Get the free EPF - publications environment-agency gov

Show details

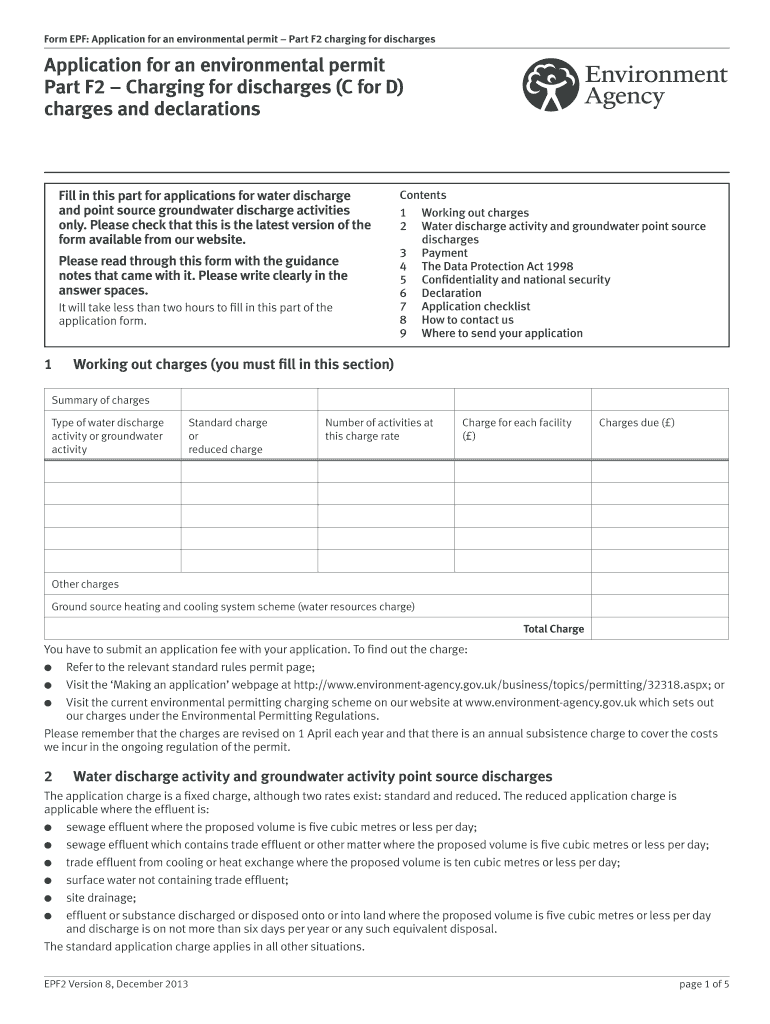

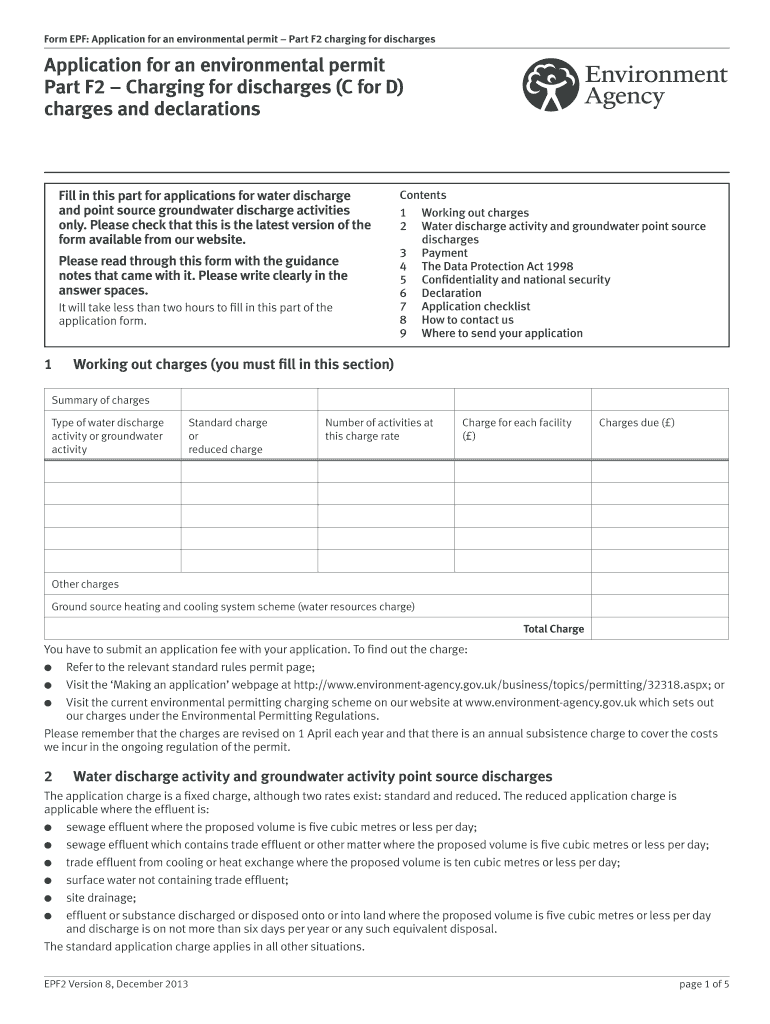

This document is an application form for an environmental permit focusing on charges related to water discharge and point source groundwater discharge activities. It outlines the necessary information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign epf - publications environment-agency

Edit your epf - publications environment-agency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your epf - publications environment-agency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing epf - publications environment-agency online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit epf - publications environment-agency. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out epf - publications environment-agency

How to fill out EPF

01

Gather required documents such as Aadhaar number, PAN card, and bank account details.

02

Access the EPF (Employees' Provident Fund) online portal or visit the nearest EPF office.

03

Fill out the EPF withdrawal form or application form carefully, ensuring all information is accurate.

04

Include necessary details like your EPF account number and the reason for withdrawal.

05

Submit the completed form along with copies of the required documents.

06

Receive confirmation of your application and track its status online or through the EPF office.

Who needs EPF?

01

Employees working in organizations that are covered under the Employees' Provident Fund Scheme.

02

Individuals seeking to withdraw their EPF savings due to retirement, job change, or financial emergencies.

03

Employers who have registered their establishments under the EPF Act.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between ETF and EPF?

While in the Employees' Provident Fund (EPF), both the employer and the employee make their contributions, the ETF only requires the employer to contribute.

What does EPF stand for in school?

Employees' Provident Fund. The Employees' Provident Fund (EPF) was established under the EPF Act, No. 15 of 1958 and is currently the largest Social Security Scheme in Sri Lanka.

What does EPF mean?

The Employees' Provident Fund (EPF) is a retirement savings scheme available to all salaried employees in India. Administered by the Employees' Provident Fund Organisation (EPFO), a statutory body under the Ministry of Labour and Employment, the scheme ensures financial security through employer-employee contributions.

What does EPF stand for in finance?

EPF wages are defined as any compensation that an employer provides to their employees in addition to basic salary, including allowances, bonuses, gratuity, commissions, or other monetary rewards.

What is an example of EPF?

Calculation of EPF Interest For example, if an employee's basic salary + dearness allowance is Rs. 50,000: Employee contribution to EPF (12% of Rs. 50,000): Rs. 6,000. Employer contribution to EPS (8.33% of Rs. 15,000): Rs. 1,250. Employer contribution to EPF (6,000 - 1,250): Rs. 4,750.

What is the English meaning of EPF?

Employees' Provident Fund Organisation.

What does EPF stand for?

About Us. The Employees Provident Fund (EPF) is one of the world's oldest provident funds, established in 1951 to safeguard the retirement future of the Malaysian workforce.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is EPF?

EPF stands for Employee Provident Fund, a government-managed retirement savings scheme for employees in many countries.

Who is required to file EPF?

Employees and employers who are required to make contributions towards the Employee Provident Fund as per the relevant labor laws must file EPF.

How to fill out EPF?

To fill out EPF, you typically need to provide personal details, employment information, and contribution amounts through the designated EPF portal or forms provided by the governing body.

What is the purpose of EPF?

The purpose of EPF is to provide financial security and savings for employees after retirement, enabling them to maintain their standard of living.

What information must be reported on EPF?

Information that must be reported on EPF includes employee details, employer details, contribution amounts, and any withdrawals or loans taken against the EPF account.

Fill out your epf - publications environment-agency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Epf - Publications Environment-Agency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.