Get the free LOW Car Insurance Quotes - find quotes on car insurance

Show details

Driverless Car Policy Documentalist your insurance We are pleased to welcome you as a policyholder. Your motor insurance is made up of four documents. This insurance booklet The schedule, which shows

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign low car insurance quotes

Edit your low car insurance quotes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your low car insurance quotes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing low car insurance quotes online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit low car insurance quotes. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out low car insurance quotes

How to fill out low car insurance quotes?

01

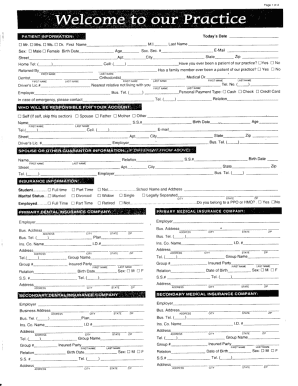

Gather your personal information: Start by collecting all the necessary personal information such as your full name, address, date of birth, and contact details. This information is essential for any insurance provider to process your quote accurately.

02

Provide details about your vehicle: Specify the make, model, and year of your car, as well as its mileage and any modifications or additional safety features it may have. These details will help determine the cost of your insurance premium.

03

Include information about your driving history: Be prepared to share information about your past driving offenses, traffic violations, or accidents, as insurance companies take these factors into account when determining your premium. Provide details about any driving courses you have completed that may help lower your rates.

04

Determine your coverage needs: Consider the type of coverage you require based on your individual circumstances and budget. Decide whether you want comprehensive coverage, collision coverage, liability insurance, or additional coverage options like roadside assistance or rental car reimbursement.

05

Get multiple quotes: To ensure you are getting the best possible rate, obtain quotes from multiple insurance providers. Compare the coverage options, deductibles, and premiums offered by each company to make an informed decision.

Who needs low car insurance quotes?

01

New drivers: Newly licensed drivers often face higher insurance premiums due to their lack of driving experience. Shopping around for low car insurance quotes can help them find affordable rates.

02

Young drivers: Drivers under the age of 25 are typically considered higher-risk by insurance companies, resulting in higher premiums. It is essential for young drivers to explore different options to find the most cost-effective coverage.

03

Budget-conscious individuals: Those who are looking to save money and minimize their expenses may seek low car insurance quotes. By comparing multiple options, they can find affordable coverage without compromising on necessary protection.

04

Drivers with a history of accidents or violations: Individuals who have a history of accidents, traffic violations, or DUIs may face higher insurance rates. It is crucial for them to seek out low car insurance quotes to find coverage that fits within their budget.

05

Those with older or less valuable vehicles: If you have an older car or one with a lower market value, it may not be cost-effective to invest in comprehensive coverage. Seeking low car insurance quotes ensures that you are not overpaying for unnecessary coverage.

In conclusion, filling out low car insurance quotes requires gathering personal and vehicle information, providing driving history details, determining your coverage needs, and comparing quotes from multiple companies. It is beneficial for new drivers, young drivers, budget-conscious individuals, those with a history of accidents or violations, and owners of older or less valuable vehicles to seek out low car insurance quotes to find the most affordable coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is low car insurance quotes?

Low car insurance quotes refer to the estimates provided by insurance companies for the cost of insuring a vehicle at a lower price.

Who is required to file low car insurance quotes?

Individuals who own or plan to purchase a car and seek insurance coverage are required to file low car insurance quotes.

How to fill out low car insurance quotes?

To fill out low car insurance quotes, one must provide accurate information about the vehicle, driving history, coverage needs, and personal details to insurance companies.

What is the purpose of low car insurance quotes?

The purpose of low car insurance quotes is to help individuals compare insurance options, determine the best coverage for their needs, and find affordable rates.

What information must be reported on low car insurance quotes?

Information such as vehicle details, driver's personal information, driving history, desired coverage, and any additional drivers must be reported on low car insurance quotes.

How do I execute low car insurance quotes online?

pdfFiller has made filling out and eSigning low car insurance quotes easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in low car insurance quotes without leaving Chrome?

low car insurance quotes can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit low car insurance quotes on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share low car insurance quotes on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your low car insurance quotes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Low Car Insurance Quotes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

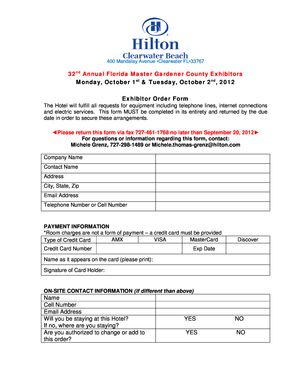

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.