Get the free Fixed Rate Mortgage - PA .gov

Show details

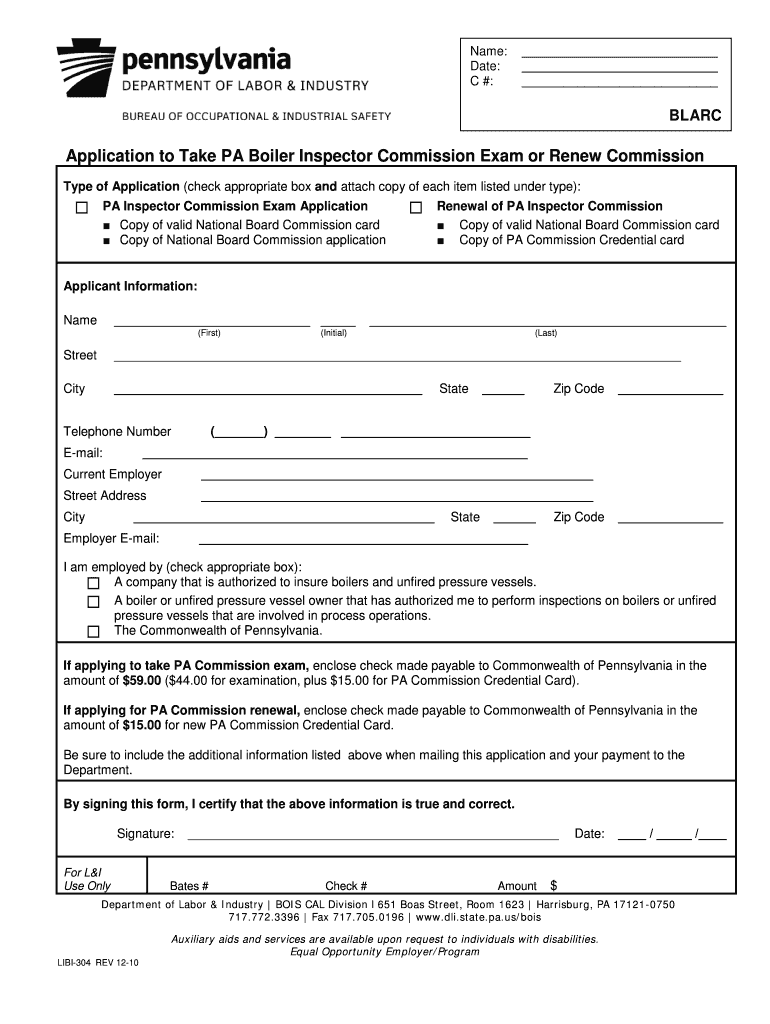

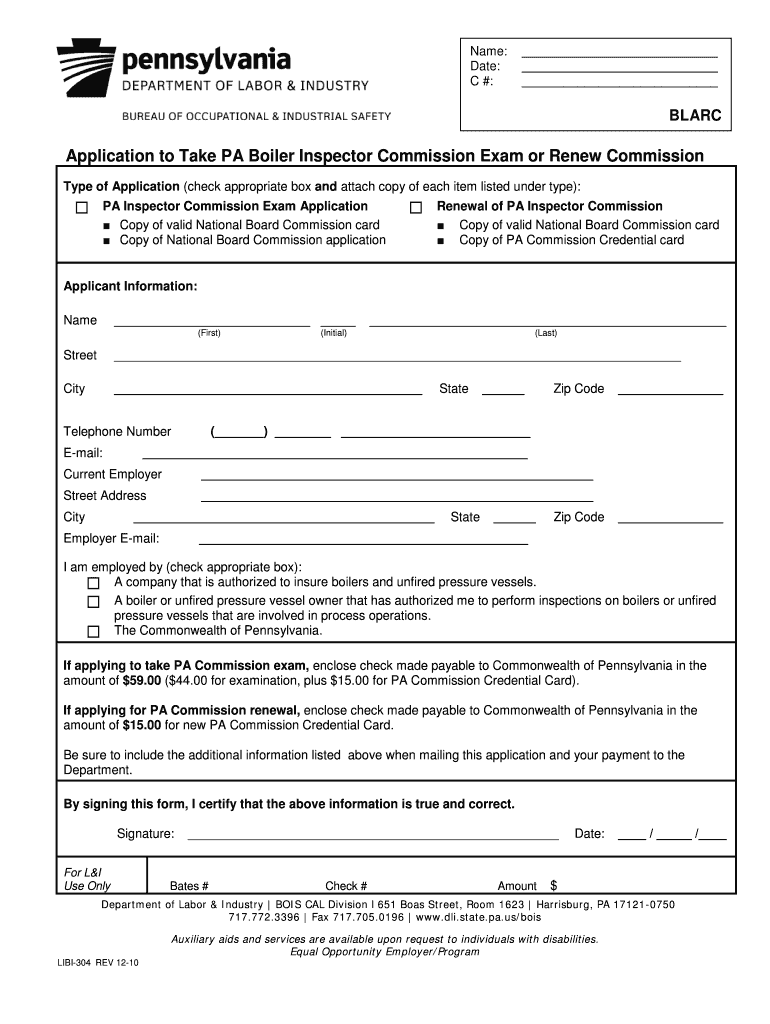

Name: Date: C #: BLARE Application to Take PA Boiler Inspector Commission Exam or Renew Commission Type of Application (check appropriate box and attach copy of each item listed under type): PA Inspector

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed rate mortgage

Edit your fixed rate mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed rate mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed rate mortgage online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fixed rate mortgage. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed rate mortgage

How to fill out a fixed rate mortgage:

01

Gather necessary documents: Before filling out a fixed rate mortgage, gather all the required documents such as proof of income, bank statements, tax returns, identification documents, and credit history.

02

Research different lenders: Explore various lenders to find the one offering the best terms, interest rates, and customer service for a fixed rate mortgage. Compare their offers and read reviews to make an informed decision.

03

Meet with a mortgage advisor: Schedule a meeting with a mortgage advisor who can guide you through the process, explain the terms and conditions, and answer any questions you may have about the fixed rate mortgage.

04

Complete the application: Fill out the mortgage application provided by the chosen lender. Include accurate information about your employment history, income, assets, liabilities, and any other required details.

05

Submit supporting documents: Along with the application, submit the necessary supporting documents as stated by the lender. This may include pay stubs, tax returns, bank statements, and identification proof.

06

Review the loan estimate: After submitting the application, you'll receive a loan estimate from the lender. Review it carefully, understanding the interest rate, monthly payments, closing costs, and any other fees associated with the fixed rate mortgage.

07

Undergo the loan approval process: The lender will conduct a detailed review of your financial information, credit score, and documentation. They may request additional information or clarification during this process.

08

Appraisal and property inspection: The lender may require an appraisal and property inspection to determine the market value and condition of the property you intend to purchase.

09

Sign the loan contract: If you receive approval, carefully review the loan contract and associated documents. Ensure that you understand the terms and conditions before signing.

10

Closing and fund disbursement: Finally, you'll need to attend the loan closing where you'll sign the final paperwork. Once completed, the lender will disburse the funds to the seller or to you, depending on the situation.

Who needs a fixed rate mortgage:

01

First-time homebuyers: Individuals purchasing their first home may find a fixed rate mortgage appealing as it provides stability and predictable monthly payments throughout the loan term.

02

Risk-averse individuals: Those who prefer a consistent payment schedule without the uncertainty of fluctuating interest rates may opt for a fixed rate mortgage to budget and plan effectively.

03

Long-term homeowners: Homeowners planning to stay in their property for an extended period often choose a fixed rate mortgage to secure a low interest rate for the entire duration of the loan.

04

Those who prefer financial stability: Fixed rate mortgages offer peace of mind, allowing borrowers to accurately plan their finances without worrying about sudden increases in mortgage payments due to interest rate changes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fixed rate mortgage without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your fixed rate mortgage into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I edit fixed rate mortgage on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing fixed rate mortgage, you can start right away.

How do I edit fixed rate mortgage on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign fixed rate mortgage on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is fixed rate mortgage?

A fixed rate mortgage is a type of mortgage where the interest rate remains the same for the entire term of the loan.

Who is required to file fixed rate mortgage?

Borrowers who have taken out a fixed rate mortgage are required to file it as part of their financial records.

How to fill out fixed rate mortgage?

To fill out a fixed rate mortgage, borrowers need to provide information about the loan amount, interest rate, term of the loan, and other relevant details.

What is the purpose of fixed rate mortgage?

The purpose of a fixed rate mortgage is to provide borrowers with predictability and stability in their monthly mortgage payments.

What information must be reported on fixed rate mortgage?

Information such as loan amount, interest rate, term of the loan, lender information, and borrower's details must be reported on a fixed rate mortgage.

Fill out your fixed rate mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Rate Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.