Get the free VA Small Business Microloan Program - York County

Show details

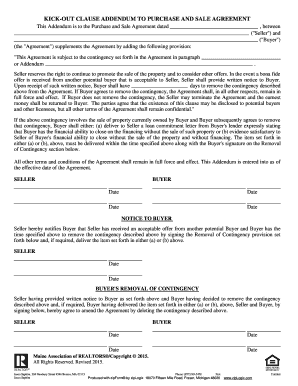

Small Business Micro-Loan Program The Virginia Small Business Financing Authority's Small Business Micro-Loan Program is designed to assist Virginia s existing small businesses across the Commonwealth.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign va small business microloan

Edit your va small business microloan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your va small business microloan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing va small business microloan online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit va small business microloan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out va small business microloan

How to fill out a VA small business microloan:

01

Research the eligibility requirements: Before starting the application process, it is essential to understand the eligibility requirements for a VA small business microloan. These may include factors such as being a veteran or service-disabled veteran, having a viable business plan, and meeting specific financial criteria.

02

Gather necessary documentation: To fill out the VA small business microloan application, you will need various documents. These may include your personal identification, business licenses and permits, financial statements, tax returns, a business plan, and any other relevant paperwork. Make sure to organize and compile all the required documentation before filling out the application.

03

Complete the application form: The next step is to complete the VA small business microloan application form. This form will typically ask for your personal information, business details, loan amount requested, and other relevant information. Fill out the form accurately and provide all necessary details to increase your chances of approval.

04

Prepare a business plan: Along with the application form, you will likely need to submit a business plan. This plan should outline your business goals, market analysis, financial projections, and strategies for growth. Ensure that your business plan is well-prepared and demonstrates the viability and potential of your small business.

05

Submit the application: Once you have completed the application form and prepared all the required documentation, it is time to submit your VA small business microloan application. Check for any additional submission requirements, such as mailing or online submission, and make sure to follow the instructions provided by the loan program.

Who needs a VA small business microloan:

01

Veterans starting a new business: VA small business microloans can be beneficial for veterans who are starting their own businesses. The loan program aims to provide financing and support to veteran-owned small businesses, helping them start and grow their ventures.

02

Service-disabled veterans: Service-disabled veterans often face unique challenges when starting or expanding a business. A VA small business microloan can assist in providing the necessary funding to overcome these hurdles and establish a successful enterprise.

03

Veterans seeking additional capital: Even for veterans with existing businesses, a VA small business microloan can be a valuable source of additional capital. It can be used to cover expenses such as equipment purchases, inventory, marketing, or other essential business needs.

In summary, filling out a VA small business microloan involves researching eligibility requirements, gathering necessary documentation, completing the application form, preparing a business plan, and submitting the application. Veterans and service-disabled veterans who are starting or expanding their businesses can benefit from a VA small business microloan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is va small business microloan?

VA small business microloan is a type of loan provided to small businesses by the Department of Veterans Affairs to help them start or expand their operations.

Who is required to file va small business microloan?

Small business owners who are veterans or are in service-connected disability status may be eligible to apply for VA small business microloan.

How to fill out va small business microloan?

To fill out a VA small business microloan, applicants must complete the necessary forms and provide documentation of their eligibility as a veteran or service-connected disability status.

What is the purpose of va small business microloan?

The purpose of VA small business microloan is to provide financial assistance to veterans and small business owners to start or expand their businesses.

What information must be reported on va small business microloan?

Applicants must report their personal information, business plan, financial statements, and details of their military service or disability status.

How can I edit va small business microloan from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your va small business microloan into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I edit va small business microloan on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing va small business microloan, you need to install and log in to the app.

How do I complete va small business microloan on an Android device?

On Android, use the pdfFiller mobile app to finish your va small business microloan. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your va small business microloan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Va Small Business Microloan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.