Get the free (PERSONAL GIFT

Show details

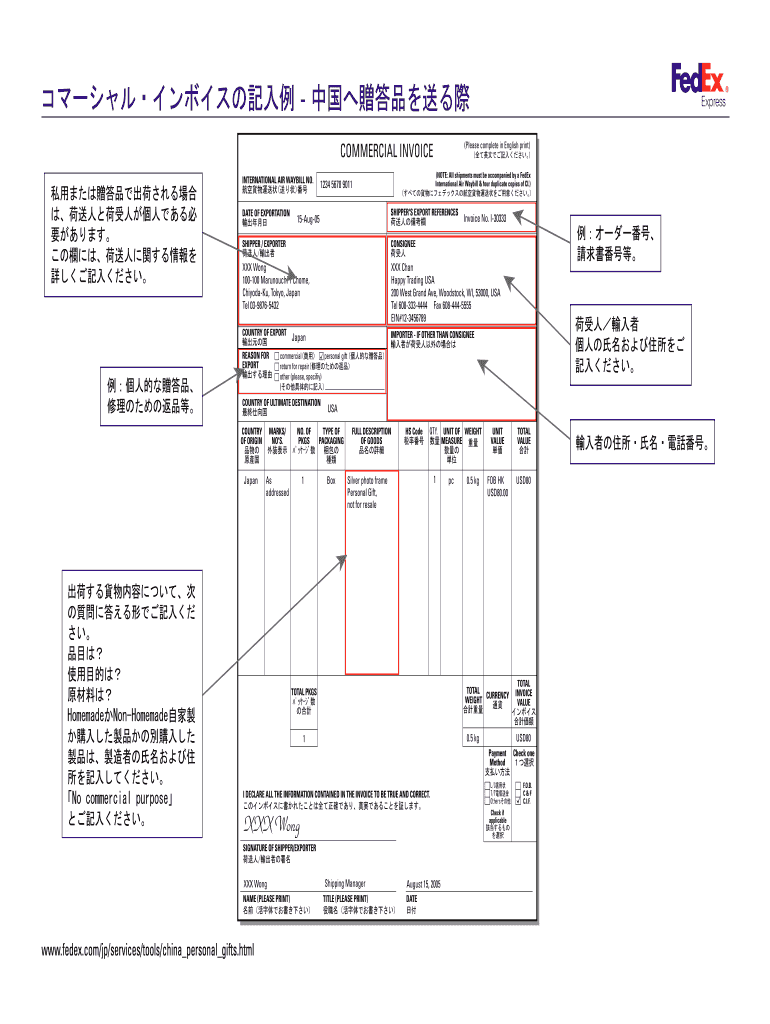

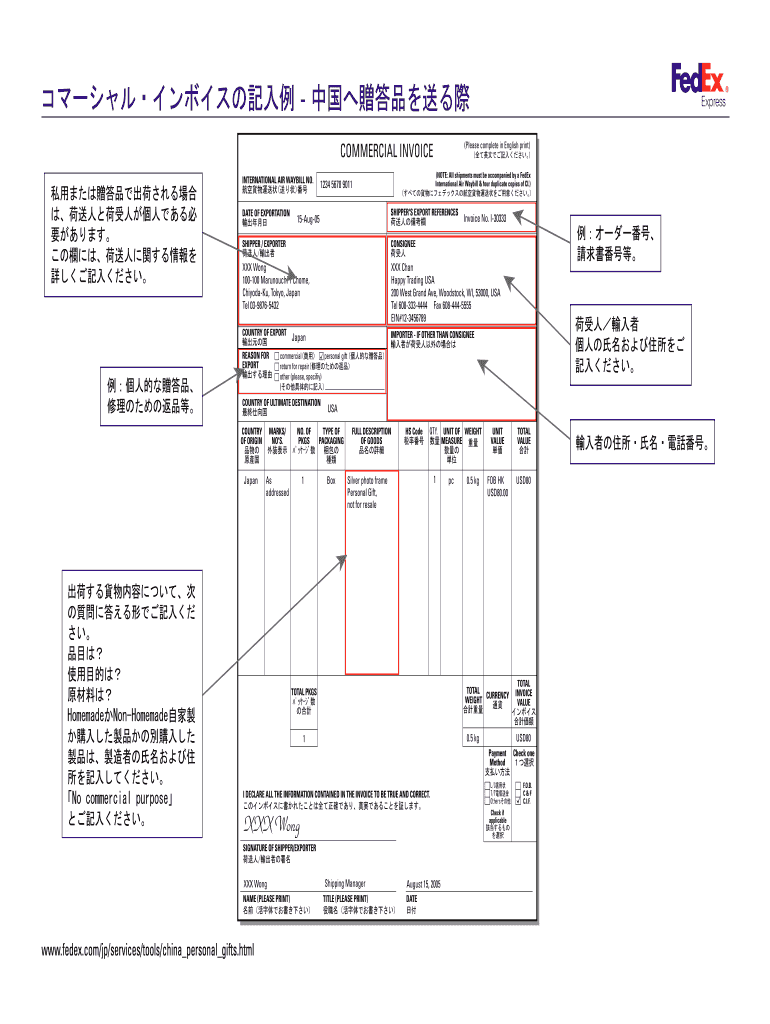

(Please complete in English print)COMMERCIAL INVOICE (PERSONAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal gift

Edit your personal gift form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal gift form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal gift online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal gift. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal gift

How to fill out a personal gift:

01

Begin by selecting a gift that is meaningful and tailored specifically to the recipient. Consider their hobbies, interests, and preferences when choosing the gift.

02

Next, personalize the gift by adding a thoughtful message or engraving their name or initials on it. This adds a special touch and makes the gift more memorable.

03

Take the time to wrap the gift beautifully. Use high-quality wrapping paper, ribbons, and bows to make it visually appealing. You can also add a handwritten note or a small card expressing your sentiments.

04

Consider the occasion for which you are giving the gift. If it's a birthday, add candles or balloons to make it festive. If it's an anniversary, include a romantic element or a symbol of love.

05

Present the gift in person if possible, as it allows you to see the recipient's reaction and share the joy together. However, if distance prevents you from doing so, ensure that the gift is securely packed and shipped to them on time.

06

Lastly, follow up with the recipient after they have received the gift. A phone call or a heartfelt thank you note can show your appreciation and make the gift-giving experience even more meaningful.

Who needs a personal gift?

01

Family members: Giving personal gifts to family members can strengthen the bond and show how much you care. Whether it's for a birthday, anniversary, or holiday, personal gifts can bring joy and create lasting memories.

02

Friends: Personal gifts for friends can demonstrate your thoughtfulness and appreciation for their friendship. It can be a way to celebrate milestones, achievements, or simply to say thank you for being there.

03

Romantic partners: Personal gifts are particularly important in romantic relationships. They can express love, affection, and understanding. Personalized gifts can create a deep emotional connection and make the recipient feel cherished.

04

Colleagues or coworkers: Personal gifts are not limited to personal relationships. They can also be given to colleagues or coworkers to show appreciation, celebrate achievements, or mark special occasions like promotions or retirements.

05

Anyone deserving of recognition: Personal gifts can be given to anyone who deserves recognition or has made a positive impact in your life. It could be a mentor, a teacher, a coach, or even a community leader.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit personal gift in Chrome?

personal gift can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit personal gift straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing personal gift.

How do I complete personal gift on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your personal gift. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is personal gift?

A personal gift is a transfer of property or money from one person to another without receiving anything in return.

Who is required to file personal gift?

Individuals who have given gifts that exceed the annual exclusion limit established by the IRS are required to file a personal gift.

How to fill out personal gift?

To fill out a personal gift, you need to report the value of the gift, the relationship between the giver and receiver, and any other relevant information on IRS Form 709.

What is the purpose of personal gift?

The purpose of personal gift is to keep track of gifts given that exceed the annual exclusion limit and to prevent tax evasion.

What information must be reported on personal gift?

The information that must be reported on a personal gift includes the value of the gift, the relationship between the giver and receiver, and any gifts given in previous years.

Fill out your personal gift online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Gift is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.