Get the free PENSION CONTRIBUTION REMITTANCE FORM

Show details

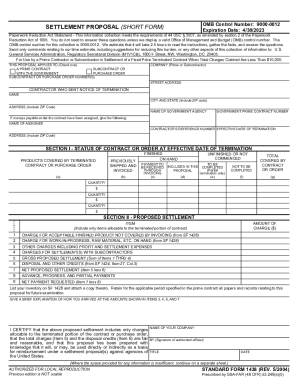

A form used to report pension contribution remittances for musicians to the American Federation of Musicians and Employers’ Pension Fund.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pension contribution remittance form

Edit your pension contribution remittance form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pension contribution remittance form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pension contribution remittance form online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pension contribution remittance form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pension contribution remittance form

How to fill out PENSION CONTRIBUTION REMITTANCE FORM

01

Obtain the Pension Contribution Remittance Form from your employer or the pension authority.

02

Fill in your personal details, including full name, address, and identification number.

03

Indicate the pay period for which you are making the contribution.

04

Enter the total amount of pension contribution to be remitted.

05

Provide the name and registration number of the pension fund.

06

If applicable, fill in the details of any additional contributions or employer contributions.

07

Review the form for accuracy and completeness.

08

Sign and date the form.

09

Submit the form along with the payment to the designated authority.

Who needs PENSION CONTRIBUTION REMITTANCE FORM?

01

Employees who contribute to a pension scheme.

02

Employers who manage payroll and pension contributions.

03

Self-employed individuals who participate in a pension fund.

04

Pension fund administrators and regulatory bodies.

Fill

form

: Try Risk Free

People Also Ask about

How to transfer pension contributions?

How to transfer pension from one place to another ? The pensioner has to submit an application to the Treasury Officer / Assistant Treasury Officer / Sub Treasury Officer concerned from where he/she gets monthly pension, giving the details of new address along with the original PPO.

What is a pension remittance?

Based on instructions given to your employer, the contribution is deducted from your monthly emolument by the employer and remitted into your Retirement Savings Account (RSA), along with the statutory pension contributions. RSA holders can withdraw voluntary contributions at any time.

What is the form for pension contribution withdrawal?

You can apply for Withdrawal Benefit or Scheme Certificate through Form 10C for retaining the Pension Fund Membership. Retention of the membership will give advantage of adding any future period of membership under the Fund and attain eligible service of 10 years to get pension.

How to fill out a pension form?

How to fill EPF form 10D: Section-wise breakdown By Whom the Pension is Claimed. Select the correct category: Type of Pension. Choose based on your eligibility: Personal & Employment Details. Name, DOB, marital status, etc. Pension Options.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PENSION CONTRIBUTION REMITTANCE FORM?

The Pension Contribution Remittance Form is a document used by employers to report and remit contributions made to an employee's pension plan. It typically includes details about the contributions for a specific period.

Who is required to file PENSION CONTRIBUTION REMITTANCE FORM?

Employers who offer pension plans to their employees are required to file the Pension Contribution Remittance Form as part of their obligation to report employee benefits and contributions.

How to fill out PENSION CONTRIBUTION REMITTANCE FORM?

To fill out the Pension Contribution Remittance Form, employers should gather accurate employee information, including their identification, contribution amounts, and relevant periods. The form typically requires specific calculations based on the company's payroll records.

What is the purpose of PENSION CONTRIBUTION REMITTANCE FORM?

The purpose of the Pension Contribution Remittance Form is to ensure that pension contributions are correctly reported and remitted to pension funds. This helps maintain compliance with legal requirements and ensures employees' retirement benefits are funded.

What information must be reported on PENSION CONTRIBUTION REMITTANCE FORM?

Information that must be reported on the Pension Contribution Remittance Form typically includes employer identification, employee details, contribution amounts, pay periods, and any applicable deductions or adjustments.

Fill out your pension contribution remittance form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pension Contribution Remittance Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.