Get the free florida repo affidavit

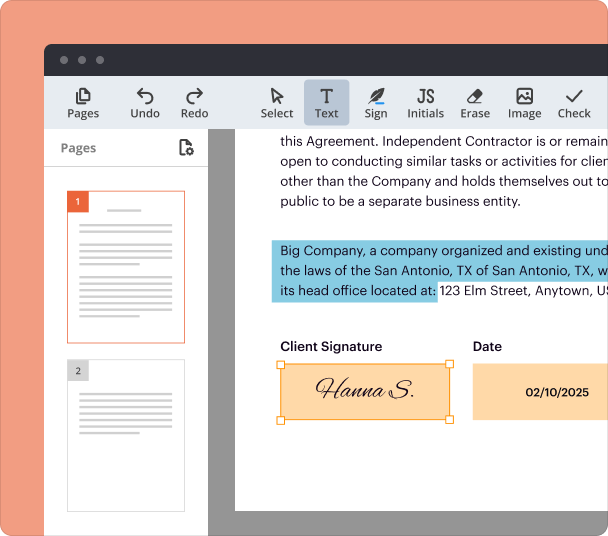

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

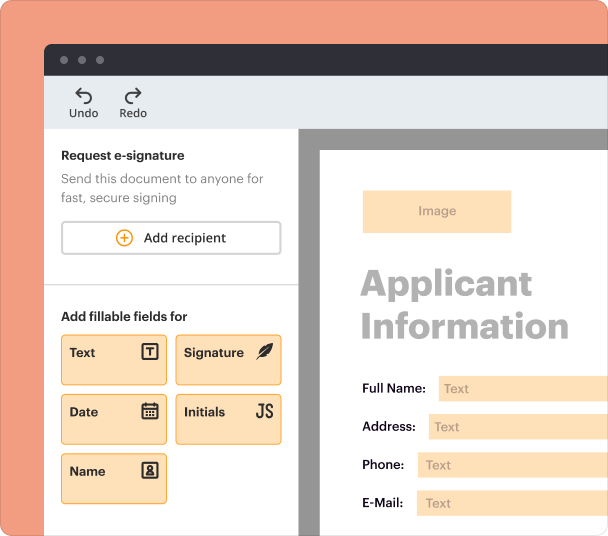

Create professional forms

Simplify data collection

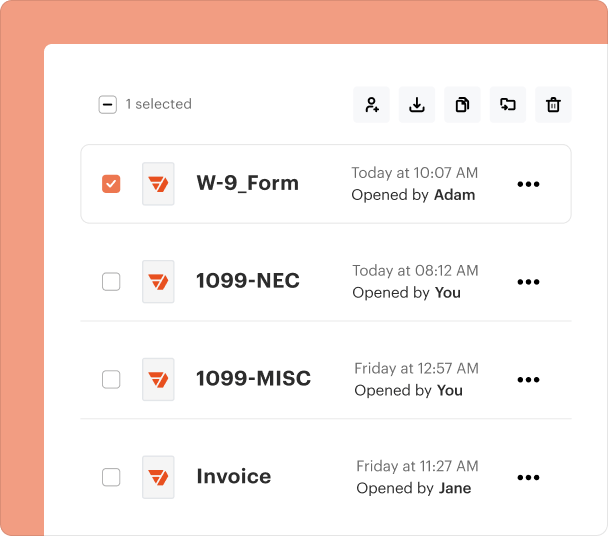

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

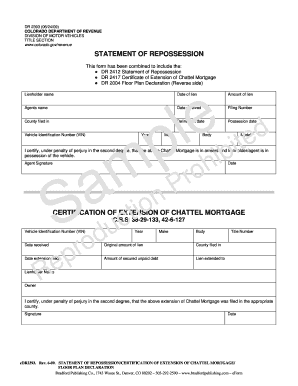

Understanding the Florida Repo Affidavit Form

What is the Florida Repo Affidavit Form?

The Florida repo affidavit form is a legal document used to assert ownership of a repossessed vehicle or mobile home. This form is certified by the lienholder, indicating that they have taken possession of the vehicle following the borrower's default on a secured obligation, typically a loan. It serves as official proof required by state law for the transfer of ownership.

Key Features of the Florida Repo Affidavit Form

This form includes critical information such as the vehicle's identification number, make, model, and title number. It also contains details about the lienholder, including their name and address. These components are essential for processing the repossession with the Florida Division of Motor Vehicles.

When to Use the Florida Repo Affidavit Form

The Florida repo affidavit form should be used when a lienholder repossesses a vehicle after the owner defaults on their financial obligations. This form is necessary to facilitate the legal process of transferring the title and ensuring compliance with Florida state laws.

Required Documents and Information

To complete the Florida repo affidavit form, the lienholder must provide specific information, including details of the repossessed vehicle and the terms of the loan agreement. It is crucial to attach any supporting documents, such as the original title and evidence of default, to establish the legal grounds for the repossession.

Best Practices for Accurate Completion

Accurate completion of the Florida repo affidavit form is vital to avoid legal complications. The lienholder should double-check all entries for correctness, ensure all required fields are filled, and that supporting documents are attached. It's advisable to keep copies of all submitted paperwork for future reference.

Common Errors and Troubleshooting

Common errors when filling out the Florida repo affidavit form include incorrect vehicle identification numbers, missing lienholder information, and failure to sign the form. Those utilizing the form should carefully review their entries and seek clarification on any requirements if unsure.

Frequently Asked Questions about florida repossession affidavit form

Where can I obtain a Florida repo affidavit form?

The Florida repo affidavit form can be obtained directly from the Florida Division of Motor Vehicles or through official state websites offering the form for download.

Can I submit the Florida repo affidavit form online?

Currently, the Florida repo affidavit form must be submitted in person or via mail, as electronic submissions are not widely accepted for this type of document.

pdfFiller scores top ratings on review platforms