Get the free Tax Deduction Often Overloo - LTCFP - ltcfp

Show details

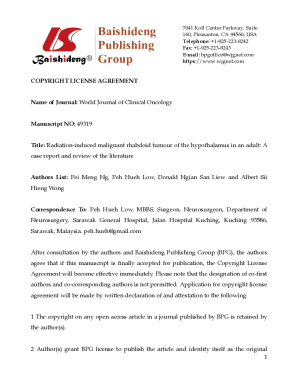

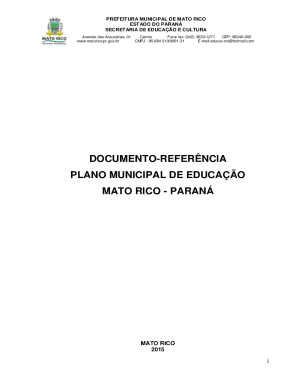

Tax Deduction Often Overlooked Long Term Care Insurance News... 1 of 2 https://www.entrepreneur.com/PRNewswire/release/94478.html Franchises for Sale Women Entrepreneur Subscribe Newsletters Special

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax deduction often overloo

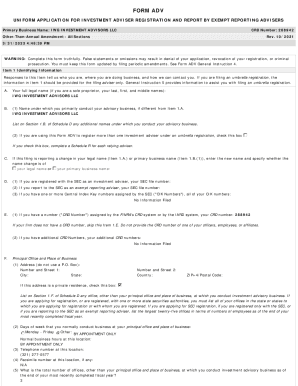

Edit your tax deduction often overloo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax deduction often overloo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

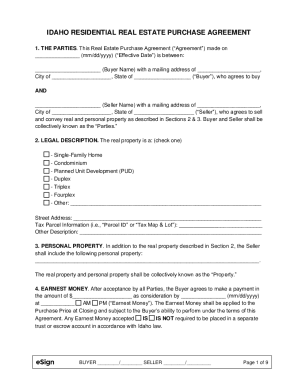

Editing tax deduction often overloo online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax deduction often overloo. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax deduction often overloo

How to fill out tax deduction often overlooked:

01

Gather all necessary documents: Start by collecting all essential paperwork, such as W-2 forms, receipts, and other records related to your expenses. These documents will help you identify potential deductions you might have overlooked.

02

Research commonly missed deductions: There are several tax deductions that people often overlook, so it's crucial to educate yourself about them. Look into deductions for medical expenses, education expenses, home office expenses, and charitable contributions, among others.

03

Consult with a tax professional: If you are uncertain about filling out tax deductions or need assistance, it's always a good idea to consult with a tax professional. They can provide guidance specific to your situation and help ensure you are taking advantage of all available deductions.

04

Double-check your calculations: It's important to review your tax deductions carefully to avoid mistakes. Make sure you have accurately calculated the deductions you are claiming and that the figures align with the supporting documentation you have gathered.

05

File your taxes accurately and on time: Once you have filled out all the necessary tax deductions and are confident in your calculations, file your taxes accurately and submit them on time. Missing the deadline can result in penalties or interest charges.

06

Maintain good record-keeping practices: To make the process easier in the future, establish a system for organizing and maintaining your tax-related documents. This way, you will have all the necessary information readily available when it's time to fill out tax deductions next year.

Who needs tax deductions often overlooked:

01

Self-employed individuals: Self-employed individuals have various deductible expenses that can significantly reduce their taxable income. These can include business-related expenses, home office deductions, health insurance premiums, and retirement contributions.

02

Parents: Parents can often overlook deductions related to their children's education, such as the American Opportunity Credit or the Lifetime Learning Credit. Additionally, childcare expenses and adoption-related costs can also be eligible for deductions.

03

Homeowners: Homeowners should be aware of deductions such as mortgage interest, property taxes, and energy-efficient home improvements. These deductions can help lower their taxable income and potentially result in a higher tax refund.

04

Charitable individuals: Individuals who frequently make charitable donations can benefit from deductions for their donations. It's important to keep track of all donations made throughout the year and obtain proper documentation for tax purposes.

05

Medical expense spenders: Medical expenses can sometimes be overlooked, especially if they don't exceed a certain percentage of the individual's adjusted gross income. However, it is important to document and track all medical expenses paid throughout the year, as they can be tax-deductible.

Note: It's always recommended to consult with a tax professional or use trusted tax software to ensure you are claiming all relevant deductions accurately and in compliance with current tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax deduction often overloo for eSignature?

Once your tax deduction often overloo is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in tax deduction often overloo without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing tax deduction often overloo and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my tax deduction often overloo in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your tax deduction often overloo right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is tax deduction often overlooked?

Tax deductions that are often overlooked include medical expenses, charitable donations, and certain business expenses.

Who is required to file tax deduction often overlooked?

Individuals and businesses who qualify for tax deductions are required to file them.

How to fill out tax deduction often overlooked?

To fill out tax deductions that are often overlooked, gather all necessary receipts and documentation, and consult with a tax professional if needed.

What is the purpose of tax deduction often overlooked?

The purpose of tax deductions that are often overlooked is to reduce taxable income and ultimately lower the amount of taxes owed.

What information must be reported on tax deduction often overlooked?

Information such as expenses incurred, donation details, and business expenses must be reported on tax deductions that are often overlooked.

Fill out your tax deduction often overloo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Deduction Often Overloo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.