Get the free bir form 2550m sample

Show details

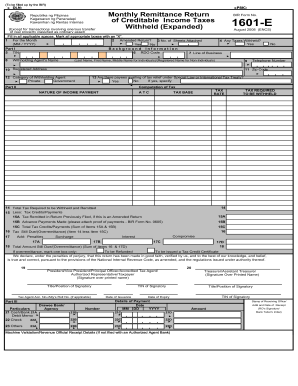

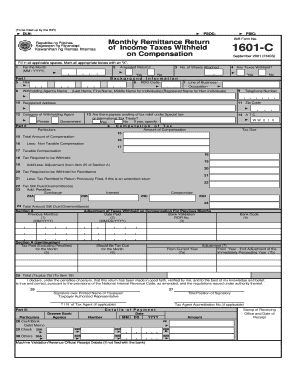

(To be filled up by the BIR) DAN: SIC: BIR Form No. Monthly Valuated Tax Hawaiian NG Rental Internal Declaration Republican NG Filipinas Catamaran NG Pananalapi Fill in all applicable spaces. Mark

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bir form 2550m sample

Edit your bir form 2550m sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 2550m sample form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bir form 2550m sample online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bir form 2550m sample. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bir form 2550m sample

How to fill out bir form 2550m sample:

01

Obtain a copy of bir form 2550m from the Bureau of Internal Revenue (BIR) or download it from their official website.

02

Fill in the required personal information at the top of the form, such as your name, taxpayer identification number (TIN), registered address, and contact details.

03

Provide the necessary details about your business, including the name of your company, your business registered address, and the nature of your business.

04

Indicate the applicable taxable period and the due dates for submitting the form.

05

Fill out the different sections of the form with accurate and complete information, such as gross sales/receipts for the month, taxable sales, exempt sales, and zero-rated sales.

06

Compute the correct amount of value-added tax (VAT) based on the information provided. Make sure to follow the prescribed tax rates and formulas.

07

If eligible, claim the appropriate input tax credits by providing the required supporting documents.

08

Double-check all the details and computations to ensure accuracy.

09

Sign and date the form at the designated spaces.

10

Attach all relevant supporting documents as required by the BIR.

11

Submit the completed form and supporting documents to the BIR within the specified deadline.

Who needs bir form 2550m sample:

01

Individuals or businesses that are engaged in the sale of goods or services and are registered for VAT purposes in the Philippines.

02

Taxpayers who reach the threshold for VAT registration, which is currently set at PHP 3,000,000 gross annual sales or receipts.

03

Entities that are mandated by the BIR to file VAT returns and comply with the corresponding tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is BIR Form 2550M?

The Monthly Value-Added Tax Declaration or BIR Form 2550m is used simply to file monthly VAT. Individuals who may get their hands on this form are those who are VAT-registered in selling or leasing goods or services. These individuals must have an actual gross sales/receipts exceeding up to P3,000,000.

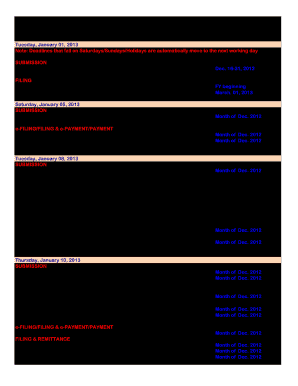

What is return period in BIR Form 2550M?

The returns must be filed not later than the 20th day following the close of the month. The returns must be filed with any Authorized Agent Bank (AAB) within the jurisdiction of the Revenue District Office where the taxpayer is required to register.

What is the difference between 2550M and 2550Q?

Thus, VAT-registered taxpayers are no longer required to file the Monthly VAT Declaration (BIR Form No. 2550M) for transactions starting January 1, 2023. Instead, they will file the corresponding Quarterly VAT Return (BIR Form No. 2550Q) within twenty-five (25) days following the close of each taxable quarter.

Is it required to file 2550M?

2550-M for the first two months of the quarter. Under the Tax Reform for Acceleration and Inclusion (TRAIN) Law, VAT registered taxpayers are no longer required to file the Monthly VAT Declaration (BIR Form 2550M) but will instead file the corresponding Quarterly VAT Return (BIR Form 2550Q).

How to generate 2550M?

STEP 1: From your portal, click on the Start Return button. STEP 2: Select Value-Added Tax Returns and hit Next. STEP 3: Choose 2550M, then click the Next button. STEP 4: Select the date of the transaction that you wish to generate the report for from the Year and Month drop-down buttons, then click Next.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bir form 2550m sample from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your bir form 2550m sample into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute bir form 2550m sample online?

Easy online bir form 2550m sample completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in bir form 2550m sample?

The editing procedure is simple with pdfFiller. Open your bir form 2550m sample in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is bir form 2550m sample?

BIR Form 2550M is a tax form used in the Philippines for the quarterly value-added tax (VAT) return. It is required to report sales, purchases, and tax liabilities.

Who is required to file bir form 2550m sample?

Businesses that are registered as VAT taxpayers in the Philippines must file BIR Form 2550M. This includes corporations, partnerships, and individuals engaged in trade or business.

How to fill out bir form 2550m sample?

To fill out BIR Form 2550M, taxpayers need to provide basic information such as taxpayer identification number (TIN), business name, and details of sales and purchases. Additionally, calculations for VAT payable or overpayment must be included.

What is the purpose of bir form 2550m sample?

The purpose of BIR Form 2550M is to ensure that registered VAT taxpayers report their sales, purchases, and the corresponding VAT due to the Bureau of Internal Revenue (BIR) accurately and timely.

What information must be reported on bir form 2550m sample?

The form requires reporting of sales and revenues, purchases, VAT exempt sales, and the resulting tax liabilities or credits for the reporting period.

Fill out your bir form 2550m sample online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Form 2550m Sample is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.