Get the free PERSONAL BUSINESS CREDIT CARD APPLICATION FORM - bo3cardsbbcomb

Show details

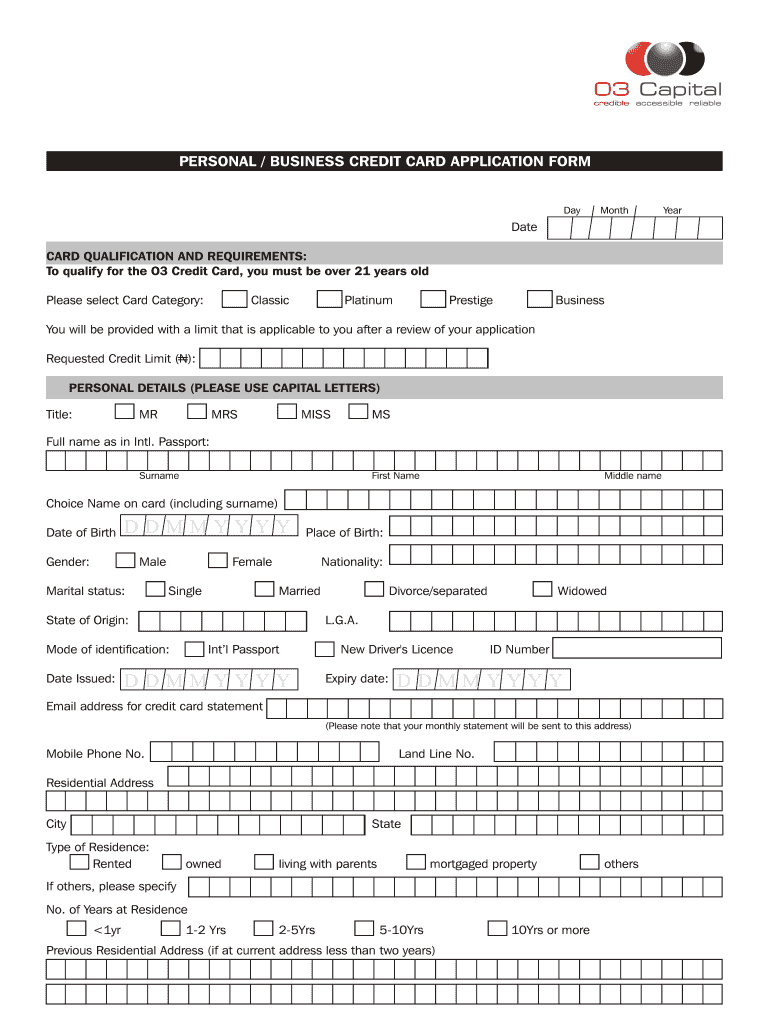

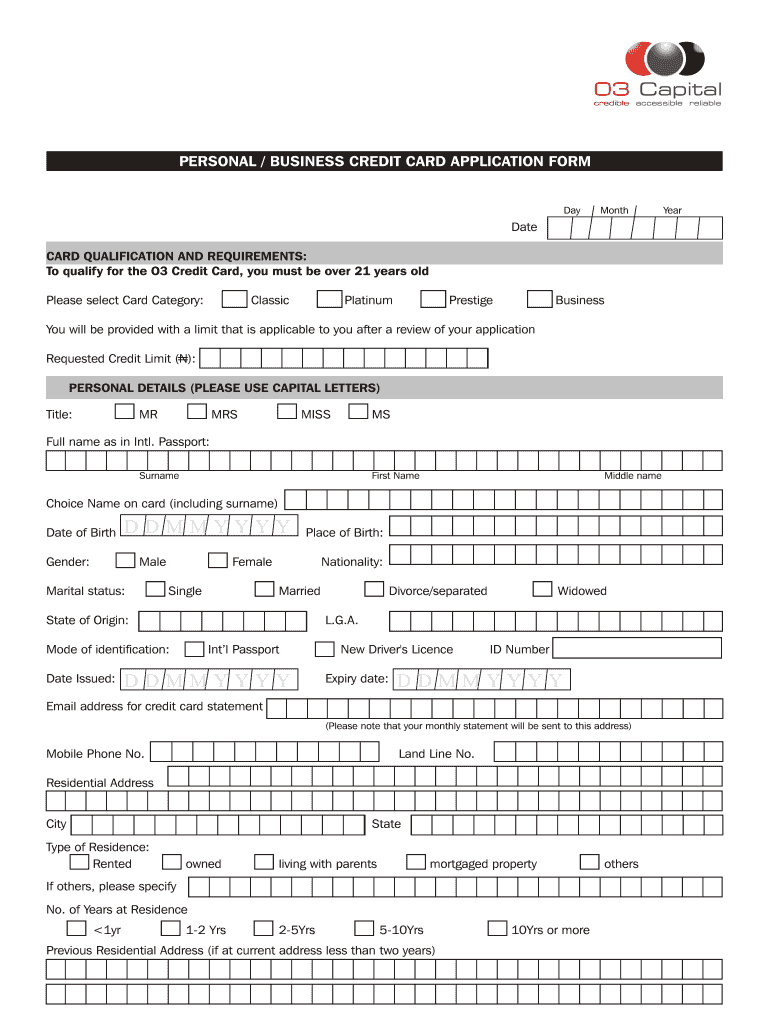

03 Capital credible accessible reliable PERSONAL / BUSINESS CREDIT CARD APPLICATION FORM Day Month Date CARD QUALIFICATION AND REQUIREMENTS: To qualify for the O3 Credit Card, you must be over 21

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal business credit card

Edit your personal business credit card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal business credit card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal business credit card online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal business credit card. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal business credit card

How to fill out a personal business credit card:

01

Gather the necessary documents: Before filling out a personal business credit card application, make sure you have all the required documents handy. These typically include your personal identification proof, business proof, financial statements, and any other information required by the credit card issuer.

02

Research and compare credit card options: With numerous credit card options available in the market, it's crucial to research and compare them to find the best fit for your business needs. Look for features like rewards programs, interest rates, annual fees, and credit limits that align with your requirements.

03

Understand the terms and conditions: Carefully read and understand the terms and conditions associated with the credit card you choose. Pay close attention to interest rates, fees, penalties, and any potential limitations or restrictions that may affect your business operations.

04

Complete the application form: Fill out the credit card application form accurately and honestly. Provide all the necessary information, including your personal details, business information, financial history, and any additional documentation required. Be thorough to minimize the chances of rejection or delays in the application process.

05

Review and double-check: Before submitting the application, review all the information you provided. Make sure there are no errors or omissions that could impact the approval process. Double-check the accuracy of your contact information, business details, and any supporting documents.

06

Submit the application: Once you are confident that the application is complete and accurate, submit it to the credit card issuer. Follow the provided instructions, whether it's submitting online or through physical documents, to ensure your application reaches the appropriate department.

Who needs a personal business credit card:

01

Small business owners: Personal business credit cards can be beneficial for small business owners who need to separate their personal and business expenses. It allows for better tracking of business-related expenses and can simplify accounting and tax preparations.

02

Freelancers and independent contractors: Individuals working as freelancers or independent contractors often find personal business credit cards helpful in managing their finances. It allows them to keep personal and business expenses separate while also having access to features like expense tracking and rewards programs.

03

Startups and entrepreneurs: For startups and entrepreneurs who are just starting their business journey, personal business credit cards can be a practical option. It provides a way to finance initial business expenses, build credit history, and track business-related spending in a separate account.

In summary, filling out a personal business credit card involves gathering the necessary documents, researching and comparing different credit card options, understanding the terms and conditions, completing the application form accurately, reviewing the information provided, and submitting the application. Personal business credit cards are beneficial for small business owners, freelancers, independent contractors, startups, and entrepreneurs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify personal business credit card without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your personal business credit card into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send personal business credit card for eSignature?

Once your personal business credit card is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute personal business credit card online?

Completing and signing personal business credit card online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

What is personal business credit card?

A personal business credit card is a credit card designed for business expenses that is issued to an individual rather than a business entity.

Who is required to file personal business credit card?

Individuals who use a personal business credit card for business expenses are required to file it for tax purposes.

How to fill out personal business credit card?

To fill out a personal business credit card, you will need to report all business-related expenses on the card, including dates, amounts, and purposes of each expense.

What is the purpose of personal business credit card?

The purpose of a personal business credit card is to conveniently separate personal and business expenses, track business spending, and potentially earn rewards or cash back on business purchases.

What information must be reported on personal business credit card?

Information that must be reported on a personal business credit card includes all business-related expenses, such as dates, amounts, and purposes of each expense.

Fill out your personal business credit card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Business Credit Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.