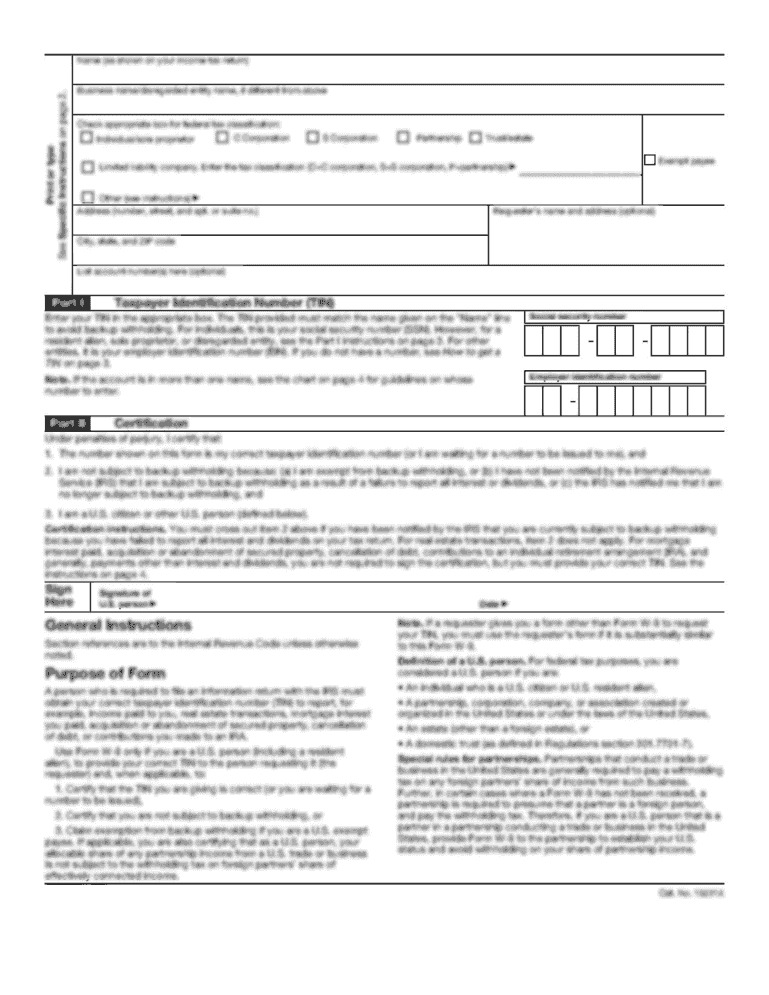

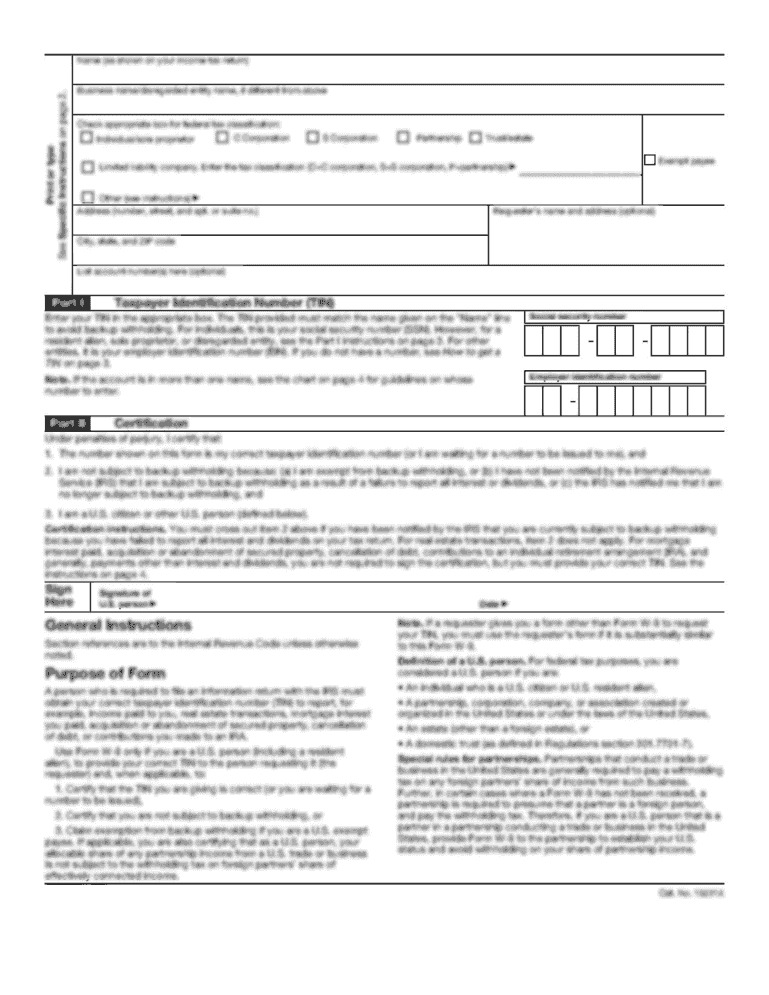

MT Form FS7 2015 free printable template

Get, Create, Make and Sign fs7 malta form

How to edit fs7 2015 form online

Uncompromising security for your PDF editing and eSignature needs

MT Form FS7 Form Versions

How to fill out fs7 2015 form

How to fill out MT Form FS7

Who needs MT Form FS7?

Video instructions and help with filling out and completing fs7 fillable

Instructions and Help about fs7 2015 form

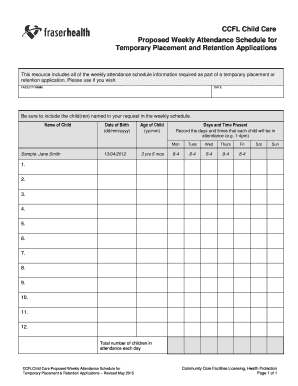

Two things are certain in life one of them is taxes the other is the dealing with taxes does not have to be time-consuming inefficient and strain the environment Malta is overhauling its public services with a program of reform that cuts across the board promoting the benefits of increased efficiency both for government and its clients the citizens of Malta since 2002 the Inland Revenue Department has been continuously increasing the level of customer service it offers while cutting down on operational costs the online services of the Inland Revenue Department cater for all stakeholders offering a true one-stop-shop solution you might have work on saving every month and the amount of forms I don't have to fill in and mail is a major advantage we employ 40 workers, so it used to take us quite a bit of time now I just output the data from payroll and transmitted it to the Inland Revenue Department as its right the first time they don't need to contact me again childcare services have seen a boost in business since the government announced the rebate system on fees paid with all the online services of the Inland Revenue Department I would need a consultant to fill in all the necessary forms for each child now its easy I can do it quickly in a couple of hours and the spreadsheet actually guides you through the process tax is not my thing so compiling the annual return was always a headache and hours spent rummaging through shoeboxes now I don't have to fill in the form, but I simply receive a text statement or check it on the website I can also pay online through my online banking site in half an hour I'm done the biggest advantage is that I no longer have to carry hundreds and hundreds of forms of all the related documents seriously though the online services have created a level playing field because the downloadable spreadsheet ensures that all tax practitioners interpret rules in exactly the same way the spreadsheet is also updated yearly and so it has all the latest developments automatically I can check my clients status online, and I can manage my work and their work in a better way in short it has helped us achieve a very good increase in efficiency the figures are impressive not just because were dealing with tax over 83 of corporate tax returns are received online 70 of employers file their line which then are processed instantly almost 4500 man-hours are being saved every year less paper is wasted less money is spent on postal services and fewer taxpayers need to call or visit the department with queries since the information is processed quickly and shared most employees do not even need to file a return government gets its dues quicker and perhaps best of all refunds are also paid much faster the online services of the Malta Inland Revenue Department faster better simpler

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the fs7 2015 form in Gmail?

How can I edit fs7 2015 form on a smartphone?

Can I edit fs7 2015 form on an iOS device?

What is MT Form FS7?

Who is required to file MT Form FS7?

How to fill out MT Form FS7?

What is the purpose of MT Form FS7?

What information must be reported on MT Form FS7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.