Get the free APPLICATION FOR REAL PROPERTY TAX RELIEF FOR VETERANS WITH 100% SERVICE-CONNECTED DI...

Show details

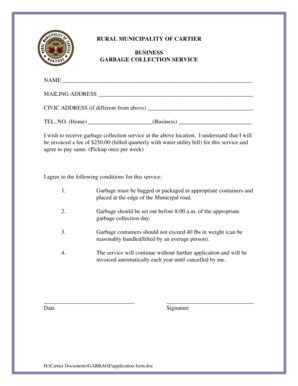

This document is an application form for veterans with a 100% service-connected disability seeking real property tax relief. It includes qualifications, required documentation, and sections for applicant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for real property

Edit your application for real property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for real property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for real property online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for real property. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for real property

How to fill out APPLICATION FOR REAL PROPERTY TAX RELIEF FOR VETERANS WITH 100% SERVICE-CONNECTED DISABILITY

01

Obtain the APPLICATION FOR REAL PROPERTY TAX RELIEF FOR VETERANS WITH 100% SERVICE-CONNECTED DISABILITY form from your local tax office or website.

02

Fill out the personal information section, including your name, address, and contact information.

03

Provide your military service details, including branch of service, dates of service, and verification of 100% service-connected disability.

04

Include documentation proving your disability status, such as a VA letter or disability rating certificate.

05

List the property for which you are seeking tax relief, including address and parcel number.

06

Sign and date the application to certify that all information provided is accurate to the best of your knowledge.

07

Submit the completed application to your local tax authority by the designated deadline, either in person or via mail.

Who needs APPLICATION FOR REAL PROPERTY TAX RELIEF FOR VETERANS WITH 100% SERVICE-CONNECTED DISABILITY?

01

Veterans who have a 100% service-connected disability rating from the Department of Veterans Affairs.

02

Surviving spouses of eligible veterans who may qualify for tax relief benefits.

Fill

form

: Try Risk Free

People Also Ask about

What does Arkansas offer 100 disabled veterans?

Who qualifies for the home exemptions? You are entitled to the home exemption if: You own and occupy the property as your principal home "real property owned and occupied as the owner's principal home") means occupancy of a home in the city with the intent to reside in the city.

Who qualifies for property tax reduction in Idaho?

Utah Disabled Veteran and Survivors Property Tax Exemption: Utah offers a property tax exemption of up to $521,620 of the taxable value of the residence or personal property of disabled Veterans. Veterans must have a 10% or greater service-connected disability to be eligible.

Do 100% disabled veterans pay sales tax on vehicles in Arkansas?

Arkansas is an ideal State for Retiring and Transitioning Military. Tax Benefits: Military Retired Pay is exempt from state income tax, and some veterans are eligible for Homestead and Personal Property Tax Exemption, as well as Gross Receipt of Tax Exemption. Find out more here. A great place to start a second career.

How do I qualify for property tax exemption in Hawaii?

Who qualifies. You might qualify for a property tax reduction if all of these are true: You're an Idaho resident. You own and occupy your home or mobile home, and the value doesn't exceed a limit set by law that will be calculated in June.

Do 100% disabled veterans pay property taxes in Arkansas?

VA Health Care Services As a 100% disabled veteran, you receive: No-cost healthcare and prescription medications for qualifying disabilities. Comprehensive medical services including primary care, specialty care, and emergency care. Free dental care (a benefit not available to most other veterans)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR REAL PROPERTY TAX RELIEF FOR VETERANS WITH 100% SERVICE-CONNECTED DISABILITY?

It is a formal request that allows eligible veterans with a 100% service-connected disability to receive exemptions or reductions on property taxes for their primary residence.

Who is required to file APPLICATION FOR REAL PROPERTY TAX RELIEF FOR VETERANS WITH 100% SERVICE-CONNECTED DISABILITY?

Veterans who have been awarded a 100% service-connected disability rating by the Department of Veterans Affairs are required to file this application to receive tax relief.

How to fill out APPLICATION FOR REAL PROPERTY TAX RELIEF FOR VETERANS WITH 100% SERVICE-CONNECTED DISABILITY?

To fill out the application, veterans need to provide their personal information, details of their service-connected disability, and proof of eligibility, such as a copy of their disability award letter.

What is the purpose of APPLICATION FOR REAL PROPERTY TAX RELIEF FOR VETERANS WITH 100% SERVICE-CONNECTED DISABILITY?

The purpose is to provide financial assistance to disabled veterans by reducing their property tax burden, thereby helping them maintain their homes and improve their quality of life.

What information must be reported on APPLICATION FOR REAL PROPERTY TAX RELIEF FOR VETERANS WITH 100% SERVICE-CONNECTED DISABILITY?

The application must report the veteran's name, address, social security number, details about the service-connected disability, and any documentation from the Department of Veterans Affairs verifying the disability rating.

Fill out your application for real property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Real Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.