Get the free gepco hcm

Fill out, sign, and share forms from a single PDF platform

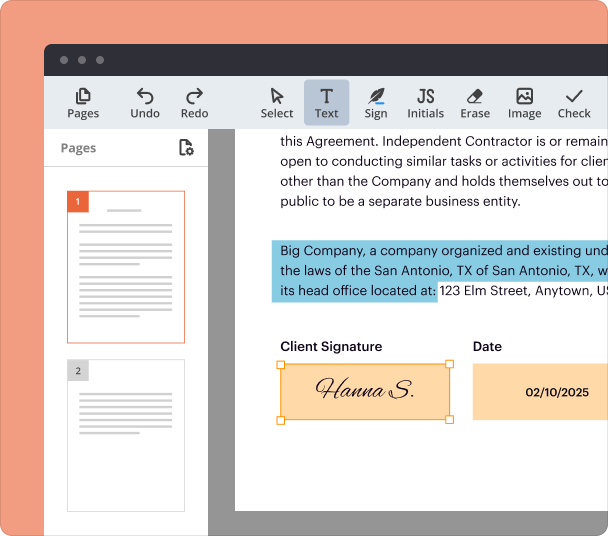

Edit and sign in one place

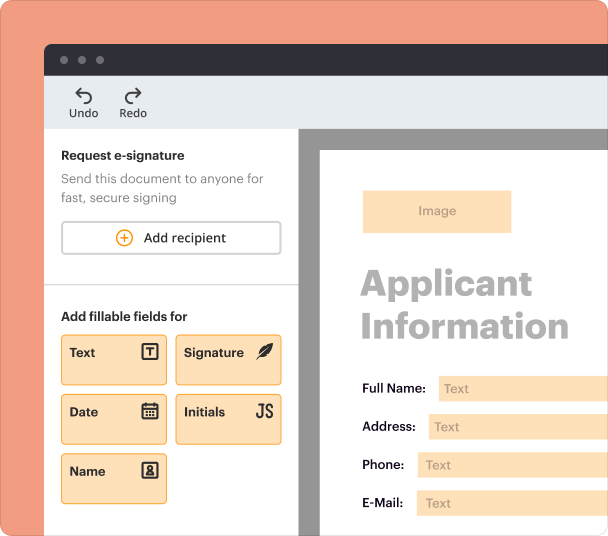

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

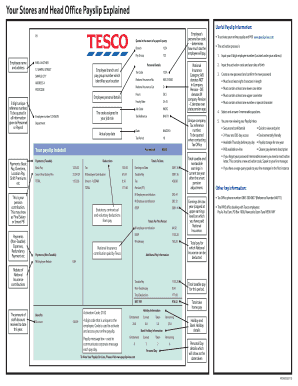

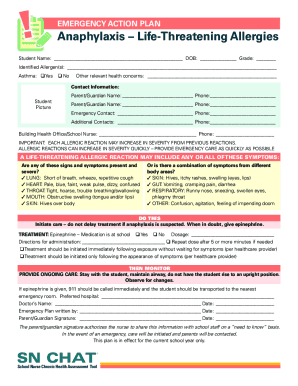

Understanding the gepco salary slip form

What is the gepco salary slip form

The gepco salary slip form is a document provided to employees of the Gujranwala Electric Power Company (GEPCO) that outlines their salary details for a specific pay period. This form includes essential information such as the employee's name, designation, gross and net pay, deductions, and allowances. It serves not only as a record of earnings but also as a crucial tool for employees managing their finances and verifying their income.

Key features of the gepco salary slip form

The gepco salary slip form includes several key features that support employee financial management. These features are designed for clarity and organization, making it easier for employees to understand their earnings and deductions.

-

This is the fundamental amount paid to the employee before any deductions.

-

This section details the amounts deducted for taxes, benefits, and any other obligatory payments.

-

The final amount an employee receives after all deductions have been applied.

-

Any additional monetary benefits awarded to the employee, such as transportation or housing allowances.

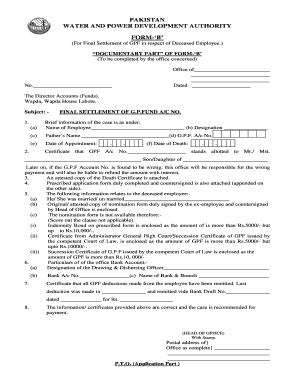

Required documents and information

To complete the gepco salary slip form accurately, certain documents and information are necessary. Collecting and organizing these documents beforehand can streamline the process:

-

A valid ID proof to verify the employee's identity.

-

Information regarding the bank account for direct deposit.

-

Necessary tax forms or documents related to deductions.

How to fill the gepco salary slip form

Filling out the gepco salary slip form requires attention to detail to ensure accuracy. Here is a step-by-step guide:

-

Begin by entering your personal details, including name, designation, and employee ID.

-

Fill in the basic salary and any allowances you receive.

-

List all deductions applicable to your salary for the pay period.

-

Calculate the net pay by subtracting the total deductions from the total earnings.

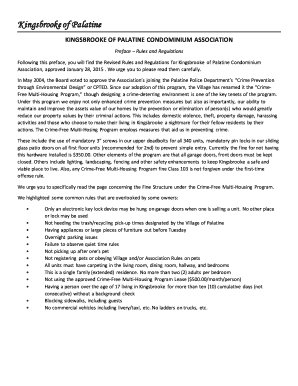

Common errors and troubleshooting

When completing the gepco salary slip form, errors can lead to confusion or financial discrepancies. Common mistakes include:

-

Ensure your name and ID are correctly spelled and match official records.

-

Double-check calculations to ensure accuracy in net pay.

-

Double-check that all required fields are filled before submission.

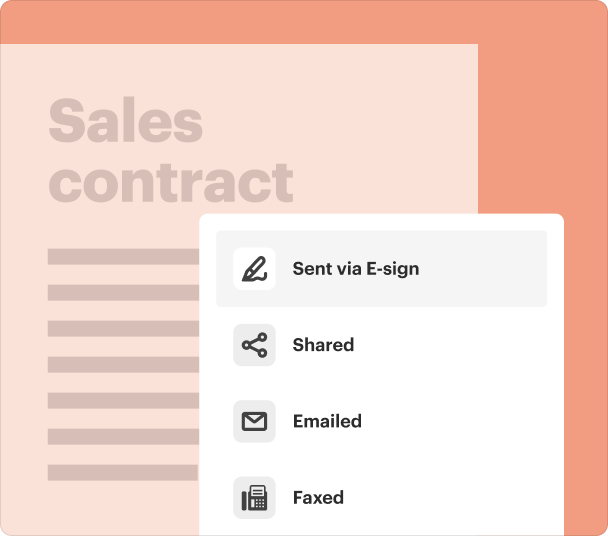

Submission methods and delivery

After completing the gepco salary slip form, there are various submission methods established to ensure timely processing. Employees should follow these steps:

-

Access the designated GEPCO online platform for digital submission.

-

Print out the completed form and submit it at the designated GEPCO office.

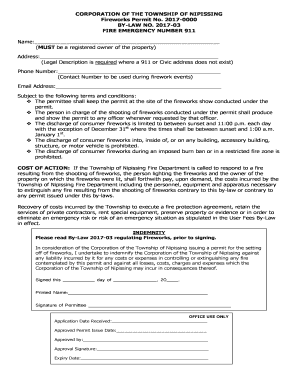

Frequently Asked Questions about gepco salary slip form

What is the purpose of the gepco salary slip form?

The purpose of the gepco salary slip form is to provide employees with a record of their earnings and deductions for each pay period, helping them manage their finances and verify income.

How often is the gepco salary slip form issued?

The gepco salary slip form is typically issued monthly, reflecting the employee's earnings for that specific month.

pdfFiller scores top ratings on review platforms