CA CalPERS Electronic Fund Transfer Authorization free printable template

Get, Create, Make and Sign calpers long term authorization form

How to edit calpers long term authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calpers long term authorization

How to fill out CA CalPERS Electronic Fund Transfer Authorization

Who needs CA CalPERS Electronic Fund Transfer Authorization?

Video instructions and help with filling out and completing calpers long term authorization pdf

Instructions and Help about calpers long term authorization

This brief special presentation is specifically for members of Callers who are facing rate increases on their long term care insurance policies well look at options and some current costs so that you can compare and make an educated decision about your options this is Jesse Slow executive director of the American Association for long-term care insurance were a national trade organization we don't sell insurance, but we help educate the public, and we deal with consumer inquiries every day and increasingly were getting calls from the hundred and fifty thousand members of the Callers long-term care program that's why I'm recording the special presentation in October 2012 the Callers board voted that all members who have lifetime coverage and built-in inflation option and have policies that they purchased between 1995 and 2004 are going to face increased costs for their long-term care insurance coverage we estimate that means about 60000 of you will have received written notification that your prices are going up, so first we want you to sit back and relax because it's not something that's immediate and while nobody likes paying more for anything we certainly understand that there are some explanations and some reasons why and most importantly you have choices you have the opportunity to adjust your coverage and avoid paying anything first, so the increases are going to come in staged amounts first there will be some smaller 5 increases the big increase starts in 2015, so you don't need to panic that one will be as much as 85, and it will be spread over two years the primary reason for these increases as we understand it is two things the first is Callers is seen increased utilization of the policy more people are going on claim that means they're using what they bought and what you bought and the costs are going up for those claims and increasingly because interest rates have dropped into entities are unable to derive the income that they need to anticipate paying future claims, so that's the primary reason that you're seeing a request for rate increases okay this is the most important slide where I'm going to spend a little of time here are recommendations the first thing is review your schedule of benefits that's the policy that you bought that you purchase several years ago and again if you're getting the 85 percent like the 85 percent increase in costs that's because you purchased lifetime protection with 5 compound inflation I will tell you those policy features are rarely even available today for a couple of reasons they're just too expensive that's number one and as you look at that you're going to see what your policy benefit amount has grown to today then step two is evaluated your benefit needs at the time that you bought it when lifetime coverage was affordable and 5 compound inflation growth was affordable that's what you chose, but today you may look if you bought it at age 55 maybe today your age 65, and you're now retired and yes...

People Also Ask about

What is the status of the CalPERS LTC lawsuit?

What happened to CalPERS Long-Term Care?

Does California have a long term care program?

How do I contact CalPERS long-term care?

Does California have LTC tax?

What is the elimination period for CalPERS long-term care?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find calpers long term authorization?

How do I execute calpers long term authorization online?

How can I fill out calpers long term authorization on an iOS device?

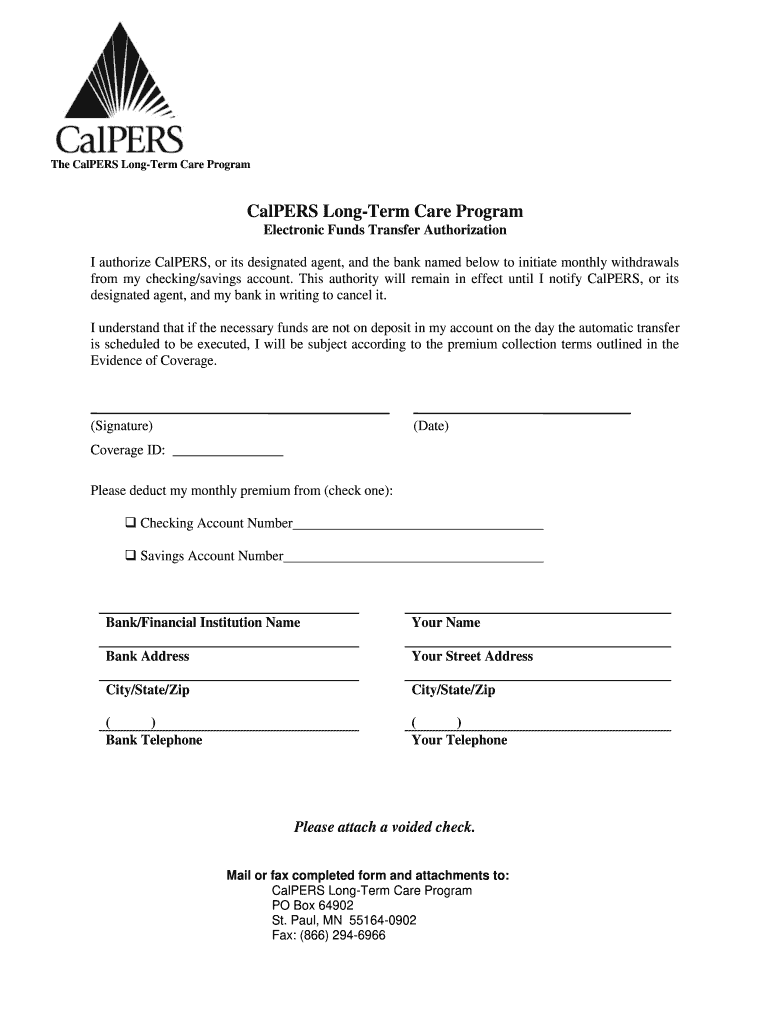

What is CA CalPERS Electronic Fund Transfer Authorization?

Who is required to file CA CalPERS Electronic Fund Transfer Authorization?

How to fill out CA CalPERS Electronic Fund Transfer Authorization?

What is the purpose of CA CalPERS Electronic Fund Transfer Authorization?

What information must be reported on CA CalPERS Electronic Fund Transfer Authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.