Get the free Foreign Registration Statement - Idaho Secretary of State - sos idaho

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign registration statement

Edit your foreign registration statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign registration statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing foreign registration statement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit foreign registration statement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

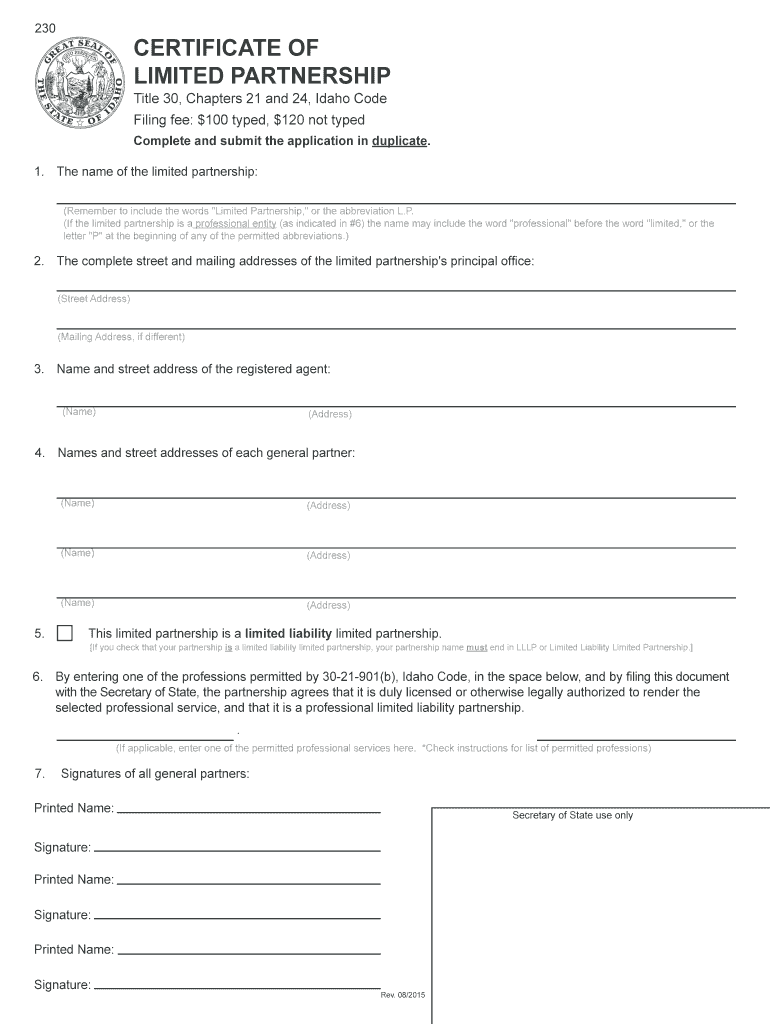

How to fill out foreign registration statement

How to fill out a foreign registration statement:

01

Obtain the necessary form: Begin by obtaining the foreign registration statement form from the appropriate authority. This form can usually be found on the official website of the agency responsible for regulating foreign registration.

02

Provide accurate information: Fill out the form with accurate and up-to-date information. This may include details about the foreign entity, such as its name, address, and ownership structure. It is important to provide all requested information to ensure the registration process is complete.

03

Attach required documents: The foreign registration statement may have specific requirements for attachments, such as copies of the entity's articles of incorporation or other foundational documents. Make sure to gather and attach any necessary documents as instructed.

04

Pay the applicable fees: Some jurisdictions require a fee to be paid along with the submission of the foreign registration statement. Check the instructions provided or contact the regulating agency to determine the amount and method of payment.

05

Submit the form: Once the form is completed, along with any required attachments and payment, submit the foreign registration statement according to the instructions provided. This may involve mailing the documents, submitting them online, or delivering them in person.

06

Follow up: After submitting the foreign registration statement, it is a good practice to follow up with the regulating agency to ensure the registration process is progressing smoothly. This may involve contacting the agency, checking the status online, or awaiting confirmation of registration.

07

Maintain compliance: Once the foreign registration statement is approved, it is important to comply with any ongoing requirements or obligations specified by the regulating agency. This may include annual reporting, updating registration information, or paying renewal fees.

Who needs a foreign registration statement?

01

Companies doing business in a foreign jurisdiction: Companies that wish to conduct business in a foreign jurisdiction are often required to file a foreign registration statement. This allows the local government to monitor and regulate the activities of the foreign entity within its borders.

02

Nonprofits operating internationally: Nonprofit organizations that operate internationally may also be required to file a foreign registration statement in the jurisdictions where they plan to carry out their activities. This allows the local authorities to ensure compliance with local laws and regulations.

03

Foreign investment funds: Foreign investment funds that seek to invest in assets located in a particular jurisdiction may need to file a foreign registration statement to comply with local securities laws and regulations.

04

Professional service providers: Certain professional service providers, such as law firms or accounting firms, that wish to offer their services in a foreign jurisdiction may be required to file a foreign registration statement. This allows the local regulatory bodies to oversee and regulate their activities within the jurisdiction.

05

Individuals conducting business as a foreign entity: Individuals who conduct business as a foreign entity or represent a foreign company within a specific jurisdiction may need to file a foreign registration statement. This ensures that they are operating within the legal framework of the jurisdiction and complying with any necessary regulations.

Please note that the specific requirements for filing a foreign registration statement may vary depending on the jurisdiction and the type of entity seeking registration. It is recommended to consult with legal or professional advisors familiar with the applicable laws and regulations in the relevant jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the foreign registration statement in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your foreign registration statement right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the foreign registration statement form on my smartphone?

Use the pdfFiller mobile app to complete and sign foreign registration statement on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit foreign registration statement on an iOS device?

Create, edit, and share foreign registration statement from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is foreign registration statement?

A foreign registration statement is a legal document filed with a government agency by a foreign entity or individual doing business in another country.

Who is required to file foreign registration statement?

Any foreign entity or individual conducting business in another country is required to file a foreign registration statement.

How to fill out foreign registration statement?

To fill out a foreign registration statement, one must provide detailed information about their business activities, financials, and ownership.

What is the purpose of foreign registration statement?

The purpose of a foreign registration statement is to ensure transparency and regulatory compliance for foreign entities conducting business in another country.

What information must be reported on foreign registration statement?

Information such as business activities, financial statements, ownership details, and contact information must be reported on a foreign registration statement.

Fill out your foreign registration statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Registration Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.