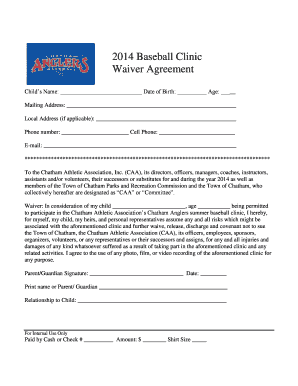

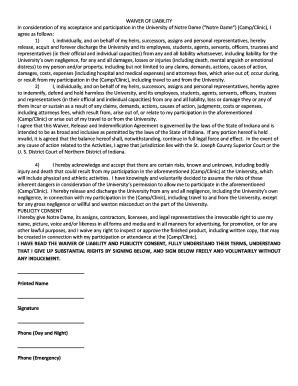

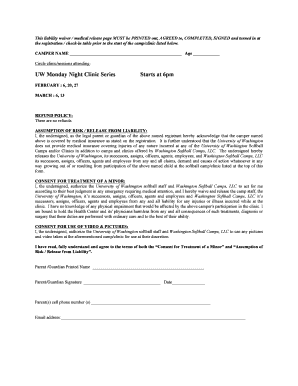

SC 300ES 2014 free printable template

Show details

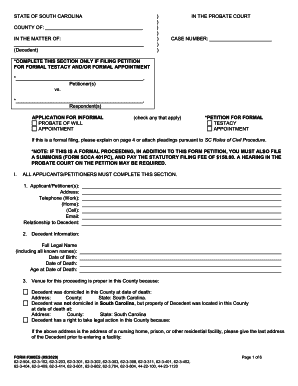

Venue for this proceeding is proper in this County because Decedent was domiciled in this County at date of death Address County State South Carolina. Decedent was not domiciled in South Carolina but property of Decedent was located in this County at date of death Decedent has a right to take legal action in this County because If the above address is the address of a nursing home a prison or other residential facility please give the last address of the Decedent prior to entering the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC 300ES

Edit your SC 300ES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC 300ES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC 300ES online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC 300ES. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC 300ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC 300ES

How to fill out SC 300ES

01

Download the SC 300ES form from the official website.

02

Fill in the required personal information such as name, address, and contact details.

03

Indicate the tax year for which the payment is being made.

04

Specify the amount owed for the estimated tax payment.

05

Include any additional information or deductions as required.

06

Review the completed form for accuracy.

07

Submit the form via mail or electronic filing, according to the instructions provided.

Who needs SC 300ES?

01

Individuals or businesses who are required to make estimated tax payments to the IRS.

02

Taxpayers who expect to owe tax of $1,000 or more when they file their tax return.

03

Self-employed individuals or freelancers who do not have taxes withheld from their income.

Fill

form

: Try Risk Free

People Also Ask about

How much does an estate have to be worth to go to probate in SC?

In South Carolina, you can use an Affidavit if an estate value is less than $25,000. You must wait 30 days after the death, and a probate judge will need to approve it. There is also potential to use a summary probate procedure, which is a possibility when an estate value is less than $25,000.

How much does it cost to go through probate in South Carolina?

South Carolina Probate Estate Fee Schedule Size of Regular EstateFiling Fee$20,000 to $59,999$67.50$60,000 to $99,999$95.00$100,000 to $599,999$95.00 plus .15 percent in excess of $100,000$600,000 and above$845.00 on the 1st $600,000 plus .25 percent in excess of $600,0002 more rows

How long do you have to file probate after death in South Carolina?

Opening an Estate. Filing Will and Probatings - The South Carolina ( SC ) Probate Code of Laws requires that the Last Will and Testament be delivered to the Probate Court within 30 days of the decedent's death.

What triggers probate in SC?

In South Carolina, the following assets are subject to probate: Property only held in the deceased's name. Any real estate that the decedent held as a tenant in common. The deceased's interest in an LLC, corporation or a partnership.

Does a car have to go through probate in SC?

In South Carolina, you will need an Order from the Probate Court in order to transfer the title of the vehicle to your name if you are not considered a surviving owner.

How long can an estate stay in probate in SC?

Full probate is usually an eight month to one year process. Once the estate is opened, our office will complete FORM 370PC, NOTICE TO CREDITORS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the SC 300ES in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your SC 300ES and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit SC 300ES straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing SC 300ES.

How do I fill out SC 300ES using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign SC 300ES and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is SC 300ES?

SC 300ES is a form used by certain taxpayers in South Carolina to calculate and report estimated tax payments for the year.

Who is required to file SC 300ES?

Taxpayers who expect to owe $100 or more in South Carolina income tax for the current tax year are required to file SC 300ES.

How to fill out SC 300ES?

To fill out SC 300ES, taxpayers must provide their estimated income, deductions, and credits for the year, calculate their estimated tax liability, and determine the amount to pay each quarter.

What is the purpose of SC 300ES?

The purpose of SC 300ES is to allow taxpayers to make quarterly estimated payments of income tax to avoid penalties for underpayment when filing their tax returns.

What information must be reported on SC 300ES?

SC 300ES requires reporting estimated taxable income, deductions, credits, total estimated tax, and the amounts due for each quarter.

Fill out your SC 300ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC 300es is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.