80TRF 2013-2026 free printable template

Show details

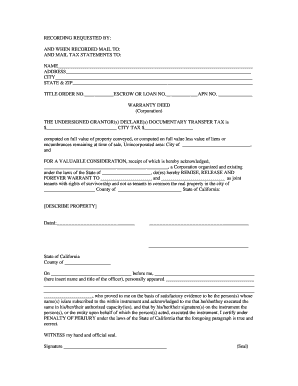

Reset Form Trust certification Please print in all CAPITAL LETTERS and use black ink. Please use this form to certify who is authorized to act on behalf of your Trust account or to change Trust/Trustee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 80TRF

Edit your 80TRF form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 80TRF form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 80TRF online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 80TRF. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 80TRF

How to fill out 80TRF

01

Obtain the 80TRF form from the relevant authority or website.

02

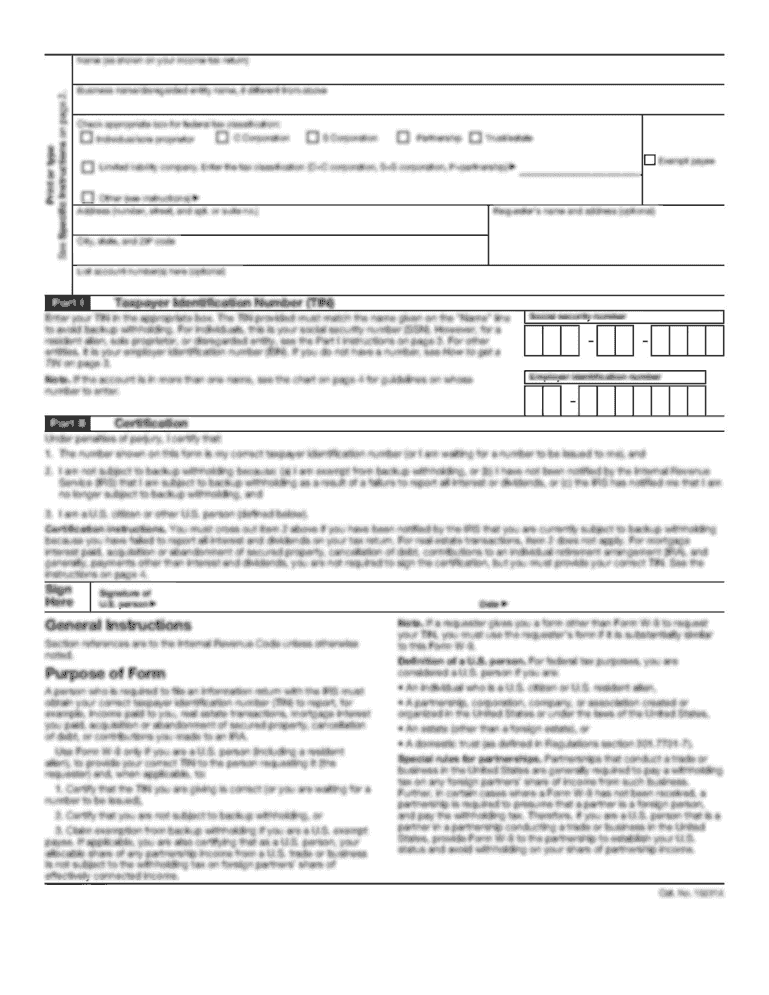

Fill out your personal information at the top of the form, including your name and contact details.

03

Enter the specific details required for the test or certification you are applying for.

04

Review the instructions carefully to ensure all required fields are filled out accurately.

05

Attach any necessary documentation or identification as specified.

06

Sign and date the form at the required section.

07

Submit the completed 80TRF form through the designated submission method (online or by mail).

08

Keep a copy of the filled-out form for your records.

Who needs 80TRF?

01

Individuals applying for specific tests or certifications that require the 80TRF form.

02

Students seeking to prove their qualifications to educational institutions.

03

Professionals needing to validate their skills or training for job opportunities.

Fill

form

: Try Risk Free

People Also Ask about

What is form 1041 used for?

Use Schedule D (Form 1041) to report gains and losses from the sale or exchange of capital assets by an estate or trust.

Is form 1041 A required?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts.

Do I have to file a 1041 for a trust with no income?

A: Trusts must file a Form 1041, U.S. Income Tax Return for Estates and Trusts, for each taxable year where the trust has $600 in income or the trust has a non-resident alien as a beneficiary.

Who is required to file 1041 A?

Use Form 1041-A to report the charitable information required by section 6034 and the related regulations. The trustee must file Form 1041-A for a trust that claims a charitable or other deduction under section 642(c) unless an exception applies. Electing small business trusts (ESBTs) described in section 641(c).

Who must file 1041 A?

Use Form 1041-A to report the charitable information required by section 6034 and the related regulations. The trustee must file Form 1041-A for a trust that claims a charitable or other deduction under section 642(c) unless an exception applies.

Is 1041 required if no income?

Form 1041 is not needed if there is less than $600 of gross income, there is no taxable income and there aren't any nonresident alien beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 80TRF online?

Easy online 80TRF completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the 80TRF in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your 80TRF and you'll be done in minutes.

How do I fill out 80TRF on an Android device?

Use the pdfFiller mobile app and complete your 80TRF and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is 80TRF?

80TRF is a form used in India for reporting transactions involving transfer of capital assets in certain categories, primarily for tax purposes.

Who is required to file 80TRF?

Individuals and entities that engage in specified transactions involving capital assets, which require disclosure for tax compliance, are mandated to file 80TRF.

How to fill out 80TRF?

To fill out 80TRF, taxpayers must provide details of the transactions, including the nature of the asset, valuation, and any relevant tax information, following the prescribed format.

What is the purpose of 80TRF?

The purpose of 80TRF is to ensure transparency in the transfer of capital assets and to aid tax authorities in monitoring compliance with tax regulations.

What information must be reported on 80TRF?

Information that must be reported on 80TRF includes the details of the transaction, valuation of transferred assets, parties involved, and any taxes paid or relevant exemptions.

Fill out your 80TRF online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

80trf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.