Get the free coworx paystub

Show details

CoWorx Employee Portal The Employee Portal allows CoWorx field employees to review recent payments print check stubs for your records. Employees. CoWorx Employees. Direct Deposit or Paycard Enrollment Employment Verification Instructions Paystubs via Employee Portal W4 Form. Employees. Instructions Paystubs via Employee Portal W4 Form. CoWorx has the best staffing agency in New Jersey and anywhere else in the US. Take time to research any tools you would scenario it might be effortlessly...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign coworx paystub form

Edit your coworx paystub form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your coworx paystub form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing coworx paystub form online

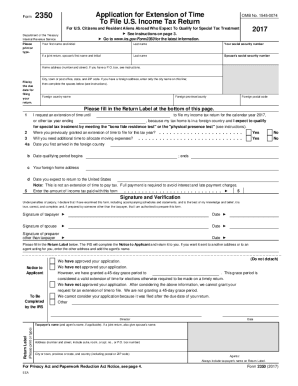

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit coworx paystub form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out coworx paystub form

How to fill out coworx staffing check stubs?

01

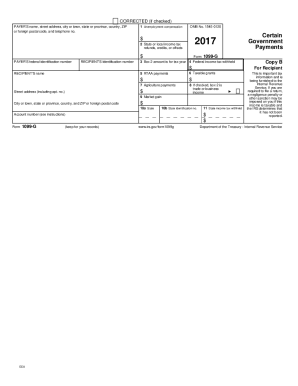

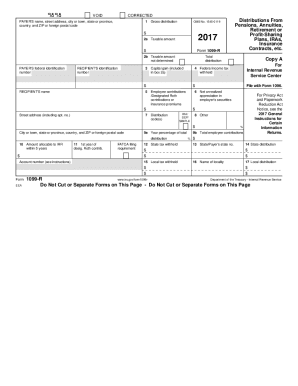

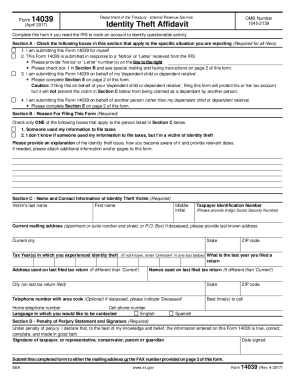

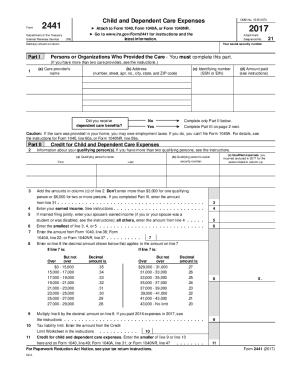

Collect all necessary information: Before starting to fill out the check stubs, gather all the relevant information required, such as the employee's name, address, social security number, and current date.

02

Fill in the employee's information: Start by entering the employee's full name, including first, middle, and last name. Ensure that the information is accurate to avoid any confusion or discrepancies.

03

Include the employee identification number: Coworx staffing check stubs typically require an employee identification number. This number helps to track and identify each employee accurately. Enter the correct identification number for the respective individual.

04

Input the pay period details: Indicate the specific pay period for which the check stub is being issued. This includes the start date and end date of the pay period. Make sure to accurately reflect the time frame to ensure clarity.

05

Specify the employee's earnings: Break down the employee's earnings based on different categories, such as regular hours, overtime hours, holiday pay, bonuses, or commissions. Calculate each category separately and input the corresponding amounts accurately.

06

Deduct applicable taxes and deductions: Deduct any federal, state, or local taxes that apply to the employee's earnings. Also, subtract any other deductions such as health insurance premiums, retirement contributions, or loan repayments. Ensure that the deductions are correctly calculated and accurately reflected.

07

Calculate the net pay: Subtract the total deductions from the total earnings to calculate the net pay—the amount the employee will receive after taxes and deductions have been taken out.

Who needs coworx staffing check stubs?

01

Coworx staffing check stubs are required for all employees who are part of the Coworx staffing agency.

02

These check stubs serve as a record of the employees' earnings, deductions, and net pay for each pay period.

03

Coworx staffing check stubs are crucial for employees to keep track of their income, understand the taxes and deductions being applied, and verify the accuracy of their payments.

04

Employers also need coworx staffing check stubs as they serve as a documentation of the payments made to employees, including the breakdown of earnings, taxes, and deductions.

05

Additionally, the check stubs are essential for tax purposes, as they provide a clear record of an employee's income and deductions, which may be required during tax filing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

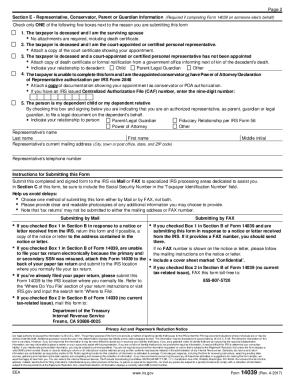

How can I send coworx paystub form to be eSigned by others?

Once you are ready to share your coworx paystub form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I execute coworx paystub form online?

Easy online coworx paystub form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit coworx paystub form on an Android device?

You can make any changes to PDF files, such as coworx paystub form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

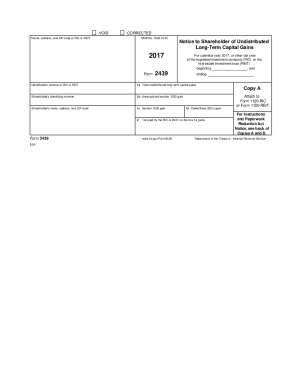

What is Coworx staffing check stubs?

Coworx staffing check stubs are documents provided to employees by Coworx Staffing that detail the employee's earnings, taxes withheld, and other deductions for a specific pay period.

Who is required to file Coworx staffing check stubs?

Employees who are compensated through Coworx Staffing are required to receive and check these stubs to ensure accurate record-keeping and compliance with tax regulations.

How to fill out Coworx staffing check stubs?

To fill out Coworx staffing check stubs, employees usually do not fill them out themselves, as they are generated by the payroll system. However, employees should verify that their personal information, hours worked, and deductions are accurately reflected.

What is the purpose of Coworx staffing check stubs?

The purpose of Coworx staffing check stubs is to provide employees with a detailed account of their earnings, deductions, and taxes, ensuring transparency and helping them keep track of their financial records.

What information must be reported on Coworx staffing check stubs?

Coworx staffing check stubs must report information such as the employee's name, pay period dates, total hours worked, gross wages, taxes withheld, and net pay.

Fill out your coworx paystub form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Coworx Paystub Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.