Get the free TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300) - ig libertyonline

Show details

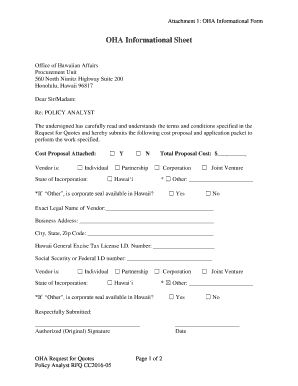

This document serves as an application packet for establishing a Traditional IRA trust with a credit union, including spaces for beneficiary designations and providing consent from a spouse and the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional ira trust application

Edit your traditional ira trust application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional ira trust application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing traditional ira trust application online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit traditional ira trust application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out traditional ira trust application

How to fill out TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300)

01

Gather necessary personal information such as your name, address, and Social Security number.

02

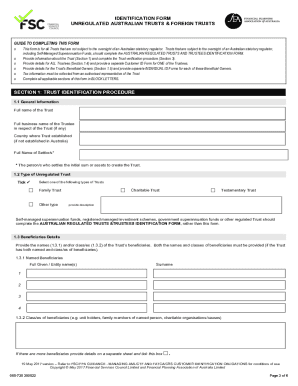

Fill out the Trust Information section, providing the name of the trust and the date it was established.

03

Indicate the Trustee(s) details, including names and contact information.

04

Complete the Beneficiary Information section, listing all individuals or entities that will benefit from the trust.

05

Review the investment instructions and determine how you want to allocate contributions within the IRA.

06

Sign and date the application packet where indicated, ensuring all signatures are from the authorized parties.

07

Include any supporting documents required, such as a copy of the trust agreement.

08

Submit the completed application packet to the financial institution managing the IRA.

Who needs TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300)?

01

Individuals establishing a Traditional IRA under a trust structure.

02

Trustees managing a trust that will hold IRA assets.

03

Beneficiaries who wish to receive distributions from a trust-held IRA.

04

Anyone seeking to ensure assets are managed according to the trust's terms while benefiting from tax advantages.

Fill

form

: Try Risk Free

People Also Ask about

Will I get a tax form for my traditional IRA?

IRA contributions will be reported on Form 5498: IRA contribution information is reported for each person for whom any IRA was maintained, including SEP or SIMPLE IRAs. An IRA includes all investments under one IRA plan.

What is the cutoff for traditional IRA?

There are no income limitations to contribute to a non-deductible Traditional IRA, and the maximum contribution per year is $7,000 for tax years 2024 - 2025 ($8,000 if you're age 50 or over).

How to withdraw funds from a traditional IRA?

Withdrawals from a SIMPLE IRA can be initiated using our separate form (PDF) or by calling us for assistance at 800-343-3548. In many cases, you'll have to pay federal and state taxes on your early withdrawal. There may also be a 10% tax penalty.

What is the income cut-off for traditional IRA?

There are no income limitations to contribute to a non-deductible Traditional IRA, and the maximum contribution per year is $7,000 for tax years 2024 - 2025 ($8,000 if you're age 50 or over).

Can you contribute to a traditional IRA after 70?

IRA contributions after age 70½ For 2020 and later, there is no age limit on making regular contributions to traditional or Roth IRAs. For 2019 and earlier, if you're 70 ½ or older, you can't make a regular contribution to a traditional IRA.

What is a traditional IRA certificate?

An individual retirement account certificate, or IRA CD, is an IRA where your money is used to earn higher dividends in certificates of deposit, or CDs.

Can I contribute to a traditional IRA if I make over $200,000?

There are no income limits to contributing to a traditional IRA. If you're a nonworking spouse, you can have what's called a spousal IRA as long as your spouse earns enough to cover the contribution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300)?

TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300) is a specific form used to establish a Traditional IRA under a trust arrangement, enabling the management of retirement funds in compliance with IRS regulations.

Who is required to file TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300)?

Individuals who wish to establish a Traditional IRA held in trust, typically with a trust company or financial institution, are required to file the TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300).

How to fill out TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300)?

To fill out the TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300), provide personal information such as the account holder's name, address, Social Security number, and details about the trust. Follow the instructions on the form carefully to ensure accuracy.

What is the purpose of TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300)?

The purpose of the TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300) is to create a Traditional IRA account that is established under a trust, allowing for specific investment and distribution strategies under the tax-advantaged framework of an IRA.

What information must be reported on TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300)?

The information that must be reported on the TRADITIONAL IRA TRUST APPLICATION PACKET - CUT (FORM 2300) includes the account holder's identification details, the trust information, investment preferences, beneficiary designations, and any other required financial disclosures as dictated by the form.

Fill out your traditional ira trust application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional Ira Trust Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.