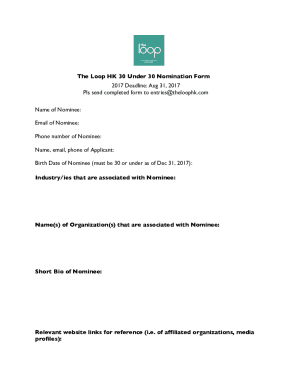

Get the free cp575g

Get, Create, Make and Sign cp 575 g form

How to edit cp575g form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cp575g form

How to fill out cp 575 g:

Who needs cp 575 g:

Video instructions and help with filling out and completing cp575g

Instructions and Help about cp575g form

What is it guys today in this video Ill show you how to replace the hard drive and the RAM on the Easter aspire B 3 5 7 for g54 v-y, so this one is configured with 8 gigabytes of memory originally I have gone and inserted in the stick of RAM which brings it up to total of 16 gigabytes of RAM and this one uses ddr3 memory, so I'll show you guys this is this laptop it has 2 slots, and I'll show you how to access them so let's begin first off obviously you'll need a Phillips head screwdriver let me zoom in and show you guys the head, so this is how it looks like okay, so then make sure that your laptop is turned off and unplugged obviously we don't want power going through it then and actually let me put something you start by removing the screw which holds the optical drive in place this is the one and really don't worry about the warranty white sticker it will not what you want if you're upgrading the RAM and then gently pry the DVD drive outside and keep it in a safe location then move on unscrewing the rest of these fruit you can see all of these clothes are of equal length, so I'd suggest you set these clothes aside keep them aside somewhere safe then move on to opening these three screws you can see these are you can see these screws are much smaller and so were going to keep these somewhere else separated from those and now what you've got to do is that we you guys should be real careful while taking this apart because since this laptop has these LEDs speakers and the card reader on the underside of the lid on the underside, so there's a cable connecting this part of the back shell so be very careful while removing it I'm going to start removing it in just a moment, so now you can use your fingers to just pry off this back again be very careful while you're doing this be very gentle you don't really want to break anything and there you go like I said be very, very gentle you don't really want to break the clips underneath the laptop that's it and you guys can see the cable connecting the and this is the great little cable which connects the speakers and the LEDs so again oh sorry the LEDs are over here, but I guess disconnected these speakers set this aside and can see yeah I guess this it is possible to clean the fan just take this out unscrews these two and the fan assembly should come off then you can clean the heat sink, but anyway this is your CPU over here and this is the Nvidia graphics card the RAM chips for the graphics card and heresy our lithium-ion battery replacing it is very simple you just take this little connector out and the battery will come off then grab a new battery insert it and reconnect this connector that's it again replacing the RAM is also extremely simple let me just put the camera there we go much better view so to replace the RAM all you have to do is gently pull these two tabs apart until the RAM pops out like this and take it out be wary this is an 8 gigabyte stick and another 8 gigabyte stick is installed...

People Also Ask about

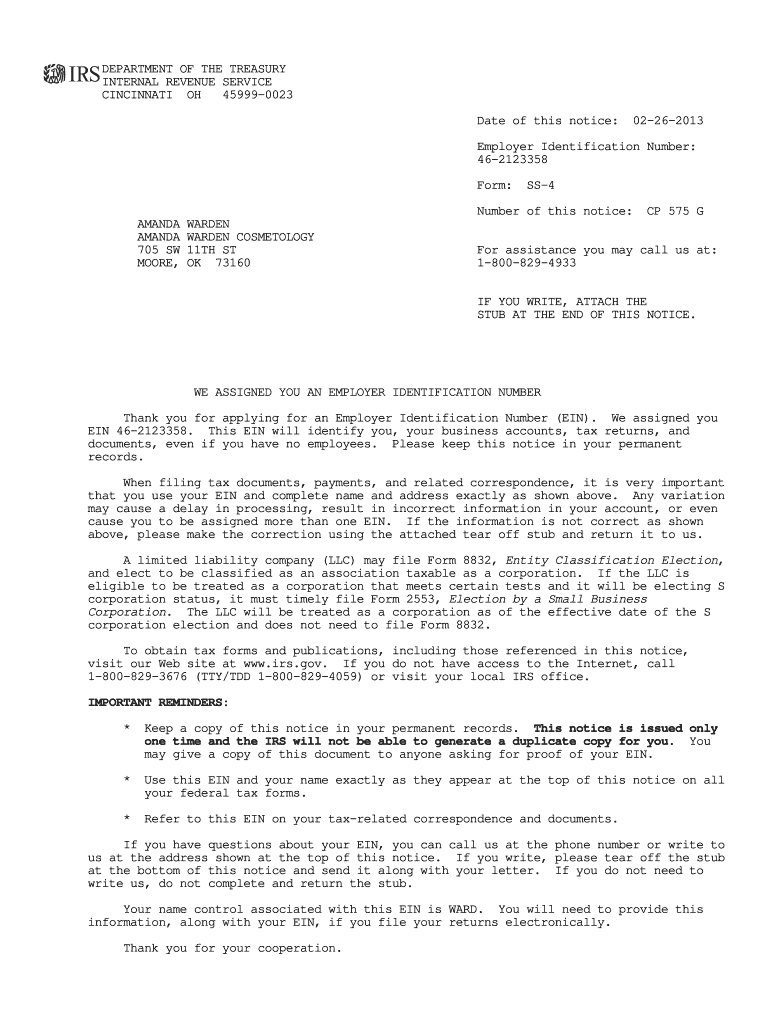

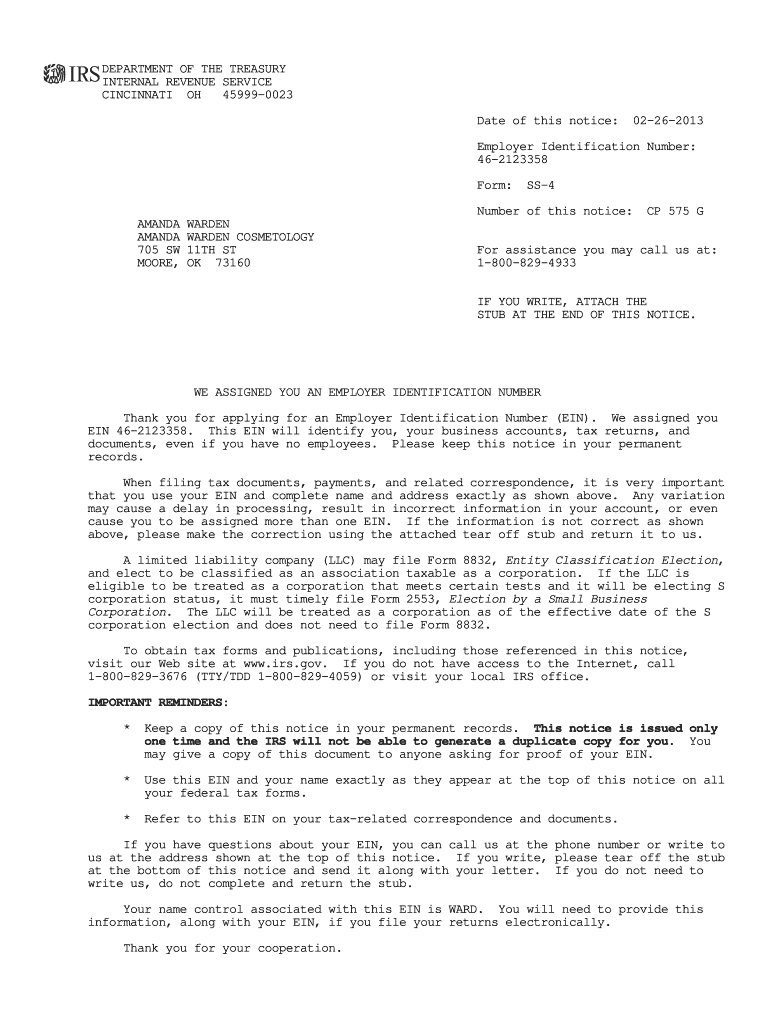

What is a CP 575 G letter?

How do I get my EIN confirmation letter CP 575?

How do I get proof of my EIN number?

How do I get a IRS verification letter CP 575?

How do I get a copy of my CP 575 online?

How do I apply for a CP 575?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cp575g form to be eSigned by others?

Where do I find cp575g form?

How do I execute cp575g form online?

What is cp 575 g?

Who is required to file cp 575 g?

How to fill out cp 575 g?

What is the purpose of cp 575 g?

What information must be reported on cp 575 g?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.