Get the free IRS Criminal Investigation

Show details

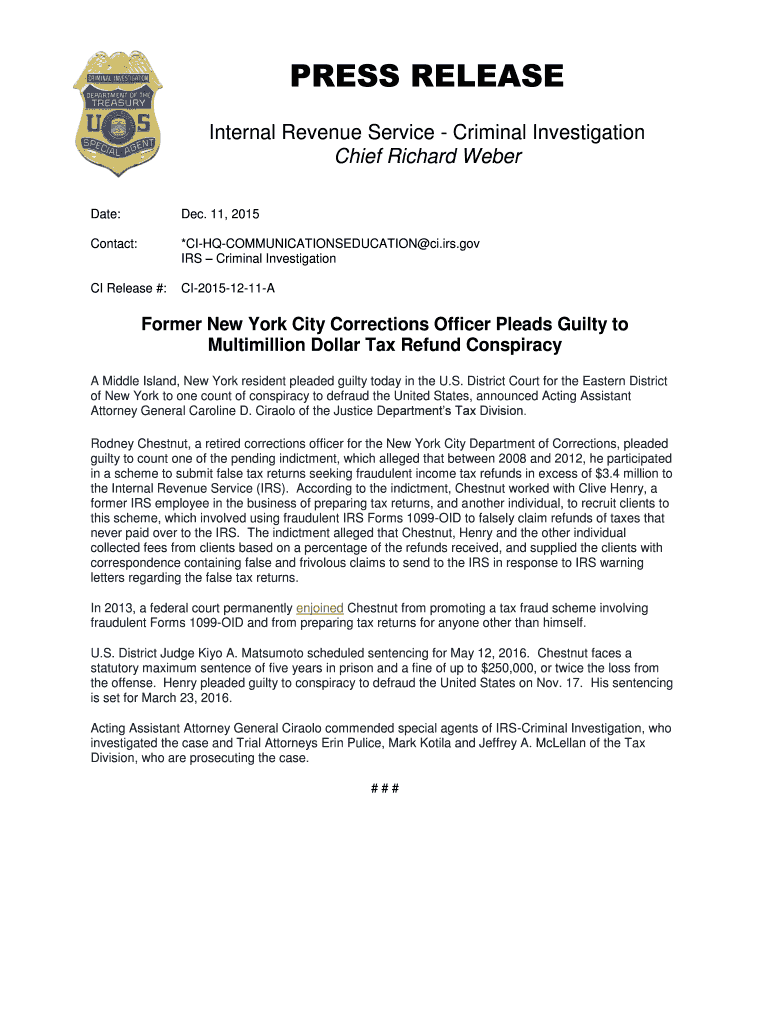

PRESS RELEASE Internal Revenue Service Criminal Investigation Chief Richard Weber Date:Dec. 11, 2015Contact:*CIHQCOMMUNICATIONSEDUCATION CI.IRS.gov IRS Criminal Investigation CI Release #:CI20151211AFormer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs criminal investigation

Edit your irs criminal investigation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs criminal investigation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs criminal investigation online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irs criminal investigation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs criminal investigation

How to fill out IRS Criminal Investigation:

01

Collect all necessary documents: Gather all relevant financial records, receipts, bank statements, tax returns, and any other documentation requested by the IRS for the investigation.

02

Speak with legal counsel: It is essential to consult with an experienced tax attorney or legal professional who specializes in criminal tax matters. They can guide and advise you throughout the process, ensuring that your rights are protected and helping you navigate the complexities of the investigation.

03

Cooperate with the investigation: It is crucial to fully cooperate with the IRS during the investigation. Provide all requested information, answer questions truthfully, and comply with any deadlines or requests from the IRS agents involved in the case. Not cooperating can have serious consequences and may escalate the situation further.

04

Keep thorough records: Maintain detailed records of all communication and interactions with the IRS during the investigation. This includes any correspondence, phone calls, or in-person meetings. These records can be helpful in protecting your rights and ensuring that the investigation proceeds fairly.

05

Seek professional guidance: Throughout the process, continue to seek advice from your legal counsel. They can help you understand your rights, review any proposed settlements or agreements, and represent your interests during negotiations or court proceedings.

Who needs IRS Criminal Investigation?

Individuals or entities suspected of committing tax-related crimes or fraud may need to undergo an IRS criminal investigation. This includes cases where there is evidence of willful evasion, intentional understatement of income, falsification of records, or any other deliberate attempt to cheat or deceive the IRS.

If the IRS believes that a violation of tax laws has occurred, they have the authority to initiate a criminal investigation. This investigation aims to gather evidence, interview individuals involved, and determine whether criminal charges should be filed.

Ultimately, it is the responsibility of the IRS to determine who needs an IRS criminal investigation based on the evidence and circumstances surrounding the tax-related offense.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in irs criminal investigation?

The editing procedure is simple with pdfFiller. Open your irs criminal investigation in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete irs criminal investigation on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your irs criminal investigation. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out irs criminal investigation on an Android device?

Use the pdfFiller Android app to finish your irs criminal investigation and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is irs criminal investigation?

IRS Criminal Investigation is a division of the IRS that investigates potential criminal violations of the tax code.

Who is required to file irs criminal investigation?

Individuals or entities suspected of committing tax-related crimes are required to file an IRS Criminal Investigation.

How to fill out irs criminal investigation?

IRS Criminal Investigation reports are typically filled out by special agents with the necessary training and expertise.

What is the purpose of irs criminal investigation?

The purpose of IRS Criminal Investigation is to identify and prosecute individuals or entities that violate tax laws.

What information must be reported on irs criminal investigation?

Information reported on an IRS Criminal Investigation includes details of potential tax crimes, evidence collected, and suspects identified.

Fill out your irs criminal investigation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Criminal Investigation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.