Get the free 3 Insurance

Show details

Growth Hormone. Enrollment Form. 1 Patient Information. 2 Prescriber Information. 3 Insurance. 4 Diagnosis. 5 Lab Work & Clinical Notes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 3 insurance

Edit your 3 insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3 insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 3 insurance online

To use the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 3 insurance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 3 insurance

How to fill out 3 insurance:

01

Gather all relevant information: Start by collecting all the necessary details required for each insurance policy. This may include personal information, such as your name, address, contact details, and social security number. Additionally, you will need information about your assets or property you wish to insure, such as its value and any existing coverage.

02

Research different insurance providers: Take the time to explore various insurance providers and compare their coverage options, premiums, and customer reviews. Look for companies that offer the policies you need and have a good reputation for customer service.

03

Determine the types of insurance you require: Identify the specific insurance policies you need based on your circumstances. This may include auto insurance, home insurance, health insurance, life insurance, or any other relevant types. Evaluate your needs and prioritize the policies accordingly.

04

Fill out the application forms: Once you have chosen the insurance providers and policies, fill out the application forms accurately and thoroughly. Ensure that you provide all the required information and double-check for any errors or omissions. Be truthful and transparent in your answers to avoid potential issues during claims processing.

05

Pay the premiums: Insurance policies come with regular premium payments. Calculate the total amount and choose a convenient payment method. Make sure to pay the premiums on time to avoid any disruptions in coverage.

06

Review the policy documents: Carefully read through the policy documents provided by the insurance company. Understand the terms and conditions, coverage limits, deductibles, and any exclusions or special provisions. If you have any questions or concerns, reach out to the insurance provider for clarification.

07

Keep your documents organized: Once you have filled out the insurance forms and received the policy documents, keep them in a secure and easily accessible place. Create a system to organize your insurance documents, such as using folders or digital storage, ensuring they are readily available when needed.

Who needs 3 insurance:

01

Individuals with multiple assets: People who own multiple assets, such as a home, car, and business, may need three different insurance policies to adequately protect each asset. Having separate insurance coverage tailored to each asset's specific risks and needs can provide comprehensive protection.

02

Families with different insurance needs: In a household, various family members may require different types of insurance. For example, parents may need life insurance to secure their family's future, while auto insurance can protect the teenaged driver in the household. Having three insurance policies can address the unique needs of each family member.

03

Self-employed individuals: Entrepreneurs or self-employed individuals may benefit from having multiple insurance policies to mitigate risks associated with their business operations, personal health, and property. They may need liability insurance for their business, health insurance for themselves, and property insurance for their office or equipment.

In conclusion, filling out three insurance policies involves gathering information, researching providers, understanding your specific needs, completing application forms accurately, paying premiums, reviewing policy documents, and keeping everything organized. Individuals who own multiple assets, have diverse family insurance needs, or are self-employed are likely to benefit from having three separate insurance policies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit 3 insurance on an iOS device?

Create, modify, and share 3 insurance using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out 3 insurance on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 3 insurance by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit 3 insurance on an Android device?

You can edit, sign, and distribute 3 insurance on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

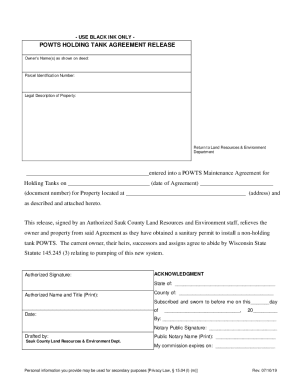

What is 3 insurance?

3 insurance refers to the form used to report information about third-party insurance coverage.

Who is required to file 3 insurance?

Third-party insurance providers are required to file 3 insurance.

How to fill out 3 insurance?

To fill out 3 insurance, providers must include information about the third-party insurance coverage they offer.

What is the purpose of 3 insurance?

The purpose of 3 insurance is to report information about third-party insurance coverage to the relevant authorities.

What information must be reported on 3 insurance?

Information such as the type of insurance coverage provided, coverage limits, and policy details must be reported on 3 insurance.

Fill out your 3 insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

3 Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.