Get the free Borrower's Information Sheet Authorization

Show details

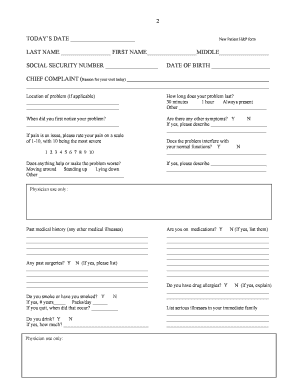

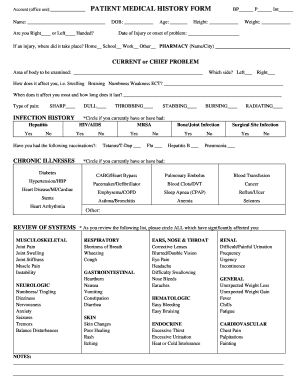

BORROWERS INFORMATION SHEET Borrowers Name(s) Borrower SS#(s) Borrowers Marital Status Borrowers current residing address(BS): Borrowers Phone # Fax # Borrowers Cell # Email If Condominium: Condo

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign borrower39s information sheet authorization

Edit your borrower39s information sheet authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your borrower39s information sheet authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit borrower39s information sheet authorization online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit borrower39s information sheet authorization. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out borrower39s information sheet authorization

How to fill out borrower39's information sheet authorization:

01

Start by carefully reading the borrower's information sheet authorization form. Make sure you understand all the instructions and requirements before proceeding.

02

Begin by providing your personal information accurately and precisely, such as your full name, address, contact information, and social security number. Double-check the details to avoid any errors.

03

Next, provide information about your employment status, including your job title, company name, and duration of employment. If you are self-employed, mention your business details and the duration of operation.

04

Fill in the section related to your income details. Include your gross monthly income and any other sources of income, such as rental properties or investments. It's essential to provide accurate and up-to-date financial information.

05

If applicable, disclose any outstanding debts or financial obligations that you may have, including mortgages, loans, credit card balances, or child support payments. Be transparent and honest in this section.

06

Review the form thoroughly to ensure you haven't missed any sections or left any fields blank. Incomplete forms can delay the processing of your application.

07

Once you have completed the form, sign and date it in the designated areas. This signifies your consent and authorization for the lender or authorized parties to access your borrower's information.

08

Make a copy of the borrower's information sheet authorization for your records before submitting it to the appropriate party.

Who needs borrower39's information sheet authorization:

01

Borrowers applying for financial loans or credit: Anyone applying for a loan, whether it's for a mortgage, personal loan, auto loan, or credit card, may be required to fill out a borrower's information sheet authorization. This form allows the lender to verify the applicant's financial information and history.

02

Lenders and financial institutions: Lenders and financial institutions use the borrower's information sheet authorization to collect the necessary information to assess the borrower's creditworthiness and make informed lending decisions. It helps them verify the borrower's income, employment details, outstanding debts, and other relevant financial information.

03

Authorized parties involved in loan processing: Various parties involved in processing the loan application, such as credit bureaus, underwriters, or mortgage brokers, may require the borrower's information sheet authorization to access the applicant's financial information and verify the provided details. This authorization ensures compliance with legal and regulatory requirements.

04

Legal and auditing authorities: In certain cases, regulatory entities, legal authorities, or auditors may request access to the borrower's information sheet authorization as part of their investigations or audits. This authorization enables them to confirm the accuracy of the provided information and ensure compliance with relevant laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is borrower's information sheet authorization?

Borrower's information sheet authorization is a form that authorizes a lender to obtain information about a borrower's financial situation and credit history.

Who is required to file borrower's information sheet authorization?

Borrowers who are seeking a loan or credit from a lender are required to file borrower's information sheet authorization.

How to fill out borrower's information sheet authorization?

Borrowers can fill out the form by providing accurate and complete information about their financial situation, employment history, and personal details.

What is the purpose of borrower's information sheet authorization?

The purpose of borrower's information sheet authorization is to allow the lender to assess the borrower's creditworthiness and make an informed decision about approving the loan or credit.

What information must be reported on borrower's information sheet authorization?

The information that must be reported on borrower's information sheet authorization includes income, expenses, assets, liabilities, employment history, and contact information.

How can I send borrower39s information sheet authorization for eSignature?

When your borrower39s information sheet authorization is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit borrower39s information sheet authorization in Chrome?

Install the pdfFiller Google Chrome Extension to edit borrower39s information sheet authorization and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the borrower39s information sheet authorization in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your borrower39s information sheet authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

borrower39s Information Sheet Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.