Get the free IRS CP102 Notice - info americanpayroll

Show details

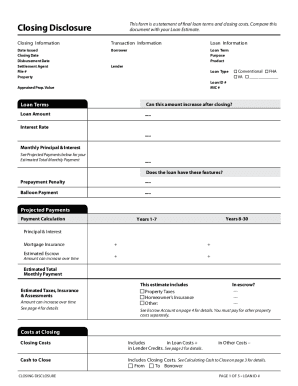

This document is a notice from the IRS regarding adjustments made to Form 941 for the tax period ending June 30, 2008. It details the miscalculation found in the tax return, the adjusted amount due,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs cp102 notice

Edit your irs cp102 notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs cp102 notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs cp102 notice online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs cp102 notice. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs cp102 notice

How to fill out IRS CP102 Notice

01

Read the CP102 notice carefully to understand the reason for its issuance.

02

Gather all relevant tax documents, including your tax return and any supporting documentation.

03

Locate the section in the notice that details the information needed from you.

04

Fill out any required forms or provide the requested documentation as instructed in the notice.

05

Double-check all entries for accuracy and completeness.

06

Mail the completed forms or documentation to the address provided in the notice.

07

Keep a copy of everything you send for your records.

Who needs IRS CP102 Notice?

01

Individuals or businesses who have received a CP102 notice from the IRS due to discrepancies in their tax returns.

02

Taxpayers who are requested to provide additional information to resolve issues with their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What is a CP in taxes?

IRAS | Confirmation of Payment (CP)

What does CP stand for?

What this notice is about. We need more time to verify your income, income tax withholding, tax credits and/or business income. Please allow up to 60 days before reaching out.

What is a CP-210 notice from the IRS?

Why you received IRS Notice CP210-220. You filed a business tax return. The IRS found an error on the return. The IRS sent CP210/220 to notify you of the change made, and to advise you of the resulting balance or refund due.

Does notice of deficiency mean I owe money?

This is a notice that the IRS has made the legal determination that you owe additional income taxes beyond what you reported on your federal income tax return. The notice includes information that they will propose a change to your tax return based on the other records they've received for that tax year.

Why would the IRS hold my refund for review?

The IRS may have found an error to your benefit or detriments. If you prove to the IRS that you correctly took the deductions and/or credits, the IRS will issue your refund or corrected refund. The IRS can freeze your refund if it's auditing your past tax returns and thinks you'll owe additional taxes in the audit.

What is a CP for taxes?

IRS CP notices are automated letters sent to address tax issues like unpaid balances, account discrepancies, or proposed adjustments. While some notices may simply provide information, others require immediate action to avoid penalties or enforcement measures.

What does CP stand for in IRS notices?

CP stands for “computer paragraph,” and these notices alert taxpayers about potential discrepancies on their tax returns. CP Notices are triggered by certain actions or balances due and sent out by the Service's automated notice system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify irs cp102 notice without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like irs cp102 notice, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send irs cp102 notice to be eSigned by others?

Once you are ready to share your irs cp102 notice, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit irs cp102 notice in Chrome?

irs cp102 notice can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is IRS CP102 Notice?

The IRS CP102 Notice is a document sent by the IRS to notify taxpayers that the IRS has not received their tax return for a specific tax year.

Who is required to file IRS CP102 Notice?

Taxpayers who have not filed their tax return and have received the CP102 Notice are required to respond by filing their missing return.

How to fill out IRS CP102 Notice?

To fill out the IRS CP102 Notice, the taxpayer must provide their personal information, including their Social Security number, and attach the completed tax return for the year in question.

What is the purpose of IRS CP102 Notice?

The purpose of the IRS CP102 Notice is to inform taxpayers that the IRS has not received their tax return and to prompt them to file the necessary documents to avoid potential penalties.

What information must be reported on IRS CP102 Notice?

The IRS CP102 Notice requires personal identification information, the tax year in question, and any pertinent details related to the tax return that needs to be submitted.

Fill out your irs cp102 notice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs cp102 Notice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.