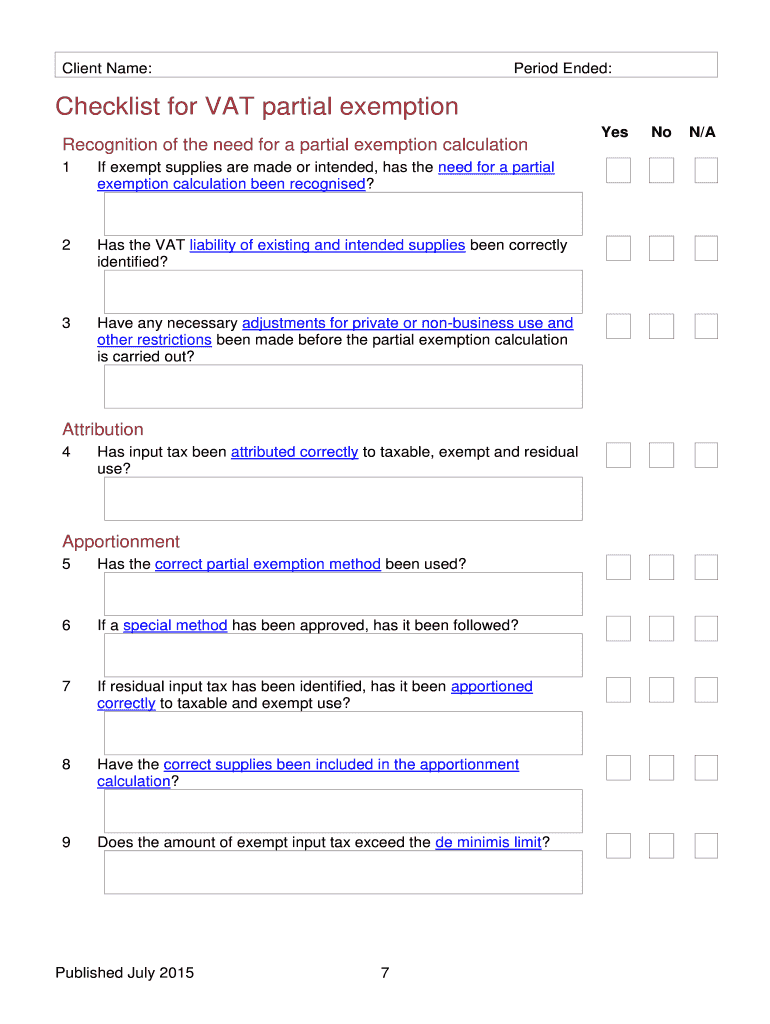

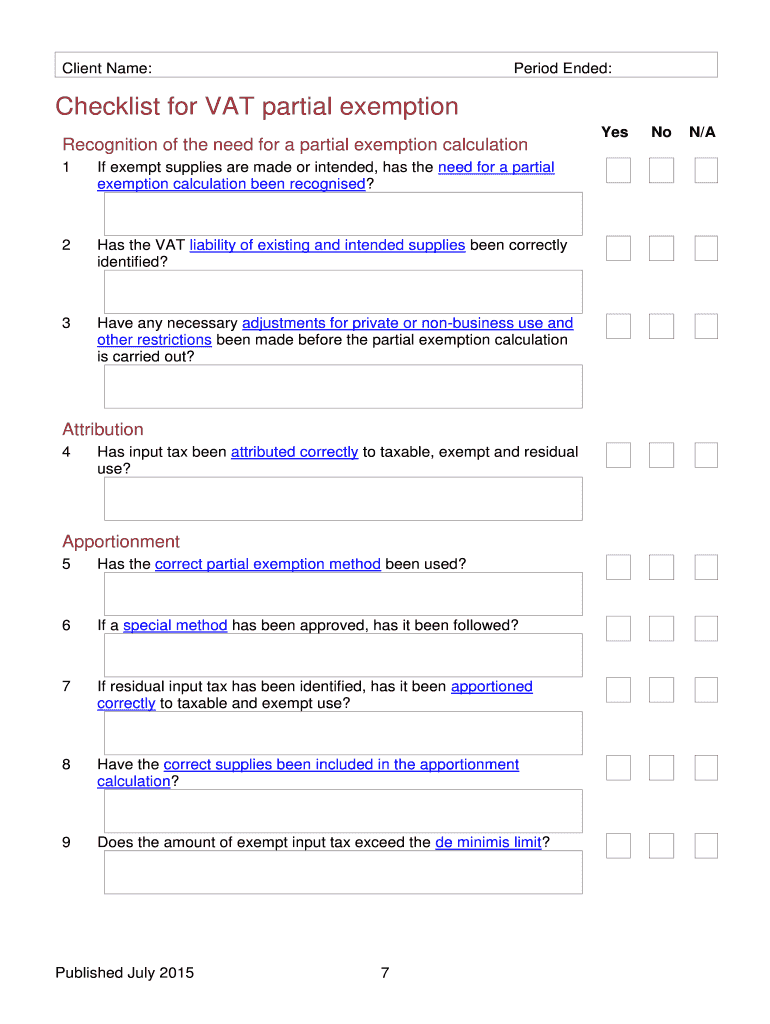

Get the free 2013-14 VAT Partial Exemption Toolkit Toolkit for 2013-14 VAT Returns

Show details

1 Aug 2015 ... their client#39’s VAT Return but wish to use it as a source of reference when .... the previous year#39’s annual adjustment to apportion its residual input ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013-14 vat partial exemption

Edit your 2013-14 vat partial exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013-14 vat partial exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013-14 vat partial exemption online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2013-14 vat partial exemption. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013-14 vat partial exemption

How to fill out 2013-14 VAT partial exemption:

01

Obtain the necessary forms: To begin filling out the 2013-14 VAT partial exemption, you will need to obtain the appropriate forms from your local tax authority. These forms are typically available online or can be obtained in person.

02

Gather your financial information: Before filling out the forms, gather all relevant financial information for the specified period (2013-14). This may include sales and purchase invoices, information on exempt and taxable supplies, and any other documents that provide a clear picture of your VAT-eligible activities.

03

Determine your eligibility: Review the criteria for partial exemption to determine if you qualify for the 2013-14 VAT partial exemption. This eligibility usually depends on factors such as your business activities, the proportion of exempt sales to total sales, and any specific regulations set by your local tax authority.

04

Calculate the partial exemption recovery rate: Once you have determined your eligibility, calculate the partial exemption recovery rate. This rate is used to determine the amount of VAT that can be reclaimed based on the proportion of taxable and exempt supplies in your business.

05

Complete the forms: With the necessary information and calculations, fill out the forms provided by your tax authority accurately and thoroughly. Pay close attention to any instructions or additional documentation required.

06

Double-check for accuracy: Before submitting your 2013-14 VAT partial exemption forms, double-check all the information for accuracy. Mistakes or missing information could delay the processing of your claim or lead to potential penalties.

Who needs 2013-14 VAT partial exemption?

01

Businesses with a mix of taxable and exempt supplies: The 2013-14 VAT partial exemption is specifically designed for businesses that have a combination of taxable and exempt sales. It allows them to recover a portion of the VAT incurred on their input costs.

02

VAT-registered businesses subject to partial exemption rules: If your business is registered for VAT and falls under the jurisdiction of partial exemption rules, you may need to utilize the 2013-14 VAT partial exemption. This generally applies to businesses that make both VAT taxable supplies and VAT-exempt supplies.

03

Businesses seeking to reduce VAT costs: The 2013-14 VAT partial exemption provides an opportunity for businesses to reduce their overall VAT costs. By accurately calculating and reclaiming the allowable proportion of VAT, businesses can minimize the financial impact of VAT on their operations.

Remember, it is always advisable to consult with a tax professional or seek guidance from your local tax authority to ensure compliance with specific regulations and to accurately complete the 2013-14 VAT partial exemption forms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2013-14 vat partial exemption in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 2013-14 vat partial exemption along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit 2013-14 vat partial exemption in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 2013-14 vat partial exemption and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out 2013-14 vat partial exemption using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign 2013-14 vat partial exemption. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is 14 vat partial exemption?

14 vat partial exemption is a system where businesses can recover a portion of the VAT they have paid on purchases, if their goods or services are used for both taxable and exempt activities.

Who is required to file 14 vat partial exemption?

Businesses that engage in both taxable and exempt activities are required to file 14 vat partial exemption.

How to fill out 14 vat partial exemption?

To fill out 14 vat partial exemption, businesses need to calculate the proportion of VAT that can be recovered based on their taxable and exempt activities, and report this information to the tax authorities.

What is the purpose of 14 vat partial exemption?

The purpose of 14 vat partial exemption is to ensure that businesses do not pay more VAT than necessary on purchases that are used for both taxable and exempt activities.

What information must be reported on 14 vat partial exemption?

Businesses must report the proportion of VAT that can be recovered, along with details of the purchases that are used for both taxable and exempt activities.

Fill out your 2013-14 vat partial exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013-14 Vat Partial Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.