Get the free Seafarers Money Purchase Pension Plan - seafarers

Show details

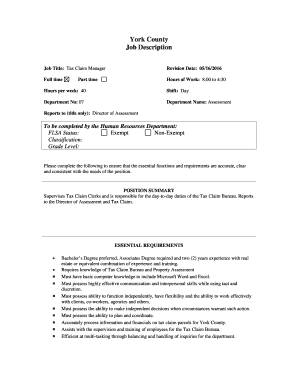

This application is for active participants age 70 and over who are still working to apply for pension benefits or required minimum distributions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign seafarers money purchase pension

Edit your seafarers money purchase pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your seafarers money purchase pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit seafarers money purchase pension online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit seafarers money purchase pension. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out seafarers money purchase pension

How to fill out Seafarers Money Purchase Pension Plan

01

Gather all necessary documents, such as identification and previous employment records.

02

Visit the official Seafarers Money Purchase Pension Plan website or contact relevant personnel for guidance.

03

Complete the application form provided, ensuring all personal details are accurate.

04

Specify your chosen contribution levels and payment frequency.

05

Review the terms and conditions of the plan carefully before submission.

06

Submit the completed application form along with any required supporting documents.

07

Await confirmation of your application and follow any further instructions provided.

Who needs Seafarers Money Purchase Pension Plan?

01

Individuals working in the maritime industry, including seafarers and marine professionals, who wish to secure their retirement.

02

Those looking for a personal pension option that allows for flexible contributions and investment choices.

03

Employees who want to supplement their state pension or other retirement savings plans.

Fill

form

: Try Risk Free

People Also Ask about

What is money purchase pension allowance?

The Money Purchase Annual Allowance (MPAA) is a reduced annual allowance for pension contributions after an individual has flexibly accessed their pension savings. Triggering the MPAA usually involves taking an uncrystallised funds pension lump sum or starting taking income from a flexi-access drawdown plan.

What is a money purchase registered pension plan?

A money purchase pension plan is one in which contributions made by the employer (and by employees, if the plan requires or allows them to contribute) are placed to the credit of each member. The pension benefits will be based on the total of the accumulated contributions and interest earnings.

What is the seafarers pension plan?

The Seafarers Pension Plan provides retirement benefits in the form of a monthly annuity to employees of signatory maritime employers who have collective bargaining agreements with the Seafarers International Union, Atlantic, Gulf, Lakes and Inland Waters or an affiliated Union.

What are money purchase pension schemes?

A money purchase scheme (also known as defined contribution) is a scheme where the final value depends on: the amount of contributions made by the member, their employer and any third party. the performance of the investments underlying the scheme.

What is the difference between a money purchase pension plan and a pension plan?

The main differences between a pension vs 401(k) have to do with their funding and the way the distributions work. In a money purchase plan, the employer provides the funding with optional employee contribution. With a 401(k), employees fund accounts with elective salary deferrals and optional employer contributions.

What is a money purchase pension plan?

A money purchase pension plan or MPPP is an employer-sponsored retirement plan that requires employers to contribute money on behalf of employees each year. The plan itself defines the amount the employer must contribute. Employees may also have the option to make contributions from their pay.

What is the seafarers money purchase pension plan?

The Seafarers Money Purchase Pension Plan provides retirement benefits in multiple benefit forms to employees of signatory maritime employers who have collective bargaining agreements with the Seafarers International Union, Atlantic, Gulf, Lakes and Inland Waters or an affiliated Union.

What is a money purchase pension?

What is a money purchase pension? A money purchase scheme (also known as defined contribution) is a scheme where the final value depends on: the amount of contributions made by the member, their employer and any third party. the performance of the investments underlying the scheme. the charges within the plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Seafarers Money Purchase Pension Plan?

The Seafarers Money Purchase Pension Plan is a retirement benefit plan designed specifically for maritime workers, allowing them to accumulate funds for retirement through employer contributions and personal contributions, offering a defined contribution structure.

Who is required to file Seafarers Money Purchase Pension Plan?

Employers who participate in the Seafarers Money Purchase Pension Plan are required to file the plan, including documentation related to contributions made on behalf of their employees who are part of the plan.

How to fill out Seafarers Money Purchase Pension Plan?

To fill out the Seafarers Money Purchase Pension Plan, employers must complete the necessary forms, providing required information such as employee details, contribution amounts, and any other relevant information as specified by the plan guidelines.

What is the purpose of Seafarers Money Purchase Pension Plan?

The purpose of the Seafarers Money Purchase Pension Plan is to provide a structured way for seafarers to save for retirement, ensuring they have financial security once they stop working, while also offering tax benefits associated with retirement savings.

What information must be reported on Seafarers Money Purchase Pension Plan?

Information that must be reported on the Seafarers Money Purchase Pension Plan includes employee identification details, contribution levels, investment choices, plan performance, and any distributions made from the account, as required by regulatory standards.

Fill out your seafarers money purchase pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Seafarers Money Purchase Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.