Get the free Tax-Deferred Retirement Account Reoccurring Distribution Form - pensionfund

Show details

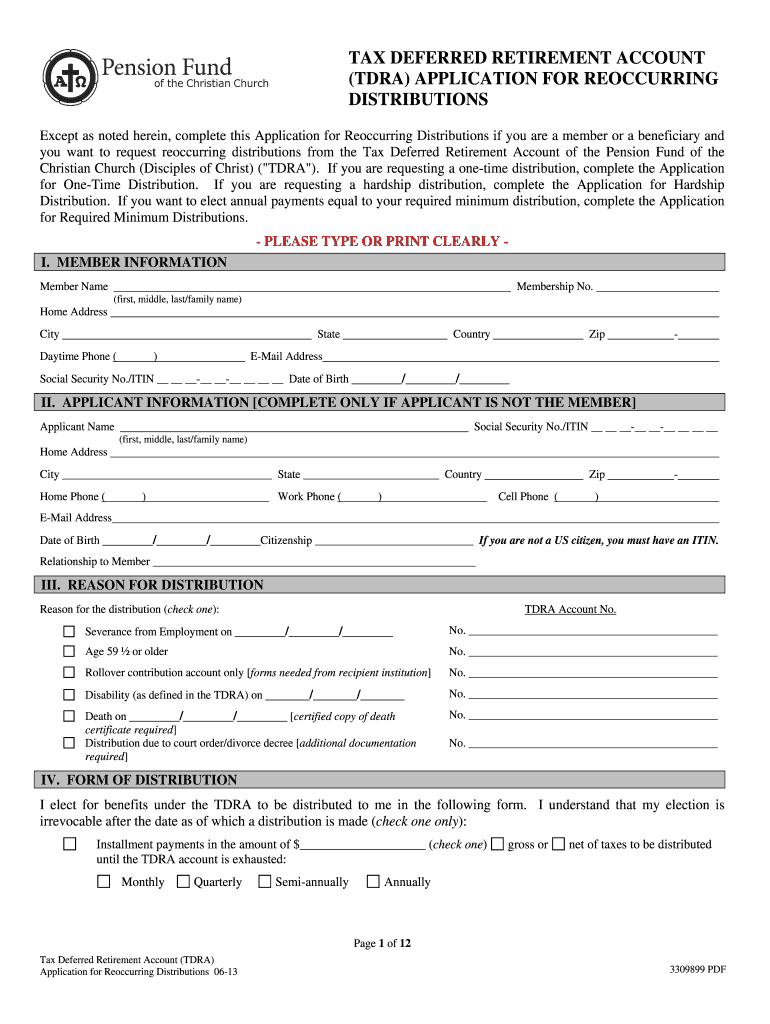

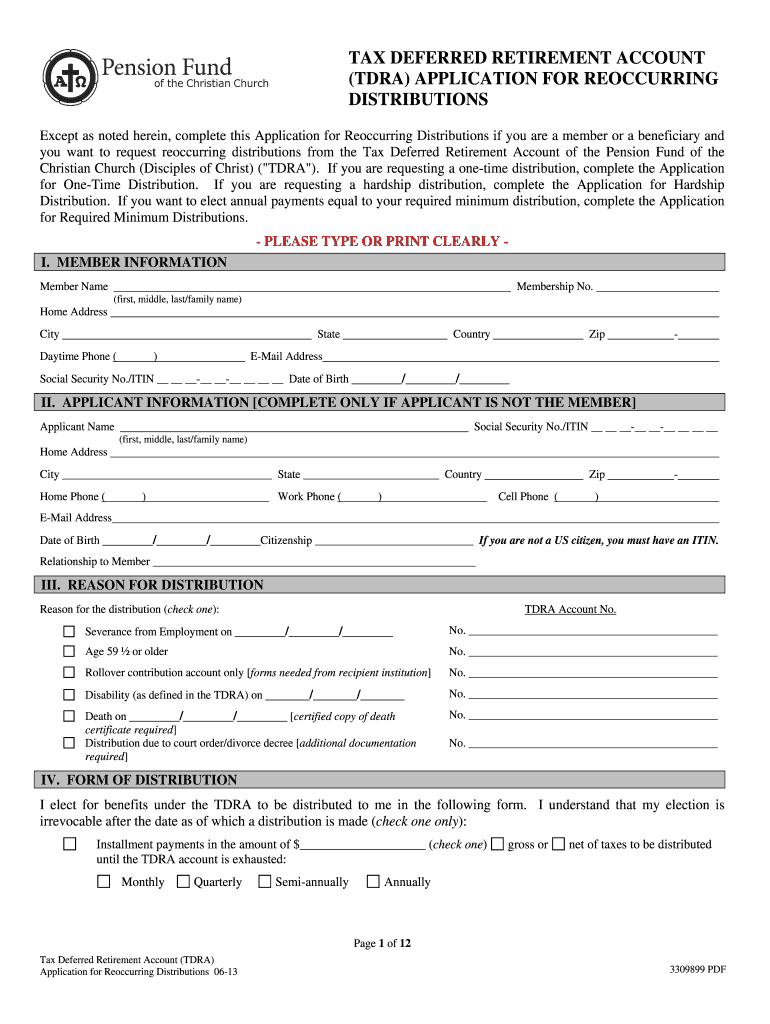

TAX DEFERRED RETIREMENT ACCOUNT (TARA) APPLICATION FOR REOCCURRING DISTRIBUTIONS Except as noted herein, complete this Application for Reoccurring Distributions if you are a member or a beneficiary,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax-deferred retirement account reoccurring

Edit your tax-deferred retirement account reoccurring form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax-deferred retirement account reoccurring form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax-deferred retirement account reoccurring online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax-deferred retirement account reoccurring. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax-deferred retirement account reoccurring

How to Fill Out a Tax-Deferred Retirement Account Reoccurring:

01

Gather the necessary information: To fill out a tax-deferred retirement account reoccurring, you will need certain information including your personal details, social security number, employment information, and financial statements.

02

Determine your contribution limit: Before filling out the form, determine your contribution limit for the year. This will depend on factors such as your age, income, and type of retirement account. Check with your financial advisor or refer to the IRS guidelines to ensure you do not exceed the limit.

03

Choose the right form: Different retirement accounts have different forms to fill out. Determine whether you have a traditional IRA, 401(k), or another type of tax-deferred retirement account, and obtain the appropriate form for that account.

04

Fill out the personal information: The form will require you to provide your full name, address, social security number, and other personal details. Ensure that all the information is accurate and up to date.

05

Enter the contribution amount: Specify the amount that you want to contribute to your tax-deferred retirement account. Remember to stay within the contribution limits mentioned earlier. This amount may be deducted from your taxable income, providing potential tax benefits.

06

Review and sign the form: Carefully review all the information provided on the form to ensure it is accurate. Once you are satisfied, sign and date the form to validate your submission.

Who Needs a Tax-Deferred Retirement Account Reoccurring:

01

Individuals planning for retirement: A tax-deferred retirement account is suitable for individuals who want to save for their retirement while enjoying the advantage of tax-deferred contributions and potential tax-free growth.

02

Employees with 401(k) plans: Many companies offer 401(k) plans to their employees, allowing them to contribute a portion of their salary on a pre-tax basis. Employees who have access to a 401(k) plan can benefit from regular automatic contributions to their retirement account.

03

Self-employed individuals: Entrepreneurs and self-employed individuals often have the option to contribute to a tax-deferred retirement account, such as a Simplified Employee Pension (SEP) IRA or a solo 401(k). This allows them to save for retirement while potentially reducing their taxable income.

In conclusion, filling out a tax-deferred retirement account reoccurring involves gathering the necessary information, determining contribution limits, selecting the right form, providing accurate personal information, specifying the contribution amount, reviewing the form, and signing it. Such accounts are beneficial for individuals planning for retirement, employees with 401(k) plans, and self-employed individuals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax-deferred retirement account reoccurring in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your tax-deferred retirement account reoccurring and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make changes in tax-deferred retirement account reoccurring?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your tax-deferred retirement account reoccurring to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete tax-deferred retirement account reoccurring on an Android device?

Complete tax-deferred retirement account reoccurring and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is tax-deferred retirement account reoccurring?

A tax-deferred retirement account allows individuals to save money for retirement without immediately paying taxes on the contributions or their investment gains.

Who is required to file tax-deferred retirement account reoccurring?

Individuals who have a tax-deferred retirement account, such as a traditional IRA or 401(k), are required to file it on their tax returns.

How to fill out tax-deferred retirement account reoccurring?

To fill out a tax-deferred retirement account, individuals need to report the contributions made during the year, any distributions taken, and any investment gains or losses.

What is the purpose of tax-deferred retirement account reoccurring?

The purpose of a tax-deferred retirement account is to help individuals save for retirement by allowing them to defer paying taxes on the contributions and investment gains until they withdraw the funds in retirement.

What information must be reported on tax-deferred retirement account reoccurring?

Information such as contributions made, distributions taken, investment gains or losses, and any required minimum distributions must be reported on a tax-deferred retirement account.

Fill out your tax-deferred retirement account reoccurring online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax-Deferred Retirement Account Reoccurring is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.