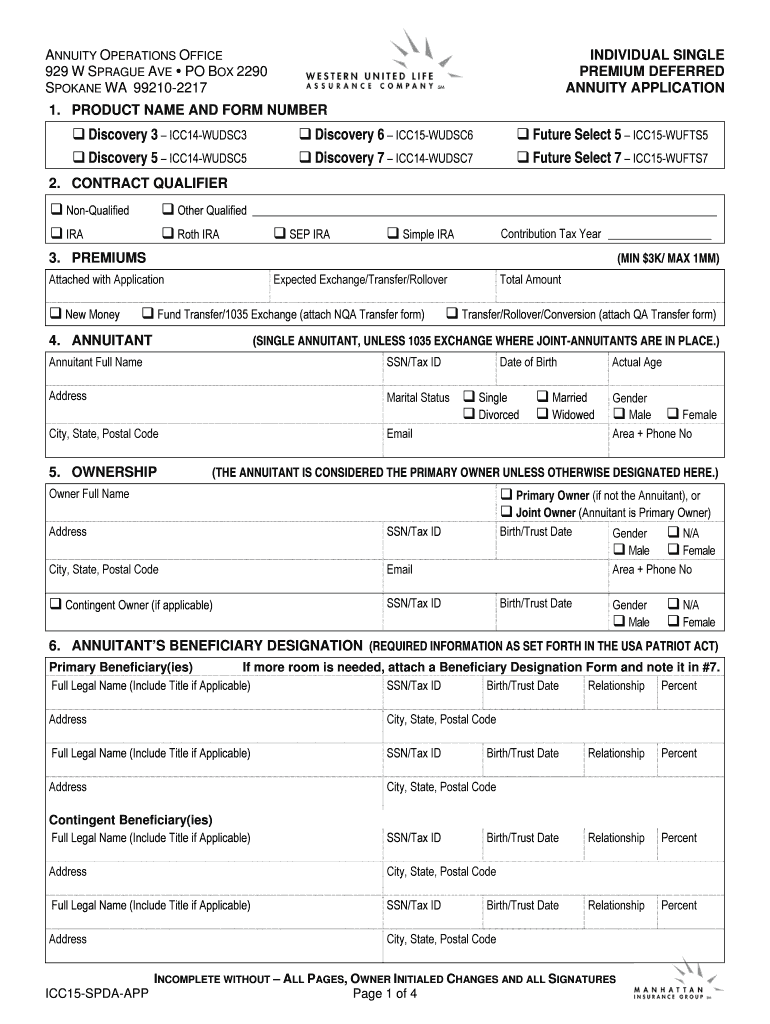

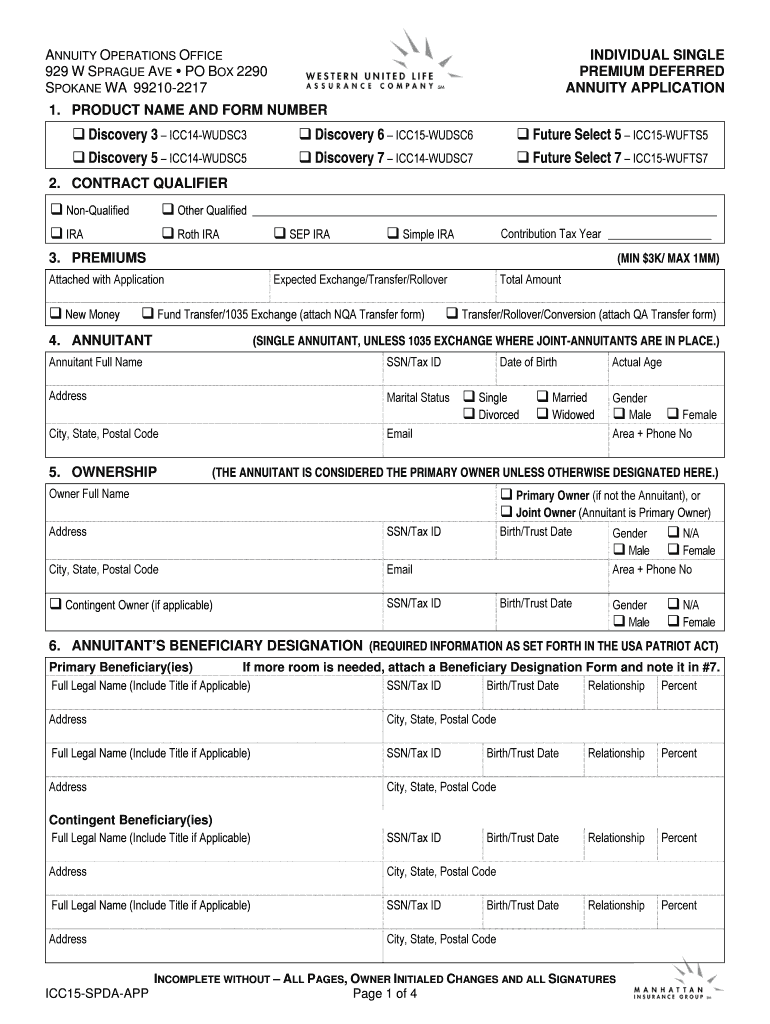

Get the free Single Premium Deferred Annuity Individual Application (becomes part of the Contract)

Show details

Single Premium Deferred Annuity Individual Application (becomes part of the Contract). ? Beneficiary ...... Future 5 ICC14-WUFTR5 / 2014-WUFTR5.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign single premium deferred annuity

Edit your single premium deferred annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your single premium deferred annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit single premium deferred annuity online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit single premium deferred annuity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out single premium deferred annuity

How to fill out single premium deferred annuity:

01

Gather the necessary documents: Before you begin, make sure you have all the required documents, such as your identification, social security number, and financial information.

02

Understand the annuity terms: Familiarize yourself with the terms and conditions of the annuity, such as the interest rate, surrender period, and income options.

03

Choose the right annuity provider: Research and compare different annuity providers to find the one that best suits your needs and offers competitive rates.

04

Determine the annuity amount and duration: Decide the amount of money you want to invest in the annuity and the term length, which can range from a few years to several decades.

05

Fill out the application form: Complete the application form provided by the annuity provider, providing accurate and up-to-date information.

06

Submit the required documents: Attach any necessary documents, such as identification proof or financial statements, along with your application.

07

Review and sign the contract: Carefully read through the annuity contract, ensuring you understand all the terms and conditions. Sign the contract once you are satisfied.

08

Make the payment: Pay the single premium amount specified in the annuity contract, either through check, wire transfer, or other accepted payment methods.

09

Keep a copy of the contract: Make sure to keep a copy of the signed annuity contract for your records.

Who needs single premium deferred annuity?

01

Individuals planning for retirement: Single premium deferred annuities can be a useful tool for individuals looking to secure a steady income stream during retirement.

02

Risk-averse investors: Those who are seeking a low-risk investment option may find single premium deferred annuities appealing, as they offer a guaranteed return and protection from market volatility.

03

People looking to consolidate assets: If you have multiple assets and want to simplify and consolidate your investments, a single premium deferred annuity can be a suitable option.

04

Those with a lump sum of money: If you come into a large sum of money, such as through an inheritance or the sale of a property, a single premium deferred annuity can offer a way to invest and grow that money gradually.

05

Individuals seeking tax advantages: Single premium deferred annuities can provide tax-deferred growth, meaning you won't have to pay taxes on the earnings until you start receiving payments.

Remember, it's always a good idea to consult with a financial advisor or professional to determine if a single premium deferred annuity is the right choice for your specific financial goals and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send single premium deferred annuity to be eSigned by others?

single premium deferred annuity is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I sign the single premium deferred annuity electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your single premium deferred annuity in seconds.

Can I edit single premium deferred annuity on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign single premium deferred annuity. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is single premium deferred annuity?

A single premium deferred annuity is a type of annuity contract where the policyholder makes one lump-sum payment to the insurance company and in return, the insurance company promises to make periodic payments at a future date.

Who is required to file single premium deferred annuity?

Individuals who purchase a single premium deferred annuity are required to file it with the insurance company.

How to fill out single premium deferred annuity?

To fill out a single premium deferred annuity, individuals need to provide their personal information, payment details, and beneficiary information.

What is the purpose of single premium deferred annuity?

The purpose of a single premium deferred annuity is to provide a guaranteed income stream for the policyholder in the future.

What information must be reported on single premium deferred annuity?

The information that must be reported on a single premium deferred annuity includes the policyholder's personal details, payment information, and beneficiary information.

Fill out your single premium deferred annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Single Premium Deferred Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.