Get the free 55 Mortgage Retirement Mortgage Application bFormb - Hodge bLifetimeb

Show details

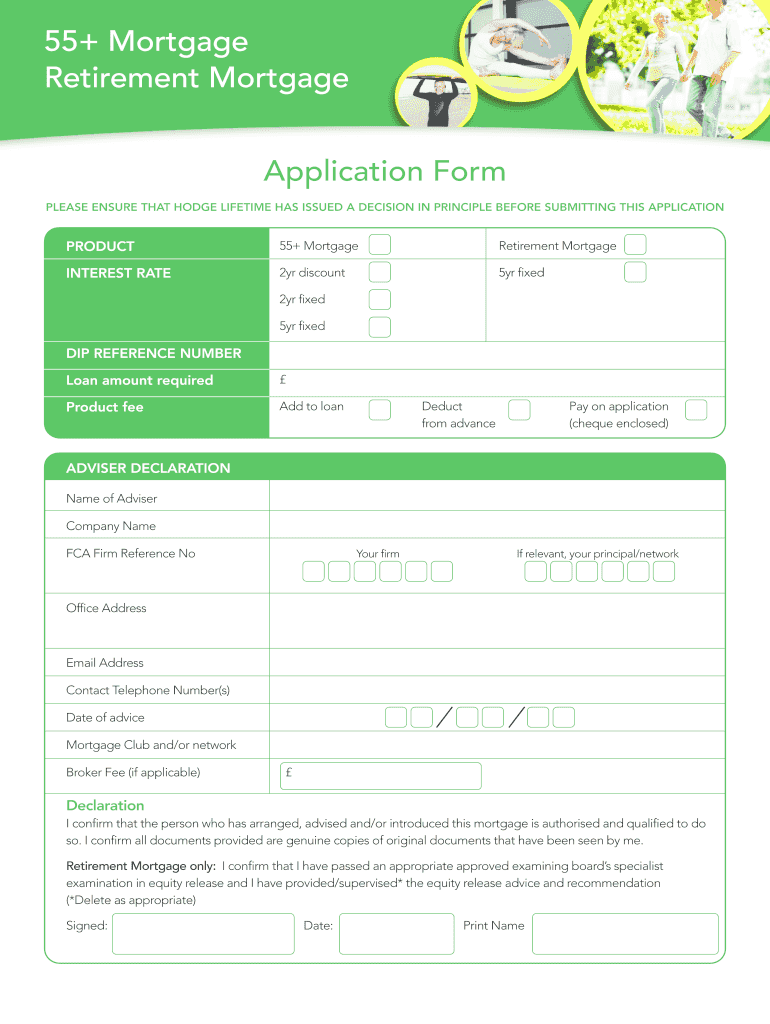

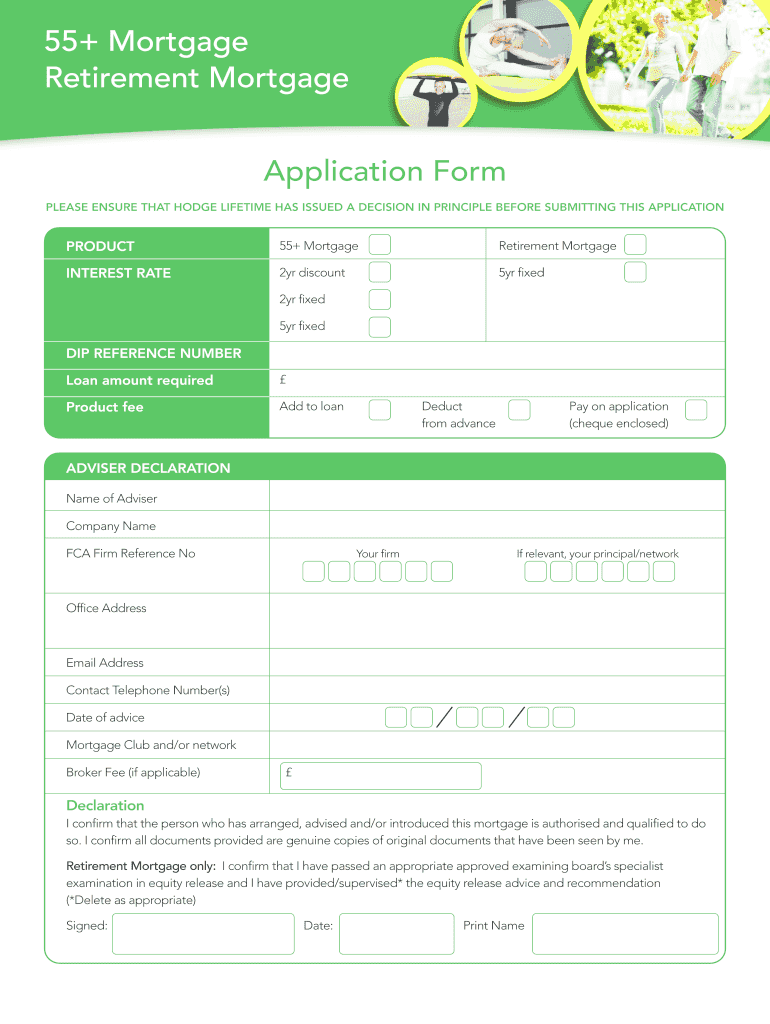

55+ Mortgage Retirement Mortgage Application Form PLEASE ENSURE THAT HODGE LIFETIME HAS ISSUED A DECISION IN PRINCIPLE BEFORE SUBMITTING THIS APPLICATION PRODUCT 55+ Mortgage Retirement Mortgage INTEREST

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 55 mortgage retirement mortgage

Edit your 55 mortgage retirement mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 55 mortgage retirement mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 55 mortgage retirement mortgage online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 55 mortgage retirement mortgage. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 55 mortgage retirement mortgage

How to fill out a 55 mortgage retirement mortgage:

01

Research the different options available: Start by understanding the various 55 mortgage retirement mortgage options offered by different lenders. Gather information on interest rates, terms, and requirements.

02

Assess your eligibility: Determine if you meet the criteria for a 55 mortgage retirement mortgage. Typically, these mortgages are available to individuals aged 55 and older, who own their primary residence and have sufficient equity.

03

Seek professional advice: Consult with a mortgage advisor or financial planner who specializes in retirement mortgages. They can provide guidance on the process and help you understand the implications.

04

Gather necessary documents: Prepare the required documents, which may include identification, proof of income, proof of ownership, and other relevant paperwork. Organize these documents properly to avoid any delays in the application process.

05

Complete the application: Fill out the mortgage application form accurately and completely. Provide all requested information truthfully and ensure that all fields are properly filled.

06

Submit your application: Once you have completed the application form and gathered all necessary documents, submit them to the lender or mortgage broker. You may be required to pay an application fee at this stage.

07

Await approval and review terms: The lender will review your application and assess your eligibility. If approved, carefully review the terms and conditions of the mortgage, including interest rates, repayment options, and any associated fees.

08

Seek legal advice: Consider consulting with a real estate lawyer to review the mortgage agreement before proceeding. They can provide insights and ensure that your rights are protected.

09

Sign the mortgage agreement: If you are satisfied with the terms, sign the mortgage agreement as instructed by your lender. Make sure to understand all the obligations and responsibilities outlined in the document.

10

Receive funds and utilize accordingly: Upon completion of all necessary paperwork, the lender will provide you with the approved funds. Use these funds as intended, such as paying off existing debts, renovating your property, or any other planned purpose.

Who needs a 55 mortgage retirement mortgage:

01

Seniors looking to supplement their retirement income: A 55 mortgage retirement mortgage can provide additional funds for retirees who wish to enhance their quality of life, travel, or cover other expenses during their golden years.

02

Homeowners seeking to unlock home equity: If you have substantial equity in your home and would like to access those funds, a 55 mortgage retirement mortgage could be a suitable option. This allows you to tap into the value of your property without selling it.

03

Individuals without other retirement income sources: For those who lack pension or significant savings, a 55 mortgage retirement mortgage can provide a steady stream of income in retirement. However, it is essential to carefully consider the long-term financial implications before committing to this option.

04

Homeowners looking to downsize or relocate: If you are considering downsizing or moving to a new location during retirement, a 55 mortgage retirement mortgage can facilitate the process by providing funds for the new property purchase.

Note: It is always advisable to consult with a financial professional and assess your unique circumstances before making any financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 55 mortgage retirement mortgage in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 55 mortgage retirement mortgage, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit 55 mortgage retirement mortgage on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 55 mortgage retirement mortgage.

How do I fill out 55 mortgage retirement mortgage using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign 55 mortgage retirement mortgage. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is 55 mortgage retirement mortgage?

A 55 mortgage retirement mortgage is a type of loan designed specifically for individuals aged 55 and older who wish to use their home equity to supplement their retirement income.

Who is required to file 55 mortgage retirement mortgage?

Individuals aged 55 and older who are seeking to take out a mortgage or loan against their home equity for retirement purposes are required to file a 55 mortgage retirement mortgage.

How to fill out 55 mortgage retirement mortgage?

To fill out a 55 mortgage retirement mortgage, individuals need to provide detailed information about themselves, their financial situation, their property, and their retirement plans.

What is the purpose of 55 mortgage retirement mortgage?

The purpose of a 55 mortgage retirement mortgage is to help retirees access the equity in their homes to support their retirement lifestyle or cover unexpected expenses.

What information must be reported on 55 mortgage retirement mortgage?

Information such as personal details, financial assets, property value, income sources, retirement plans, and loan amount requested must be reported on a 55 mortgage retirement mortgage.

Fill out your 55 mortgage retirement mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

55 Mortgage Retirement Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.