Get the free The transferor (donor) may be required to file Form 709, Federal

Show details

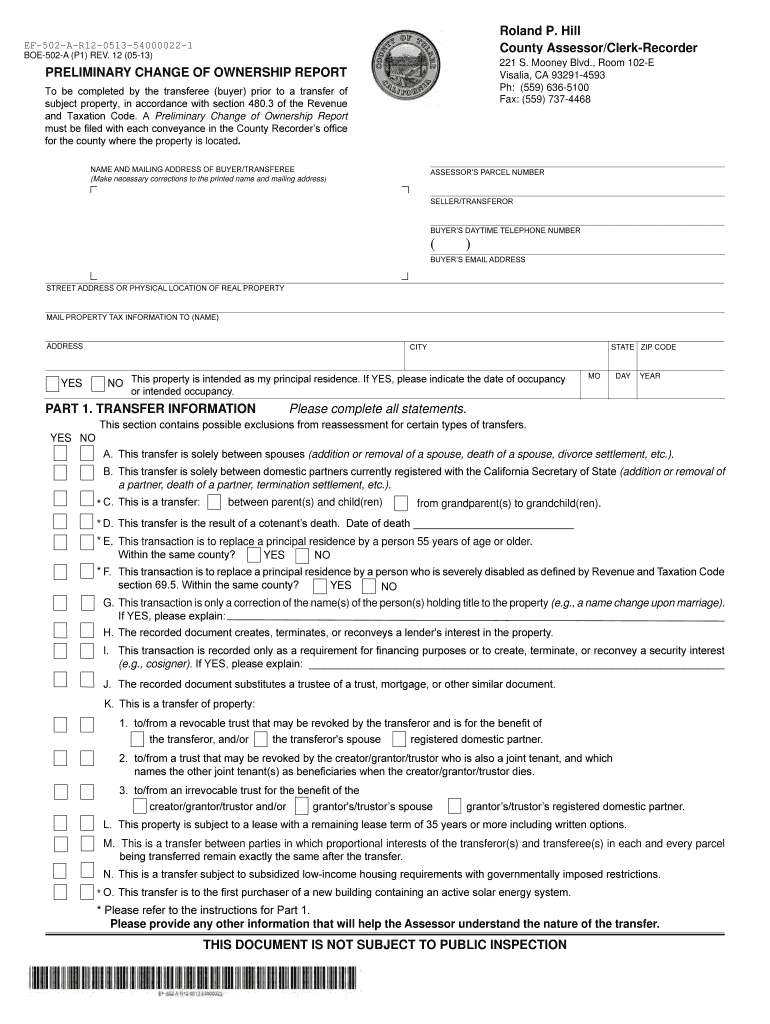

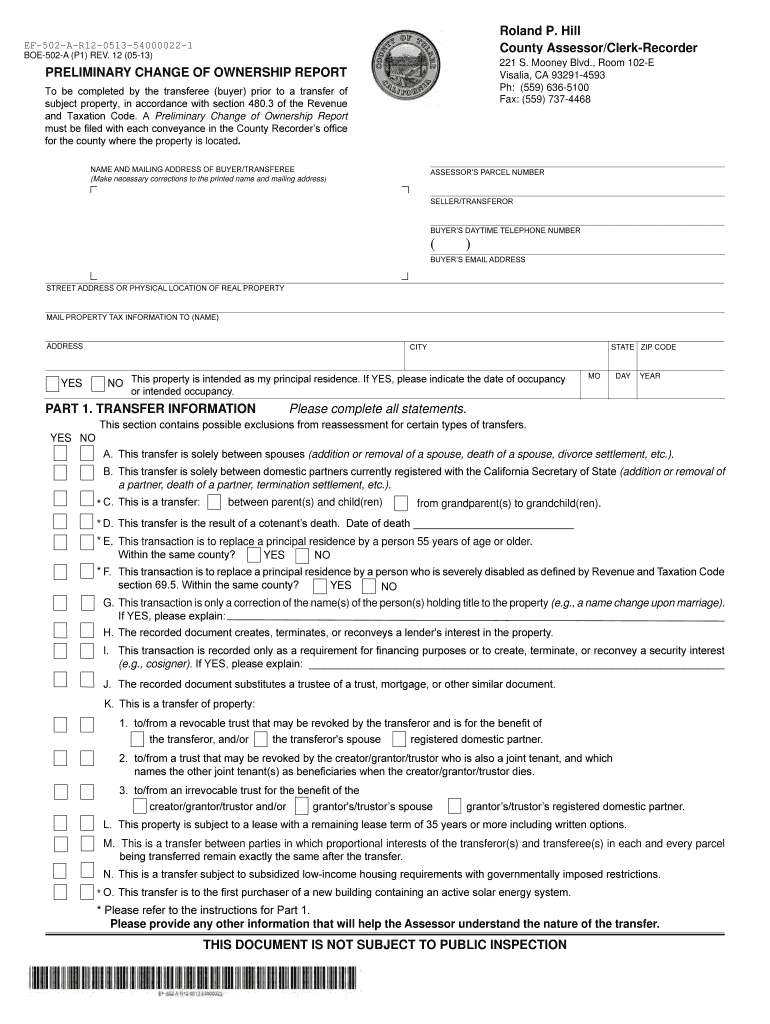

Roland P. Hill County Assessor/Clerk-Recorder EF-502-A-R12-0513-54000022-1 BOE-502-A (P1) REV. 12 (05-13) 221 S. Mooney Blvd., Room 102-E Visalia, CA 93291-4593 pH: (559) 636-5100 Fax: (559) 737-4468

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign the transferor donor may

Edit your the transferor donor may form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your the transferor donor may form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing the transferor donor may online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit the transferor donor may. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out the transferor donor may

To fill out the transferor donor may, you can follow these steps:

01

Begin by gathering all the required information and documents such as your personal details, assets, and beneficiaries' information.

02

Start by writing down your full name, address, and contact information at the top of the may form.

03

Clearly state that you are the transferor donor and that you are of sound mind and willingly making this may.

04

Identify your assets and list them comprehensively. This may include properties, bank accounts, investments, vehicles, and any other valuable belongings.

05

Specify how you want your assets to be distributed after your passing. Clearly mention the names of your beneficiaries and what they should inherit. You can also designate specific items or amounts for each beneficiary if desired.

06

Appoint an executor to carry out the instructions outlined in your may. This person will be responsible for managing your assets and ensuring that your wishes are fulfilled.

07

Consider adding any additional clauses or provisions that you deem necessary, such as conditions for receiving an inheritance or instructions for the care of dependents or pets.

08

Once you have completed all the necessary details, review the may thoroughly to ensure accuracy and clarity. It's advisable to seek legal advice or consult with an attorney to ensure your will is legally binding and encompasses your intentions.

Who needs the transferor donor may?

The transferor donor may is essential for anyone who wants to plan and dictate how their assets should be distributed after their passing. It is particularly important for individuals who have accumulated significant assets or have specific requests regarding the distribution of their estate. Creating a transferor donor may ensures that your assets are distributed according to your wishes, minimizing the potential for disputes or legal issues among your heirs. Regardless of age or wealth, having a transferor donor may helps provide peace of mind and guarantees that your loved ones are taken care of in the way you desire.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify the transferor donor may without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including the transferor donor may, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I fill out the transferor donor may on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your the transferor donor may by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit the transferor donor may on an Android device?

You can make any changes to PDF files, like the transferor donor may, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is the transferor donor may?

The transferor donor may is a form used to report gifts or transfers of property during the process of estate planning.

Who is required to file the transferor donor may?

Any individual or entity who has made gifts or transfers of property during the tax year is required to file the transferor donor may.

How to fill out the transferor donor may?

The transferor donor may can be filled out online or by mail using the appropriate form provided by the IRS.

What is the purpose of the transferor donor may?

The purpose of the transferor donor may is to report any gifts or transfers of property that may have tax implications.

What information must be reported on the transferor donor may?

The transferor donor may must include details of the gifts or transfers made, the value of the property, and the relationship between the transferor and the recipient.

Fill out your the transferor donor may online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

The Transferor Donor May is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.