Get the free Tax Lots - Tom Green County Government

Show details

RESOLUTION AUTHORIZING TAX RESALE OF THE COUNTY COMMISSIONERS OF TOM GREEN COUNTY Date: 0//1.(20/ 'j Buyer: MIGUEL DURAN, SINGLE PERSON 1110 ASHFORD SAN ANGELO, TOM GREEN COUNTY, TEXAS 76903 Property:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax lots - tom

Edit your tax lots - tom form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax lots - tom form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax lots - tom online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax lots - tom. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax lots - tom

How to fill out tax lots - Tom:

01

Start by gathering all necessary financial documents such as statements from financial institutions, investment records, and transaction statements.

02

Organize these documents in an orderly manner, grouping them by year or type of investment.

03

Begin by calculating the cost basis for each tax lot – which is the original purchase price of a security plus any additional costs or fees associated with the purchase.

04

Enter the relevant information, such as the description and quantity of each security, the purchase date, and the cost basis, into a tax lot tracking software or spreadsheet.

05

Keep track of any adjustments or changes to the tax lots throughout the year, such as stock splits, dividends, or reinvestments.

06

Calculate the capital gains or losses for each tax lot by subtracting the cost basis from the selling price or current market value.

07

Use the calculated capital gains or losses to determine your tax liability and complete the appropriate tax forms, such as Schedule D.

08

Double-check all the entered information, perform any necessary reconciliations, and ensure accuracy before submitting your tax return.

Who needs tax lots - Tom?

01

Individual investors who have bought and sold securities throughout the year need tax lots to accurately calculate their capital gains or losses.

02

Traders or active investors who frequently engage in multiple transactions benefit from keeping track of tax lots to determine their taxable income.

03

Taxpayers who receive dividends or reinvest in securities should maintain tax lots to accurately report their earnings and determine any tax obligations.

04

Investors looking to review and analyze their investment performance may find tax lots helpful in understanding their portfolio's returns and making informed investment decisions.

05

Financial advisors or accountants responsible for managing their clients' tax obligations would require tax lots to accurately prepare and file their clients' tax returns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax lots - tom in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your tax lots - tom and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute tax lots - tom online?

pdfFiller has made it easy to fill out and sign tax lots - tom. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit tax lots - tom on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign tax lots - tom. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is tax lots - tom?

Tax lots refer to the different units or parcels of stocks or securities that an individual investor owns.

Who is required to file tax lots - tom?

Individual investors who buy and sell stocks or securities are required to file tax lots.

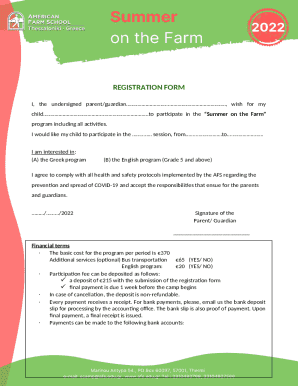

How to fill out tax lots - tom?

Tax lots can be filled out by documenting the purchase date, cost basis, sale date, and sale price of each unit or parcel of stock or security.

What is the purpose of tax lots - tom?

The purpose of tax lots is to accurately report capital gains or losses from the buying and selling of stocks or securities.

What information must be reported on tax lots - tom?

The information that must be reported on tax lots includes purchase date, cost basis, sale date, and sale price of each unit or parcel of stock or security.

Fill out your tax lots - tom online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Lots - Tom is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.