Explain the reason for recharacterization: Briefly explain the reason why you are requesting the recharacterization. Common reasons include misclassifying the contribution, wanting to switch between traditional and Roth IRAs, or correcting an excess contribution.

07

Sign and date the form: Review the completed form for accuracy, sign and date it. Some financial institutions may require a witness or a notary public to witness your signature.

Who needs an IRA recharacterization request?

01

Individuals who made an incorrect contribution: If you made a contribution to the wrong type of IRA, such as mistakenly contributing to a traditional IRA instead of a Roth IRA or vice versa, you will need an IRA recharacterization request.

02

Those who want to switch between traditional and Roth IRAs: If you had initially made a traditional IRA contribution but later decide that a Roth IRA would be more advantageous for your financial situation, an IRA recharacterization request would be necessary.

03

Correcting an excess contribution: If you realized that you have exceeded the annual contribution limit for your IRA, you can request a recharacterization to remove the excess contribution and any associated earnings or losses.

In summary, filling out an IRA recharacterization request involves obtaining the necessary forms, providing personal information, specifying the IRA accounts involved, describing the contribution, providing contribution details, explaining the reason for recharacterization, and signing and dating the form. This request is typically needed by individuals who made an incorrect contribution, those who want to switch between traditional and Roth IRAs, or those correcting an excess contribution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ira recharacterization request?

An IRA recharacterization request is a request made by an individual to change the classification of a previous IRA contribution from one type (such as a traditional IRA) to another type (such as a Roth IRA).

Who is required to file ira recharacterization request?

Any individual who wants to change the classification of their previous IRA contribution is required to file an IRA recharacterization request.

How to fill out ira recharacterization request?

To fill out an IRA recharacterization request, individuals typically need to contact their IRA custodian or trustee and complete the necessary forms or provide the required information. The specific process may vary depending on the financial institution managing the IRA.

What is the purpose of ira recharacterization request?

The purpose of an IRA recharacterization request is to allow individuals to change the tax treatment of their contributions in order to align with their financial goals and circumstances. For example, someone may decide to recharacterize a traditional IRA contribution as a Roth IRA contribution if they anticipate benefiting more from tax-free withdrawals in the future.

What information must be reported on ira recharacterization request?

The specific information required on an IRA recharacterization request can vary, but generally, it may include details such as the account holder's name, account number, the amount being recharacterized, and the tax year to which the recharacterization applies.

Can I create an eSignature for the ira recharacterization request in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your ira recharacterization request and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit ira recharacterization request straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing ira recharacterization request, you can start right away.

How do I complete ira recharacterization request on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your ira recharacterization request. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your ira recharacterization request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Recharacterization Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.