IRS 1120-W 2010 free printable template

Show details

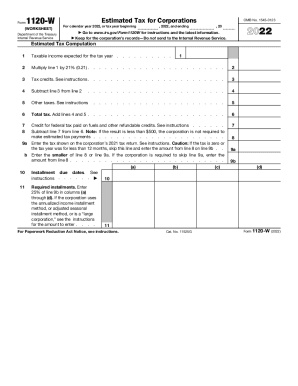

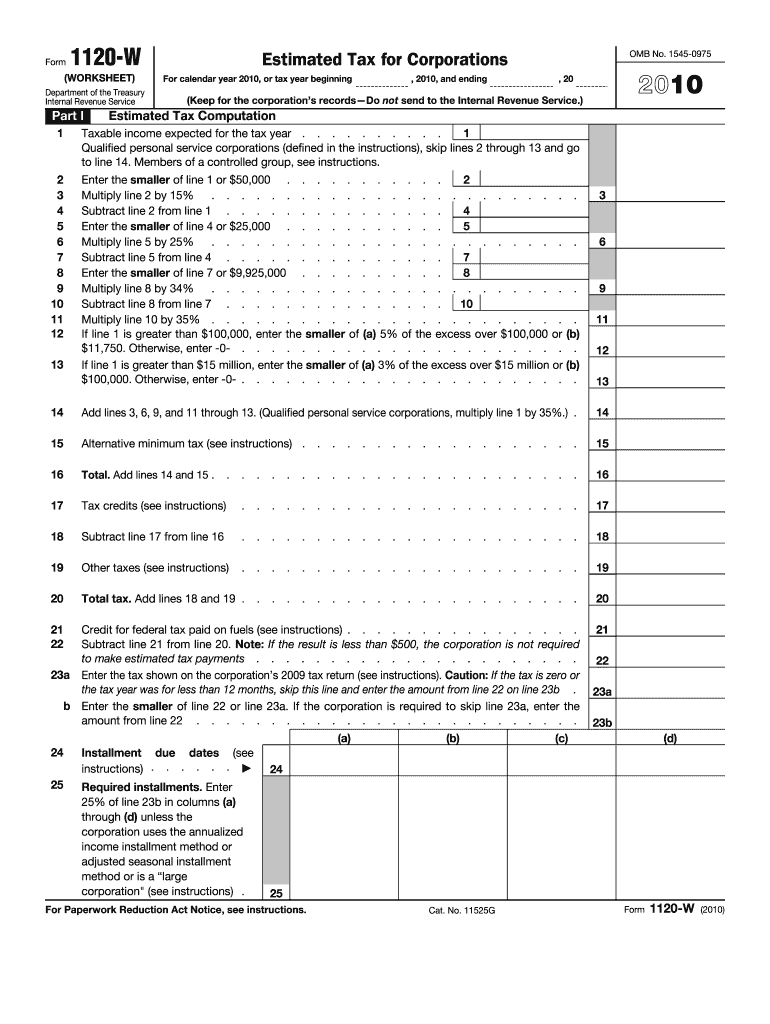

Form 1120-W Estimated Tax for Corporations For calendar year 2010, or tax year beginning, 2010, and ending, 20 OMB No. 1545-0975 (WORKSHEET) Department of the Treasury Internal Revenue Service (Keep

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-W

How to edit IRS 1120-W

How to fill out IRS 1120-W

Instructions and Help about IRS 1120-W

How to edit IRS 1120-W

To edit IRS 1120-W, you will need a version of the form available in PDF format. Using pdfFiller can streamline the process of making changes. You can upload the document to pdfFiller, utilize its editing tools to modify any sections, and effectively save your updated version. Ensure to review all changes before finalizing the document.

How to fill out IRS 1120-W

To fill out IRS 1120-W, start by gathering the financial information necessary for the calculations. The form requires estimates of tax liability based on expected income and deductions for the year. Carefully input the data into the appropriate sections, ensuring accurate figures to avoid underpayment penalties. Utilize pdfFiller to fill and sign the document electronically, if needed.

About IRS 1120-W 2010 previous version

What is IRS 1120-W?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-W 2010 previous version

What is IRS 1120-W?

IRS 1120-W is a form used by corporations to calculate and pay estimated income tax. It is specifically designed for corporations to estimate their tax liability for the current tax year, allowing them to make timely quarterly payments. This form helps ensure compliance with U.S. federal tax regulations by enabling corporations to manage their tax obligations proactively.

What is the purpose of this form?

The purpose of IRS 1120-W is to facilitate the payment of estimated taxes for corporations. Corporations use this form to report their expected income and deductions for the year, supporting their tax payment schedule under federal law. By estimating tax payments accurately, corporations can avoid penalties associated with underestimating their tax obligations.

Who needs the form?

Corporations that expect to owe tax of $500 or more for the tax year must file IRS 1120-W. This includes both domestic and foreign corporations operating within the United States. Smaller corporations or those that do not anticipate owing tax may not need to file this form.

When am I exempt from filling out this form?

If a corporation expects to owe less than $500 in federal tax for the current year, it may be exempt from filing IRS 1120-W. Additionally, newly formed corporations not expecting to owe taxes in their first year might also be exempt. Always verify compliance based on specific circumstances and consult IRS guidelines for clarification.

Components of the form

The components of IRS 1120-W include several sections for reporting income, deductions, and credits. Corporations must provide details such as expected gross income, allowable deductions, and other tax-related computations. Accurate completion of each section is crucial for determining the correct tax obligation.

What are the penalties for not issuing the form?

If a corporation fails to file IRS 1120-W or does not pay the required estimated taxes, it may face significant penalties. The IRS typically assesses penalties based on the amount of unpaid tax and the duration of delinquency. Late payment penalties can compound quickly, leading to increased financial liability.

What information do you need when you file the form?

When filing IRS 1120-W, organizations need detailed financial information, including projected income, deductions, and tax credits. This typically involves historical data from previous years and expectations for the current year. Collecting accurate estimates is essential for compliance and to mitigate penalties.

Is the form accompanied by other forms?

IRS 1120-W may need to be submitted alongside additional forms depending on the specific financial situation of the corporation. Commonly, it could be accompanied by IRS Form 1120, which is the corporate income tax return. Always check jurisdiction-specific guidelines for any additional requirements.

Where do I send the form?

The completed IRS 1120-W can be submitted electronically or mailed to the IRS. The mailing address depends on the corporation's location and the applicable IRS submission guidelines. Corporations should consult the IRS website for the correct address and any changes affecting submission protocols.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.