Get the free Wage Refund Calculation Request - fa ufl

Show details

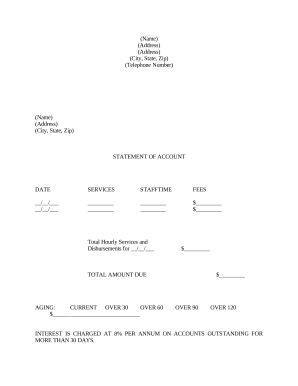

This document is a request form for calculating and processing a wage refund due to overpayment of an employee.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wage refund calculation request

Edit your wage refund calculation request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wage refund calculation request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wage refund calculation request online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wage refund calculation request. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wage refund calculation request

How to fill out Wage Refund Calculation Request

01

Obtain the Wage Refund Calculation Request form from your employer or the relevant authority.

02

Carefully review the instructions provided with the form to understand the requirements.

03

Enter your personal details in the designated fields, including your name, address, and contact information.

04

Fill out your employment details, such as your job title, employee ID, and dates of employment.

05

Provide a detailed explanation of the reasons for the wage refund request, including specific dates and amounts if applicable.

06

Attach any supporting documentation that may be required, like pay stubs, bank statements, or previous correspondence.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form via the prescribed method, whether that’s in person, by mail, or electronically.

Who needs Wage Refund Calculation Request?

01

Employees who believe they have been underpaid or have overpaid wages.

02

Individuals seeking to reclaim wages due to payroll errors.

03

Workers who have faced wage disputes with their employers.

04

Anyone affected by compensation adjustments that warrant a refund.

Fill

form

: Try Risk Free

People Also Ask about

How do I request a deposit refund?

Request an expedited refund by calling the IRS at 800-829-1040 (TTY/TDD 800-829-4059). Request a manual refund expedited to you.

How do I request a Wage Tax refund in Philadelphia?

Wage Tax refund requests can be submitted through the Philadelphia Tax Center, including for salaried or commissioned employees. If you requested a refund on your return, you do not need to fill out these forms. To request a refund, once in the Philadelphia Tax Center, you need to know your FEIN, SSN, or PHTIN.

How to calculate refund?

Every year, your refund is calculated as the amount withheld for federal income tax, minus your total federal income tax for the year. A large portion of the money being withheld from each of your paychecks does not actually go toward federal income tax.

How do I request a refund check?

How do I get a new one? If you lost your refund check, you should initiate a refund trace: Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation).

Can payroll taxes be refunded?

The "claim" process is used to request a refund or abatement of the overpayment. If you file Form 94X-X to correct overreported tax amounts in the last 90 days of a period of limitations, you must use the claim process.

How do I get a refund check?

If you were expecting a federal tax refund and did not receive it, check the IRS Where's My Refund page. You will need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Wage Refund Calculation Request?

A Wage Refund Calculation Request is a formal document submitted to request the calculation of wage refunds owed to an employee due to overpayment, incorrect wage distributions, or as per company policies.

Who is required to file Wage Refund Calculation Request?

Individuals who have overpaid wages or believe they are entitled to a wage refund after reviewing their payroll records are required to file a Wage Refund Calculation Request.

How to fill out Wage Refund Calculation Request?

To fill out a Wage Refund Calculation Request, one must provide personal information, details of the overpayment, the period in which it occurred, and any supporting documentation that verifies the claim.

What is the purpose of Wage Refund Calculation Request?

The purpose of a Wage Refund Calculation Request is to formally document and initiate the process of obtaining refunds for overpaid wages, ensuring that employees receive the correct compensation.

What information must be reported on Wage Refund Calculation Request?

The information that must be reported includes the employee's identification details, payroll period, amounts in question, reasons for requesting a refund, and any relevant documentation to support the claim.

Fill out your wage refund calculation request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wage Refund Calculation Request is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.