Get the free Withdrawal - Hardship - Sunwest Pensions

Show details

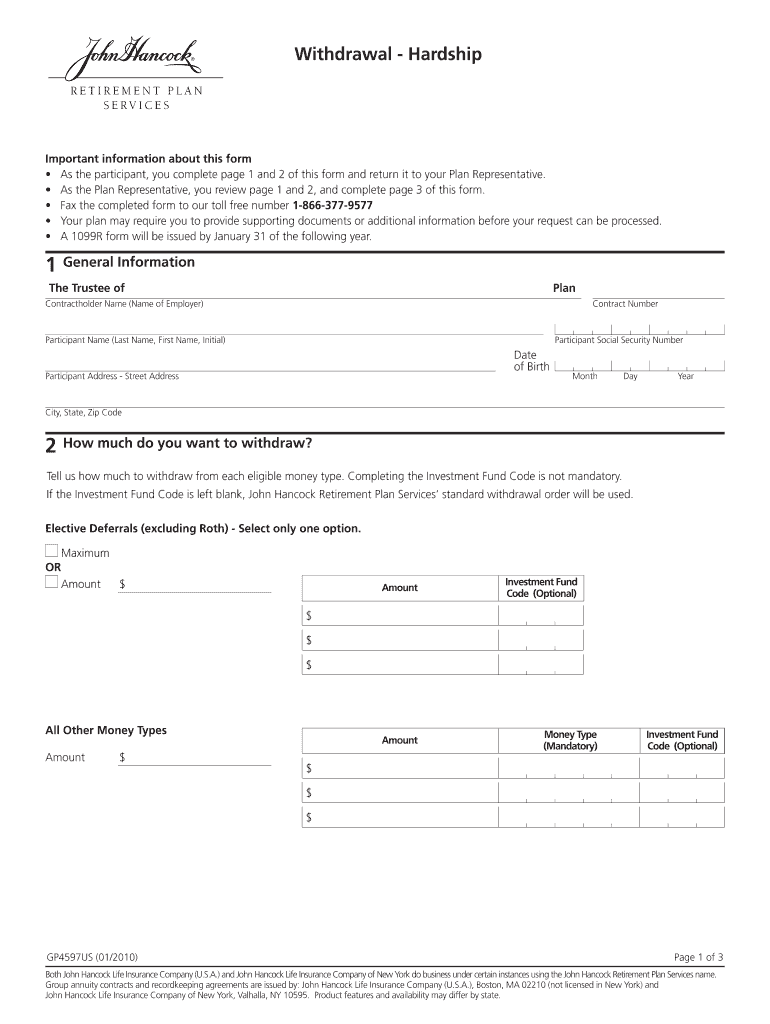

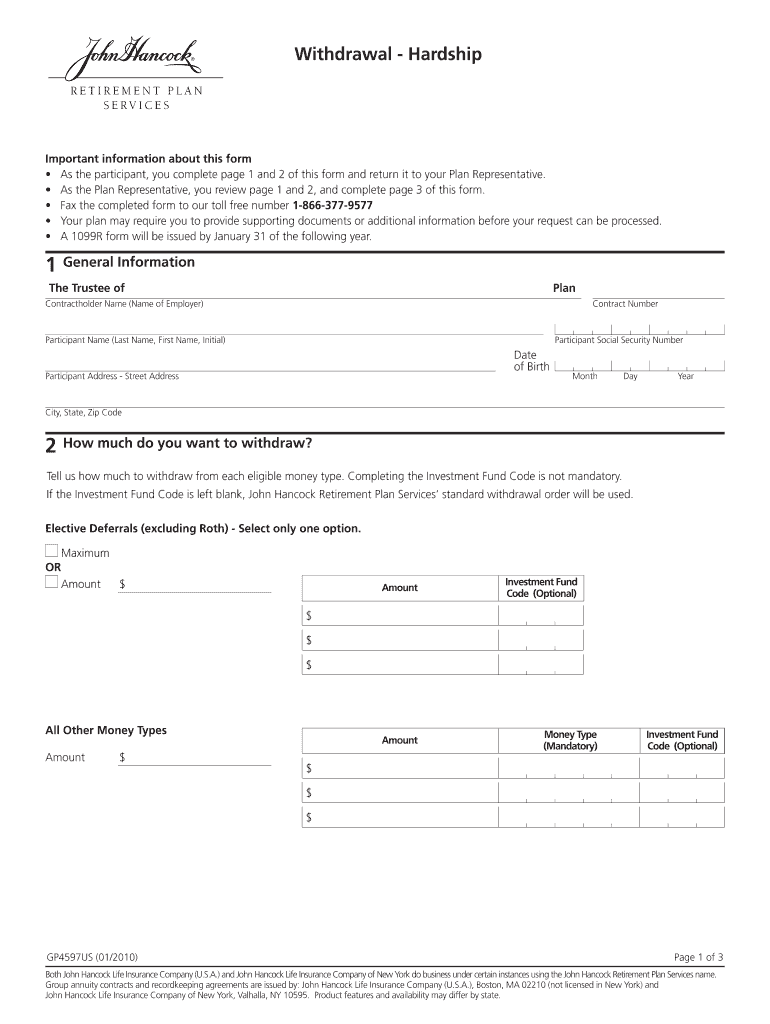

Reset Form Withdrawal Hardship Important information about this form As the participant, you complete page 1 and 2 of this form and return it to your Plan Representative. As the Plan Representative,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign withdrawal - hardship

Edit your withdrawal - hardship form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your withdrawal - hardship form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing withdrawal - hardship online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit withdrawal - hardship. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out withdrawal - hardship

How to fill out withdrawal - hardship?

01

Start by obtaining the necessary forms: To fill out a withdrawal - hardship request, you will need to obtain the relevant forms from the organization or institution responsible for handling such requests. This could be your employer, a financial institution, or a government agency. You may be able to find these forms on their website or by contacting their customer service.

02

Understand the eligibility criteria: Before filling out the withdrawal - hardship forms, it is important to understand the eligibility criteria for this type of withdrawal. Different organizations may have different requirements, but generally, a withdrawal - hardship is granted when an individual is facing unexpected financial difficulties or emergencies. It is important to review the guidelines and requirements to ensure that you meet the necessary criteria.

03

Gather supporting documentation: To support your withdrawal - hardship request, you will usually need to provide relevant documentation. This may include proof of financial hardship, such as medical bills, unemployment records, or divorce papers. Additionally, you may need to provide documentation related to the purpose of your withdrawal, such as invoices, estimates, or quotes if you are requesting funds for medical expenses, repairs, or other specific purposes.

04

Complete the forms accurately: Once you have the necessary forms and supporting documentation, it is time to fill them out accurately. Make sure to read all instructions carefully and complete all sections as required. Double-check your information for any errors or omissions before submitting the forms.

05

Include a detailed explanation: Along with the forms, it is usually helpful to include a detailed explanation of why you are requesting a withdrawal - hardship. Clearly articulate your financial difficulties or emergency situation, providing any relevant details that may support your case. This can help the decision-making authorities better understand your situation and increase your chances of a successful outcome.

Who needs withdrawal - hardship?

01

Employees facing financial difficulties: Many companies offer withdrawal - hardship options to their employees as part of their retirement plans. If you are experiencing financial hardships due to unexpected circumstances such as medical expenses, job loss, or other emergencies, you may be eligible to request a withdrawal - hardship from your retirement account.

02

Individuals with special financial circumstances: Some financial institutions, such as banks or credit unions, may offer withdrawal - hardship options for individuals who are facing unique financial circumstances. This could include situations like avoiding foreclosure, paying for higher education expenses, or covering funeral costs. If you find yourself in a challenging financial situation, it may be worth exploring if a withdrawal - hardship is available to you.

03

Participants in government assistance programs: Certain government assistance programs, such as unemployment benefits or welfare, may provide the option for participants to request a withdrawal - hardship in cases of extreme financial need. These withdrawals could help individuals meet their immediate financial obligations during times of crisis.

04

Students facing financial difficulties: Education-related withdrawals - hardships may be available for students facing significant financial challenges while pursuing their studies. These could include unexpected expenses or situations that impact their ability to continue their education. Students should check with their educational institution or student loan provider for details on the availability and process for this type of withdrawal.

In summary, to fill out a withdrawal - hardship request, you need to obtain the necessary forms, understand the eligibility criteria, gather supporting documentation, accurately complete the forms, and include a detailed explanation of your financial difficulties. Different individuals who may need withdrawal - hardship include employees facing financial difficulties, individuals with special financial circumstances, participants in government assistance programs, and students facing financial challenges in their education.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send withdrawal - hardship for eSignature?

Once your withdrawal - hardship is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete withdrawal - hardship online?

Easy online withdrawal - hardship completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I complete withdrawal - hardship on an Android device?

Use the pdfFiller app for Android to finish your withdrawal - hardship. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is withdrawal - hardship?

Withdrawal - hardship refers to the process of taking out money from a savings or retirement account due to financial difficulties.

Who is required to file withdrawal - hardship?

Individuals who are facing financial hardship and meet the eligibility criteria set by their financial institution or retirement plan may be required to file for withdrawal - hardship.

How to fill out withdrawal - hardship?

To fill out a withdrawal - hardship form, you need to provide necessary personal and financial information, such as your name, account details, reasons for hardship, and supporting documentation. The exact process may vary depending on the financial institution or retirement plan provider.

What is the purpose of withdrawal - hardship?

The purpose of withdrawal - hardship is to allow individuals facing financial difficulties to access funds from their savings or retirement accounts to cover expenses or emergencies.

What information must be reported on withdrawal - hardship?

The information required to be reported on a withdrawal - hardship may include personal details (name, address, social security number), account details, documentation of financial hardship, and any other information specified by the financial institution or retirement plan provider.

Fill out your withdrawal - hardship online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Withdrawal - Hardship is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.