Get the free Group Life Portability Insurance Application - sccounty01 co santa-cruz ca

Show details

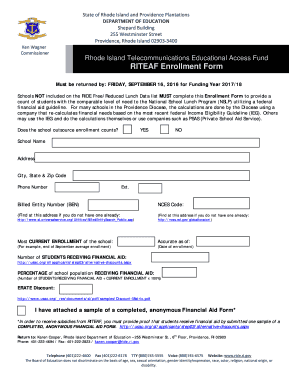

Este documento es una solicitud para la compra de un seguro de vida portátil en caso de que finalice el empleo de un individuo. Incluye instrucciones sobre la elegibilidad y el proceso de aplicación.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group life portability insurance

Edit your group life portability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group life portability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group life portability insurance online

Follow the steps down below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit group life portability insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group life portability insurance

How to fill out Group Life Portability Insurance Application

01

Begin by obtaining the Group Life Portability Insurance Application form from your employer or insurance provider.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information, including your full name, address, date of birth, and Social Security number.

04

Indicate the reason for applying for portability coverage (e.g., leaving employment, retirement).

05

Fill out details regarding your existing group life insurance policy, including policy number and coverage amount.

06

Complete any required health questions or declarations honestly and accurately.

07

Sign and date the application to confirm that all information is correct and complete.

08

Submit the application as instructed, whether online, by mail, or in person, along with any required documentation.

Who needs Group Life Portability Insurance Application?

01

Individuals who are leaving their employer but wish to maintain their life insurance coverage.

02

Employees transitioning to retirement and wanting to continue life insurance benefits.

03

Those who have been part of a group life insurance plan and want to ensure continued protection for their beneficiaries.

Fill

form

: Try Risk Free

People Also Ask about

Is it better to convert or port life insurance?

Conversion may be a good solution for employees who are leaving a job, reducing hours, retiring, or have reached an age when group coverage may be reduced or eliminated. Converted coverage is permanent universal life insurance.

How does GTL insurance work?

Portability is a policy feature that provides the option to continue coverage for an insured and their covered dependents after it would otherwise end. The coverage shifts (or "ports") from being part of a group policy to being a standalone individual policy.

How to fill out a life insurance application?

GTL is the type of life insurance most employers offer as part of a benefits package. It provides financial protection during a specific time frame, such as when employees have dependents or significant debt. If an employee passes away during the term, death benefits are paid to the beneficiaries.

What is group life portability insurance?

Portability or porting is an optional feature chosen by your former employer. It allows you and your dependents to continue their Group Term Life and Accidental Death and Dismemberment (AD&D) insurance under a separate policy.

How does life insurance portability work?

If your employer's group life insurance is portable, you can opt to "port" your coverage, paying your premium directly to the insurance company to keep your coverage in force. This is typically used when someone leaves their job or is fired and, as a result, will have a gap in coverage.

How does GTL insurance work?

GTL is the type of life insurance most employers offer as part of a benefits package. It provides financial protection during a specific time frame, such as when employees have dependents or significant debt. If an employee passes away during the term, death benefits are paid to the beneficiaries.

What is group term life portability insurance?

Portability or porting is an optional feature chosen by your former employer. It allows you and your dependents to continue their Group Term Life and Accidental Death and Dismemberment (AD&D) insurance under a separate policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Life Portability Insurance Application?

The Group Life Portability Insurance Application is a form that allows individuals covered under a group life insurance policy to continue their life insurance coverage after leaving the employer or the group plan.

Who is required to file Group Life Portability Insurance Application?

Individuals who are leaving an employer or a group life insurance plan and wish to maintain their life insurance coverage are required to file the Group Life Portability Insurance Application.

How to fill out Group Life Portability Insurance Application?

To fill out the Group Life Portability Insurance Application, an individual should provide personal information such as name, address, and details of the group policy. It's important to follow the instructions on the application form and provide any necessary documentation.

What is the purpose of Group Life Portability Insurance Application?

The purpose of the Group Life Portability Insurance Application is to allow individuals to transfer their life insurance coverage from a group policy to an individual policy, ensuring they do not lose coverage when they leave the group.

What information must be reported on Group Life Portability Insurance Application?

The information that must be reported includes personal identification details, the group policy number, the reason for leaving the group plan, and any current health status or medical history that may affect the coverage.

Fill out your group life portability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Life Portability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.