Get the free New Mexico DOL 903 Export PR-1128

Show details

Este documento proporciona instrucciones y detalles sobre la solución extendida que permite crear un archivo de exportación para informes trimestrales al Departamento de Trabajo del Estado de Nuevo

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new mexico dol 903

Edit your new mexico dol 903 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new mexico dol 903 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new mexico dol 903 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new mexico dol 903. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new mexico dol 903

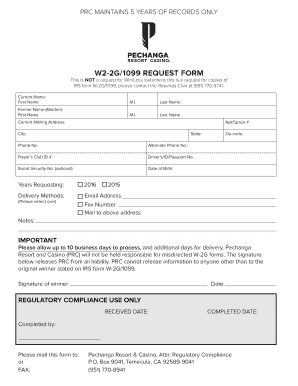

How to fill out New Mexico DOL 903 Export PR-1128

01

Obtain the New Mexico DOL 903 Export PR-1128 form from the New Mexico Department of Labor website or your local office.

02

Fill in the 'Employer Information' section, including your business name, address, and contact details.

03

Provide the 'Employee Information' by entering the employee's name, Social Security number, and job title.

04

In the 'Wage Information' section, input the employee's wage rate, hours worked, and any deductions that apply.

05

Complete the 'Reason for Export' section by explaining why the employee is being exported.

06

Review the entire form for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the completed form to the appropriate New Mexico DOL office either in person or by mail.

Who needs New Mexico DOL 903 Export PR-1128?

01

Employers in New Mexico who are exporting employees to work in another state or country.

02

Businesses that require documentation for employees working temporarily out of state.

Fill

form

: Try Risk Free

People Also Ask about

What is ES 903A?

An employer who files Form ES-903A, Quarterly Wage and Contribution Report, to the New Mexico Department of Workforce Solutions, or Form TRD-31109, Quarterly Wage, Income, Withholding and Workers' Compensation Fee Report to TRD, is not required to submit Forms W-2 to TRD.

What is New Mexico's exports?

In July 2025, the top exports of New Mexico were Integrated Circuits ($597M), Office Machine Parts ($383M), Blank Audio Media ($101M), Telephones ($28.5M), and Computers ($24.1M). New Mexico exports mostly to Mexico ($646M), Malaysia ($291M), China ($262M), Vietnam ($56.5M), and Canada ($15.5M).

What is New Mexico's export?

In 2024, New Mexico exported $12B, making it the 34th largest exporter out of the 54 states in United States. The top exports of New Mexico were Office Machine Parts ($4.29B), Integrated Circuits ($3.43B), Blank Audio Media ($971M), Telephones ($368M), and Semiconductor Devices ($238M).

What is New Mexico's biggest industry?

Mining, gas and oil extraction, and quarrying are the largest contributors to the growth of real GDP in New Mexico. The federal government employs about 29,500 people, while the private sector employs about 650,000.

What is the main source of income in New Mexico?

Oil and gas production, tourism, and federal government spending are important drivers of New Mexico's economy.

What is Mexico's main export?

Among Mexico's major exports are machinery and transport equipment, steel, electrical equipment, chemicals, food products, and petroleum and petroleum products. About four-fifths of Mexico's petroleum is exported to the United States, which relies heavily on Mexico as one of its principal sources of oil.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New Mexico DOL 903 Export PR-1128?

New Mexico DOL 903 Export PR-1128 is a form used for reporting employment information related to wages and hours worked for employees in New Mexico, particularly those employed in export-related activities.

Who is required to file New Mexico DOL 903 Export PR-1128?

Employers in New Mexico who have workers engaged in export activities are required to file the New Mexico DOL 903 Export PR-1128.

How to fill out New Mexico DOL 903 Export PR-1128?

To fill out the New Mexico DOL 903 Export PR-1128, employers must enter details such as employee identification, hours worked, wages, and any applicable deductions. It is crucial to follow the instructions provided on the form closely.

What is the purpose of New Mexico DOL 903 Export PR-1128?

The purpose of the New Mexico DOL 903 Export PR-1128 is to ensure compliance with state labor laws by accurately reporting employment data related to export activities, which helps in tracking workforce statistics and ensuring fair labor practices.

What information must be reported on New Mexico DOL 903 Export PR-1128?

The information that must be reported on the New Mexico DOL 903 Export PR-1128 includes employee names, Social Security numbers, total hours worked, total wages paid, and any other relevant employment data specified by the form's instructions.

Fill out your new mexico dol 903 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Mexico Dol 903 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.