Get the free Transfer agreement for depositary receipts

Show details

This document is a transfer agreement for depositary receipts of ordinary shares B in uniQure B.V., detailing client information, bank details, and the transfer process.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer agreement for depositary

Edit your transfer agreement for depositary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer agreement for depositary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transfer agreement for depositary online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit transfer agreement for depositary. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

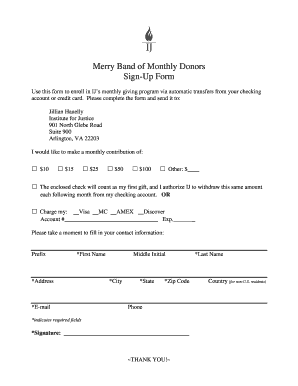

How to fill out transfer agreement for depositary

How to fill out Transfer agreement for depositary receipts

01

Begin by obtaining a blank Transfer Agreement form for depositary receipts.

02

Fill in the name and address of the transferor (the person transferring the depositary receipts).

03

Provide the name and address of the transferee (the person receiving the depositary receipts).

04

Enter the number of depositary receipts being transferred.

05

Include the date of the transfer.

06

Specify any terms or conditions of the transfer, if applicable.

07

Both the transferor and transferee should sign and date the agreement.

08

Ensure all parties receive a copy of the signed agreement for their records.

Who needs Transfer agreement for depositary receipts?

01

Individuals or entities involved in the transfer of depositary receipts.

02

Financial institutions facilitating the transfer.

03

Legal and financial advisors assisting in the transaction.

Fill

form

: Try Risk Free

People Also Ask about

What are the risks of American depository receipts?

ADR risk factors and expenses Because ADRs are issued by non-US companies, they entail special risks inherent to all foreign investments. These include: Exchange rate risk — the risk that the currency in the issuing company's country will drop relative to the US dollar.

What is an example of a depositary receipt?

Examples of ADRs Diageo Plc ADR. Diageo is an alcoholic beverage company that is located in the United Kingdom. Teva Pharmaceutical ADR. GlaxoSmithKline ADR. Infosys ADR. Siemens AG ADR. Novartis AG ADR. Total S.A. ADR. ADR Ratio.

What is a depositary receipt?

A depositary receipt (DR) is a negotiable financial instrument issued by a bank to represent a foreign company's publicly traded securities. The depositary receipt trades on a local stock exchange.

What is a depositary agreement?

Depositary Bank Agreement means an agreement among a Loan Party, a bank or other depositary institution and the Collateral Agent, in form and substance reasonably satisfactory to the Collateral Agent.

What is a depository agreement?

Depositories may include banks, safehouses, vaults, financial institutions, and other organizations.

What is an example of a depositary?

The deposit account control agreement enables the secured party to obtain control over the deposit account, and so enables its security interest in the deposit account to be perfected. It is an example of a collateral document entered into by a debtor to secure obligations under a loan agreement.

What does a deposit account control agreement do?

According to the AIF/AIFM-law a depositary agent is an independent third party in charge of controlling activities related to monitoring and verification of obligations of the fund and activities the management company is obliged to fulfill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Transfer agreement for depositary receipts?

A Transfer Agreement for Depositary Receipts is a legal document that outlines the terms and conditions under which depositary receipts are transferred between parties, typically involving shares of a foreign company that represent ownership in that company's stock.

Who is required to file Transfer agreement for depositary receipts?

Generally, the parties involved in the transaction, including the issuer of the depositary receipts and the transfer agent, are required to file the Transfer Agreement for Depositary Receipts to ensure compliance with regulatory requirements.

How to fill out Transfer agreement for depositary receipts?

To fill out the Transfer Agreement for Depositary Receipts, one must provide details such as the names of the parties involved, description of the depositary receipts, transaction terms, signatures of the relevant parties, and any additional required information depending on jurisdiction.

What is the purpose of Transfer agreement for depositary receipts?

The purpose of a Transfer Agreement for Depositary Receipts is to formalize the transfer of ownership of the depositary receipts, provide legal protection to the parties involved, and ensure compliance with applicable regulations and laws.

What information must be reported on Transfer agreement for depositary receipts?

The information that must be reported on a Transfer Agreement for Depositary Receipts includes the identity of the parties involved, number of depositary receipts being transferred, date of transfer, terms of the transfer, and any additional regulatory disclosures as required.

Fill out your transfer agreement for depositary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer Agreement For Depositary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.