Get the free Mortgage Hazard Insurance Application - bKenBancb

Show details

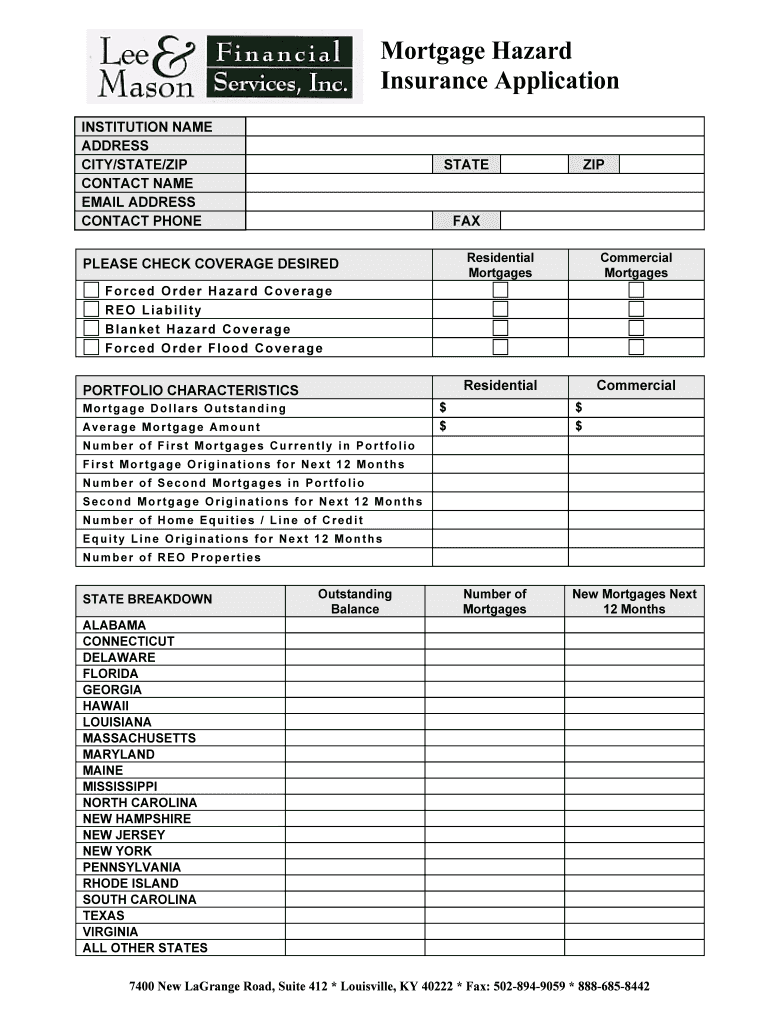

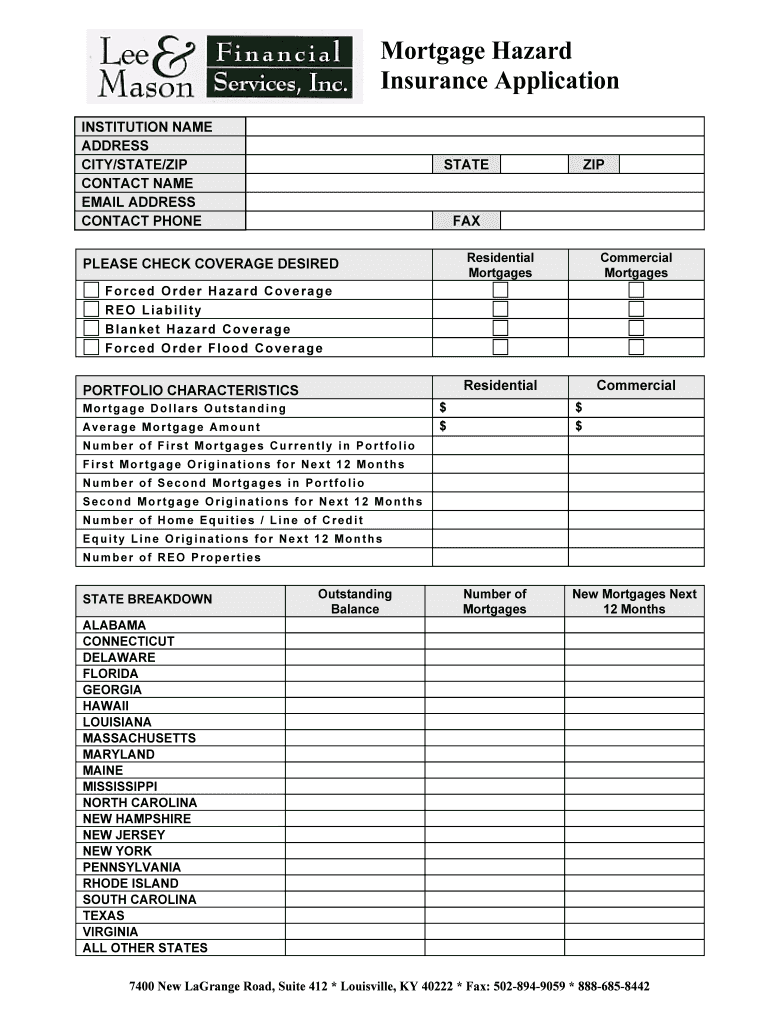

Mortgage Hazard Insurance Application INSTITUTION NAME ADDRESS CITY/STATE/ZIP CONTACT NAME EMAIL ADDRESS CONTACT PHONE STATE ZIP FAX PLEASE CHECK COVERAGE DESIRED Residential Mortgages Commercial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage hazard insurance application

Edit your mortgage hazard insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage hazard insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage hazard insurance application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage hazard insurance application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage hazard insurance application

How to fill out a mortgage hazard insurance application:

Gather necessary information:

01

Basic personal details: Your full name, current address, contact information.

02

Property details: Address of the property you are seeking insurance for.

03

Loan information: Mortgage lender's name, loan number, and the amount of coverage required.

Provide property details:

01

Supply accurate details about the property to be insured, including its address, type of construction, year built, square footage, and number of units (if applicable).

02

Include any additional features or upgrades that can affect the insurance coverage, such as swimming pools, fire sprinkler systems, or security alarms.

Information about the mortgage:

01

Enter your mortgage lender's name, loan number, and the amount of coverage required by the lender.

02

Specify whether you want replacement cost coverage for your home or just the actual cash value.

Declare previous claims:

01

Disclose any past insurance claims you have made for property damage or loss.

02

Provide details about the claims, such as the date, type of loss, and the amount paid out.

Evaluate other coverages:

01

Consider additional coverage options, such as personal liability, sewer backup, or earthquake insurance.

02

Determine the coverage limits and deductibles you want for these additional coverages.

Choose your insurance provider:

01

Research different insurance companies and compare their rates, coverage options, and customer reviews.

02

Once you have selected an insurance provider, provide their name, contact information, and policy number (if applicable).

Who needs mortgage hazard insurance application?

01

Homeowners with a mortgage: Anyone who has taken out a mortgage loan to finance their home requires mortgage hazard insurance. Lenders typically require borrowers to maintain this insurance to protect their investment in the property.

02

Condo or coop owners: Individuals who own a condominium or cooperative unit are often required by their association to have hazard insurance for their unit. The application may differ slightly for condo or coop owners as it might include additional coverage for common areas.

03

Landlords or real estate investors: Property owners who rent out their homes or own multiple properties may need mortgage hazard insurance. This coverage can protect against potential property damage caused by tenants or other hazards.

04

Property buyers: If you are in the process of purchasing a home and have not yet closed on the mortgage, your lender may require you to provide proof of insurance coverage before finalizing the loan.

Remember, specific requirements and application processes can vary depending on the lender, insurance provider, and the location of the property. It is always recommended to consult with your lender or insurance agent to ensure you fill out the application correctly and adequately fulfill your insurance obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage hazard insurance application for eSignature?

When you're ready to share your mortgage hazard insurance application, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the mortgage hazard insurance application electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your mortgage hazard insurance application in minutes.

How do I edit mortgage hazard insurance application straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing mortgage hazard insurance application.

What is mortgage hazard insurance application?

Mortgage hazard insurance application is a form that homeowners fill out to apply for insurance coverage that protects their property against hazards such as fire, wind, and vandalism.

Who is required to file mortgage hazard insurance application?

Homeowners who have a mortgage on their property are typically required by their lender to have hazard insurance and therefore must file a mortgage hazard insurance application.

How to fill out mortgage hazard insurance application?

To fill out a mortgage hazard insurance application, homeowners need to provide information about their property, including its value, location, and any previous insurance coverage.

What is the purpose of mortgage hazard insurance application?

The purpose of a mortgage hazard insurance application is to ensure that the property is adequately insured against hazards that could damage or destroy it.

What information must be reported on mortgage hazard insurance application?

Information such as the property's address, value, construction materials, previous insurance coverage, and any additional endorsements or coverage options must be reported on a mortgage hazard insurance application.

Fill out your mortgage hazard insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Hazard Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.