Get the free BOE-571-L (S1F) - sccounty01 co santa-cruz ca

Show details

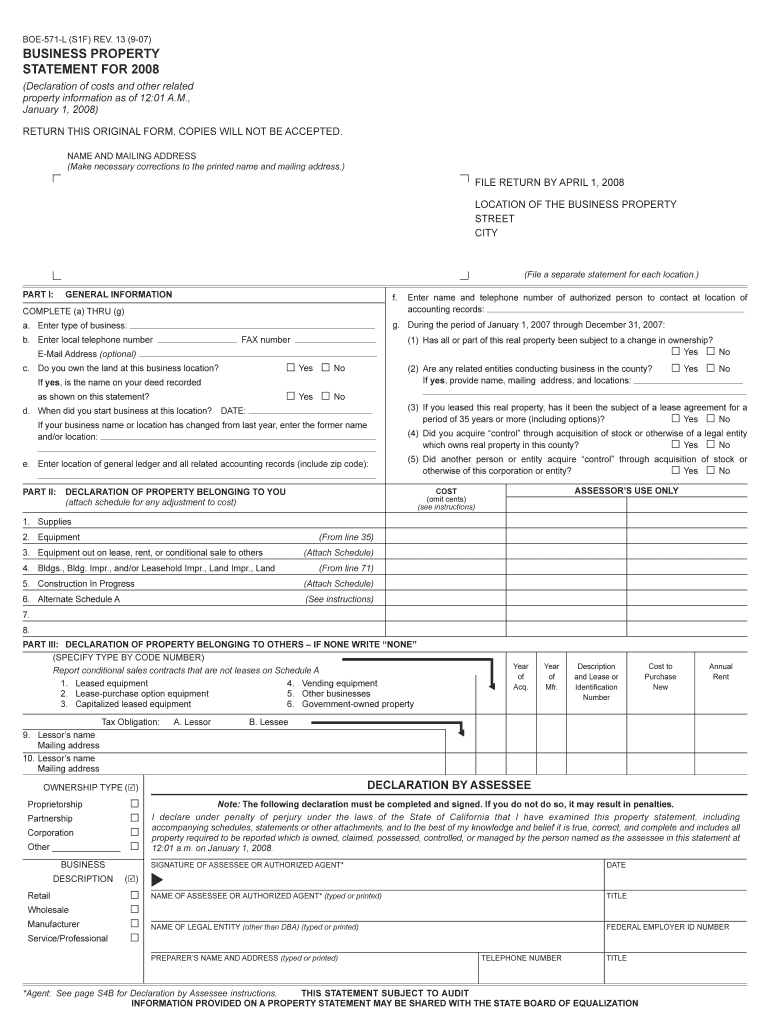

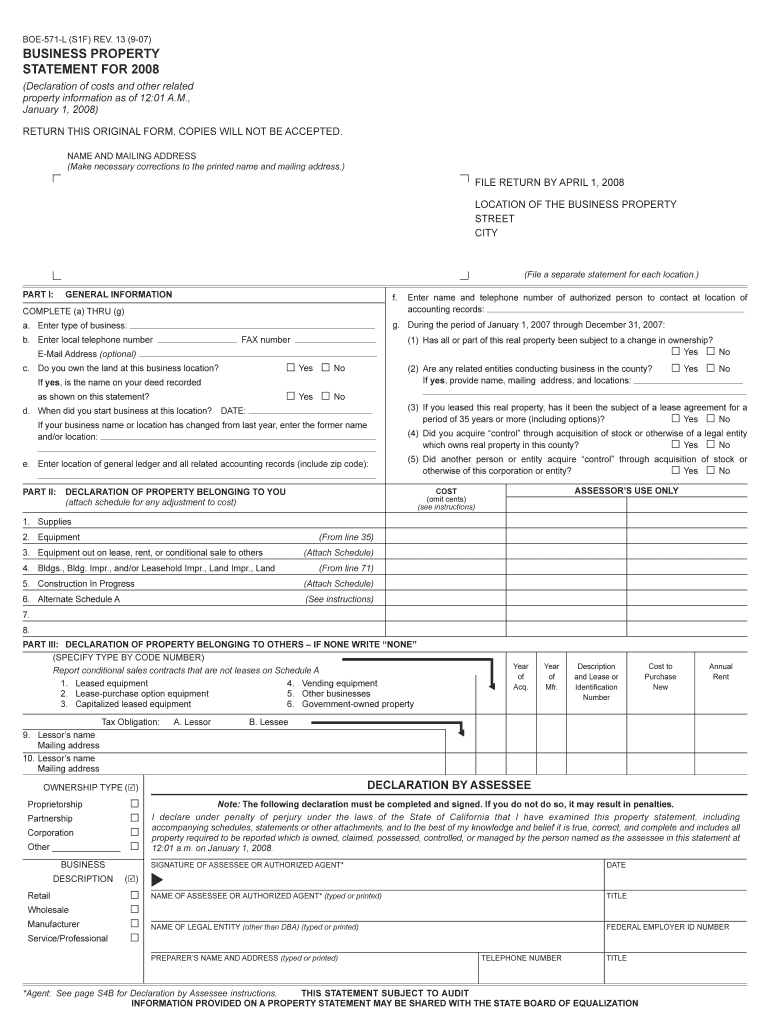

Declaration of costs and other related property information as of 12:01 A.M., January 1, 2008. This form is used to report assessable business property owned, claimed, possessed, controlled, or managed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe-571-l s1f - sccounty01

Edit your boe-571-l s1f - sccounty01 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe-571-l s1f - sccounty01 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit boe-571-l s1f - sccounty01 online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit boe-571-l s1f - sccounty01. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe-571-l s1f - sccounty01

How to fill out BOE-571-L (S1F)

01

Obtain a copy of the BOE-571-L (S1F) form from the California Board of Equalization website.

02

Fill in the property owner's name and address at the top of the form.

03

Provide the assessor's parcel number (APN) for the property in question.

04

Indicate the type of property (e.g., residential, commercial) in the designated section.

05

Complete the ownership information, including the date of purchase and any previous owners.

06

Fill out the section regarding the property’s current use and the intended use if it changes.

07

Attach any necessary supporting documentation that may be required.

08

Review all entered information for accuracy before submission.

09

Submit the completed form to the appropriate local assessor's office promptly.

Who needs BOE-571-L (S1F)?

01

Property owners who are applying for a property tax exemption or a reduction in assessed value due to specific circumstances.

02

Individuals or entities owning property that has undergone changes affecting its assessment status.

03

Those seeking to report properties for reassessment due to changes in ownership or use.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to keep property tax statements in California?

Overview. You need to keep records related to your personal or business tax returns. The statute of limitations to examine your return and mail a Notice of Proposed Assessment (NPA) adjusting your return is usually 4 years from the due date of the return, or the date the return is filed.

Do I have to file a business property statement in California?

An annual filing of a Business Property Statement is a requirement of section 441(d) of the California Revenue and Taxation Code. Statements are sent in order to gather the most up to date information on the business property so that an accurate value can be determined.

Does California have business personal property tax?

The California Constitution states in part that, "Unless otherwise provided by this Constitution or the laws of the US, (a) All property is taxable". That is, unless otherwise exempted, all forms of tangible property are taxable in California and the Assessor is required to assess business personal property.

What is a California business property statement?

The BPS collects information regarding the supplies, business equipment and leasehold improvements for each business location within the county. The information an owner provides on the statement is then used to assess and tax property in accordance with California State Law.

What is the business property tax form in California?

Business Property Statement (571-L Forms) Businesses are required by law to file an annual Business Property Statement if their aggregate cost of business personal property exceeds $100,000, or if the Assessor requests the information. Separate filings are required for each business location.

Do I need to file a fictitious business name statement in California?

A fictitious business name statement (known as Doing Business As or DBA) must be registered with the city and/or county clerk in the county of the registrant's principal place of business if the business is: A sole proprietorship doing business under a name not containing the owner's surname. A partnership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BOE-571-L (S1F)?

BOE-571-L (S1F) is a form used in California for reporting the information regarding the purchase and use of fuel for tax purposes.

Who is required to file BOE-571-L (S1F)?

Individuals or businesses that purchase fuel for non-highway use in California are required to file BOE-571-L (S1F).

How to fill out BOE-571-L (S1F)?

To fill out BOE-571-L (S1F), taxpayers need to provide details about the fuel purchased, including quantity and purpose of use, and complete sections as instructed on the form.

What is the purpose of BOE-571-L (S1F)?

The purpose of BOE-571-L (S1F) is to report fuel purchases and to ensure compliance with California fuel tax regulations, particularly for non-highway fuel usages.

What information must be reported on BOE-571-L (S1F)?

The information that must be reported on BOE-571-L (S1F) includes the type of fuel, quantity purchased, date of purchase, purpose of use, and details of the purchaser.

Fill out your boe-571-l s1f - sccounty01 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe-571-L s1f - sccounty01 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.