Get the free NOTICE OF REAL PROPERTY TAX SALE

Show details

This document provides notice of a tax sale for delinquent properties in Jackson County, Indiana, detailing the process, requirements for bidding, and information about properties up for sale due

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of real property

Edit your notice of real property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of real property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notice of real property online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit notice of real property. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of real property

How to fill out NOTICE OF REAL PROPERTY TAX SALE

01

Obtain the NOTICE OF REAL PROPERTY TAX SALE form from your local tax office or website.

02

Fill in the property owner’s name and address accurately.

03

Provide the property's legal description, including the parcel number.

04

Enter the date of the sale and the auction location.

05

Specify the minimum bid amount for the property.

06

Include details about any existing liens or encumbrances on the property.

07

Sign and date the form to validate your submission.

08

Submit the completed form to the appropriate tax authority before the deadline.

Who needs NOTICE OF REAL PROPERTY TAX SALE?

01

Property owners who are behind on tax payments.

02

Local tax authorities responsible for collecting property taxes.

03

Investors interested in purchasing properties at tax sales.

04

Real estate professionals assisting clients in tax sale transactions.

Fill

form

: Try Risk Free

People Also Ask about

How long can you be delinquent on property taxes in Arkansas?

(1) (A) All lands upon which the taxes have not been paid for one (1) year following the date the taxes were due, October 15, shall be forfeited to the state and transmitted by certification to the Commissioner of State Lands for collection or sale.

What is the downside of buying tax liens?

You can purchase tax lien certificates at public auctions and may be rewarded with interest payments as property owners repay the debt over time. Tax lien investments can be risky, as some homeowners may be unable to repay their debts or file for bankruptcy.

What happens if your property is sold at a tax sale?

After a tax lien sale, you still own the home because the purchaser only buys a lien against your property. If you pay off the amount of the lien or the purchase price (depending on the situation), plus allowed costs, like interest, within a specified time, you get to keep the home.

What is a property tax notice?

Every year, you receive an assessment notice indicating changes in the assessed value and the taxable value of your property. The assessed value represents 50% of the estimated market value of your property and the taxable value indicates how much of that value you will pay taxes on.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

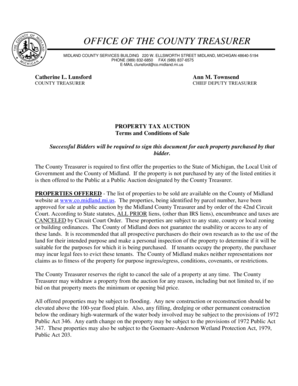

What is NOTICE OF REAL PROPERTY TAX SALE?

A NOTICE OF REAL PROPERTY TAX SALE is a legal document that announces the sale of a property due to unpaid property taxes. It typically provides details about the property, the amount owed, and the date of the sale.

Who is required to file NOTICE OF REAL PROPERTY TAX SALE?

Local government authorities or tax assessors are typically required to file a NOTICE OF REAL PROPERTY TAX SALE when properties are at risk of being sold due to delinquent taxes.

How to fill out NOTICE OF REAL PROPERTY TAX SALE?

To fill out a NOTICE OF REAL PROPERTY TAX SALE, one must include information such as the property owner's name, property description, the amount of taxes owed, and details about the sale date and auction process.

What is the purpose of NOTICE OF REAL PROPERTY TAX SALE?

The purpose of a NOTICE OF REAL PROPERTY TAX SALE is to inform the public and the property owner about an impending sale of the property due to unpaid taxes, thereby providing an opportunity for the owner to pay the owed amount and reclaim the property.

What information must be reported on NOTICE OF REAL PROPERTY TAX SALE?

The information that must be reported on a NOTICE OF REAL PROPERTY TAX SALE includes the property owner's details, a detailed description of the property, the total amount of property taxes owed, penalties, the date of the sale, and the procedures for participating in the sale.

Fill out your notice of real property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Real Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.